Artemis Deal Directory surpasses one thousand catastrophe bonds & ILS listed

We have been collecting data and information about, analysing and tracking the catastrophe bond and insurance-linked securities (ILS) marketplace for a quarter of a century as Artemis, and we’ve just hit a new milestone as our extensive Deal Directory has now surpassed the one thousand transaction landmark.

The Artemis Deal Directory has always been the heart of our offering even before Artemis was formally launched in 1999. The Deal Directory existed prior to Artemis as a store of market data and research information, reflecting our interest in the nascent ILS market.

The Artemis Deal Directory is a unique and extensive collection of catastrophe bond and related ILS transactions, hand-collected from our market sources, analysed and collected diligently over more than twenty five years.

The Deal Directory features key information on catastrophe bonds and related insurance-linked securities (ILS) and analysis to help investors learn about the ILS asset class, developing their appetite to allocate to it, and cedents can explore what is possible with cat bonds and ILS.

With practically every catastrophe bond, other 144A ILS deal and a growing range of private cat bonds listed in our Deal Directory, it is the most widely consumed database on this market.

Of course we also have our popular Artemis Dashboard and the range of catastrophe bond and ILS market charts that underpin it as well.

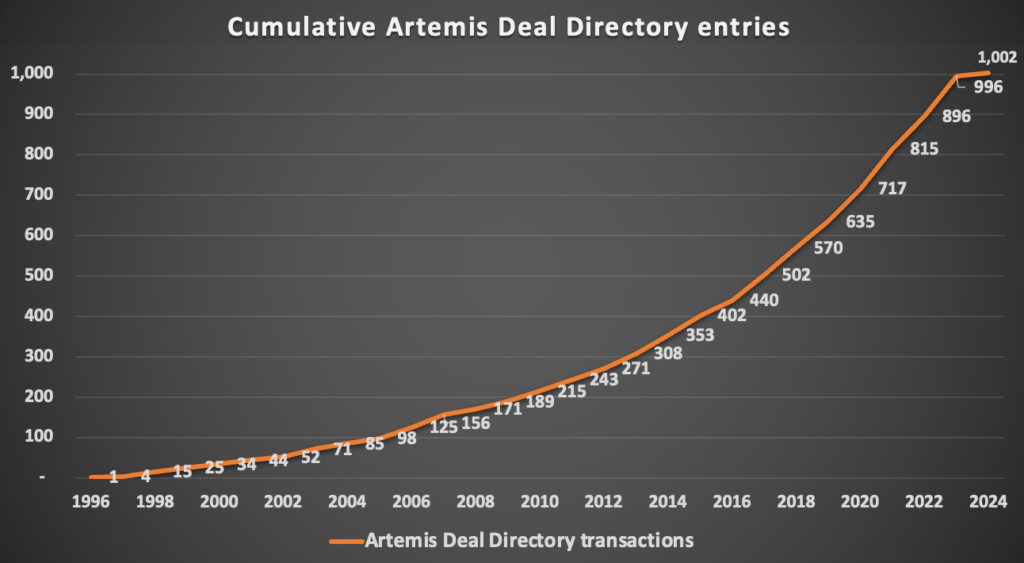

Reaching over one thousand cat bond and ILS transactions analysed is a new milestone for us, so we thought it would be interesting to look at how the growth of our Deal Directory can be used to visualise ILS market growth.

The chart below represents the cumulative build-up of transactions in our Deal Directory, showing the strong and steepening growth curve that has accelerated in recent years.

