As property cat reinsurance flattens, any reversal on retentions seen as unacceptable

While much has been made about the mid-year renewal seasons’ flattening to slightly down trajectory of property catastrophe rates, this isn’t currently seen as a significant issue by investors in the reinsurance space. But, any reversal on where retentions and attachments sit is seen as unacceptable by many.

Institutional investors allocating to reinsurance equities are keen to see profitability remain higher, even as inward rates may soften off for a time.

While the hard market rates have been a key driver of profits, the adjustments to terms and conditions over recent years, particularly in terms of retention and attachment points, are an equally significant input to the potential for reinsurance firms to deliver profits their investors deem attractive.

Analysts have highlighted some caution over the flat to down rate environment at the renewals, saying the forward-trajectory is what needs to be tracked.

But some are far more vocal when it comes to attachment points, citing concerns on some broker commentary that a little was given back in some areas of the market at June and July.

As ever, when it comes to property catastrophe reinsurance rates, the United States is seen as the main indicator to watch.

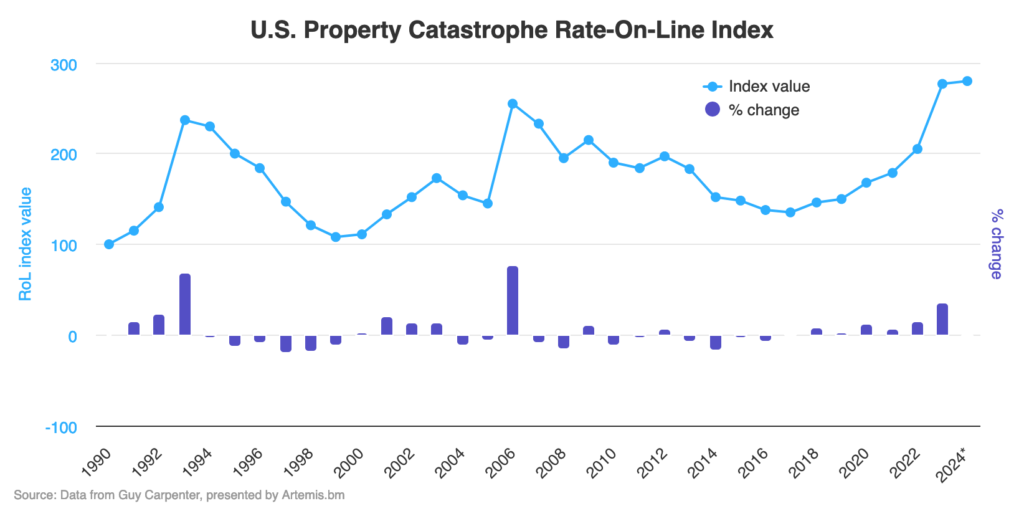

As we reported, the Guy Carpenter U.S. Property Rate on Line Index tells the story of the rate environment, being now up by only 1.2% in 2024 after the mid-year renewal season (as seen below).

Importantly though, while the trajectory has flatted considerably since the start of the year, US property catastrophe reinsurance rates-on-line remain up by roughly 107% since 2017, meaning the profit potential of this line of business is still substantial.

But, while the rates remain high, for investors allocating to the reinsurance market, either traditionally through equities or via insurance-linked securities (ILS), it is the sharing of major losses between the primary insurers covered and the risk capital providers that most want to see maintained.

The sentiment remains that the reinsurance market had softened too far, leading to a situation where primary companies were passing the lions share of many catastrophe losses to their reinsurers and ILS funds.

Improved terms and higher attachments reversed that trend, to a situation investors now prefer to see as the status quo, but which can be challenging for less well-capitalised primary players.

With peak hurricane season underway and still a significant number of storms expected by forecasters, if those forecasts prove anywhere near-accurate then uncertainty persists, both over profits of property catastrophe reinsurance portfolios, as well as of the future rate trajectory at the important 1/1 January 2025 reinsurance renewals.

With those higher retentions and attachment levels, it means reinsurers and ILS managers are more insulated from smaller storm and other catastrophe losses, while the reduction in aggregate coverage also serves to insulate them from attrition.

Which means larger loss events are likely required to create any meaningful capital erosion that could stimulate a renewed acceleration of pricing at January 1st 2025.

In some cases this means analysts are already forecasting a greater likelihood of another flat to slightly down renewal at 1/1 2025, than anything else at this time.

But what that means for the terms of coverage provided for 2025, remains to be seen.

The big question is going to be, just how unacceptable do investors feel any reversal movement on retentions to be and will they express this in their appetite to continue backing reinsurance, if a reversal does occur.

A secondary question is just how much, in retention, do reinsurers and ILS managers feel can safely be taken back, should the negotiations for next year’s renewals come down to terms as well as price.

If capital exerts pressure and firmly makes its preference for the new status-quo to persist known, it might make for interesting fundraising discussions later this year, which could also be a driver of renewal dynamics.

As we all know by now, just how influential capital is in this marketplace.