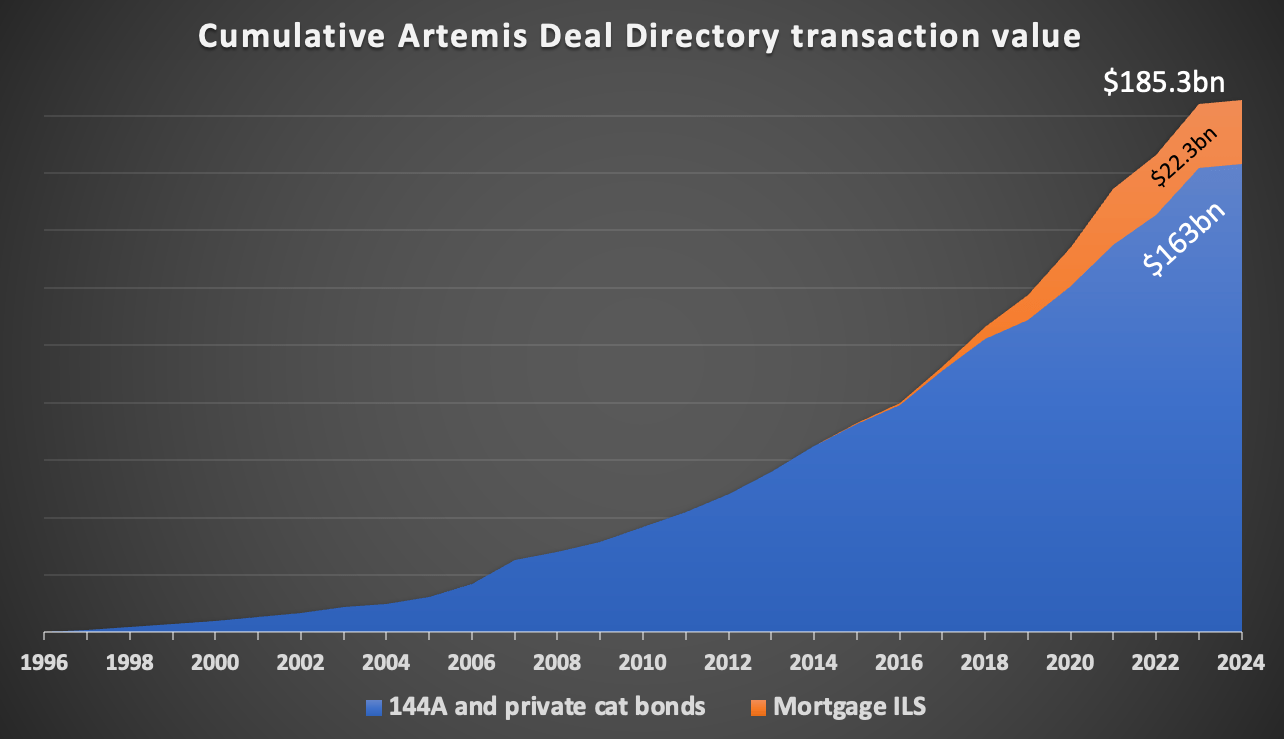

Also helpful is this chart showing the cumulative over time, dollar value of issuance across all completed transactions in the Artemis Deal Directory, which we’ve split out to also include mortgage insurance-linked notes issuances that we have also tracked.

In total we have listed, analysed and tracked over $185 billion of insurance-linked securities (ILS) in our Deal Directory. If you were to add in the sidecar issuance we’ve tracked since the 1990’s as well, the total would be well above $200 billion.

Over the last twelve months, the pages of our Artemis Deal Directory, Dashboard and Charts together received more than 400,000 views, with tens of thousands of people utilising the database over the course of the year.

We can also see that there are more than 1,000 very regular users of the Deal Directory and associated pages of Artemis, with a large proportion of these being investors and investment managers.

With the pace of catastrophe bond and ILS issuance now increasing, we added 100 entries to the Deal Directory in 2023 alone, we could reach the next milestone of 1,500 transactions listed within five years it seems.

It’s actually taken 27 years to collect this data, as it all began with the George Town Re Ltd. catastrophe bond in December 1996 for us.

We look forward to tracking the next thousand catastrophe bonds and ILS in our Deal Directory!

Download your copy of our brand new catastrophe bond market report, reviewing Q4 and full-year 2023 cat bond issuance.

Find all of Artemis’ catastrophe bond market charts and data here, or via the Artemis Dashboard.

All of our charts are updated as new catastrophe bond issues complete, and as older issuances mature, based on the data in Artemis’ extensive catastrophe bond Deal Directory.