Are there age limits on health insurance?

Private medical insurance (PMI) can help you bypass lengthy NHS waiting lists so you can access medical treatment as and when you need it. But is there a point where your age can prevent you from accessing cover (as it can with life insurance)? To help you plan for your health regardless of age, here’s what to consider.

What is the maximum age for private health insurance?

Upper age limits vary by health provider. Some have strict criteria for acceptance after your 65 birthday, with others covering people of all ages.

In most cases, you’ll find the cut-off is around 80 years old for new private health insurance policies. Existing policyholders will usually be able to renew their cover, but there may be restrictions, and it will be at your provider’s discretion.

To buy a policy, you’ll typically need to be at least 18 years old. If you’ve got children, you can add them to your policy, usually for an additional charge. Some health insurers will even offer incentives if you choose to add children to your policy. For example, if you add two or more children to an Aviva policy, you’ll only pay for your eldest child.

Can you get health insurance over 75?

Yes, you can. The average limit for new policies is 80 years old, so at 75, you should still have a good choice of providers.

Can you get health insurance over 80?

Yes, you can still find private health insurance if you’re 80 years old (or over). Bear in mind that many health insurance providers have an upper age limit of 80 years old. If you’re older than this and looking for a new policy, you may find your choice of provider limited.

If you’re renewing your policy with your existing health insurer, there shouldn’t be any issues (subject to their terms and conditions).

Does age affect the cost of private medical insurance?

Yes, it does. Generally, you can expect the cost of private health insurance to rise as you get older. This is simply because we’re more likely to suffer from health problems as we age.

However, the effect age has on the overall cost of your policy varies. If you have a basic or mid-level policy, you may see premiums rise marginally. If you have a more comprehensive package, you’re more likely to see significant price rises, particularly after the age of 50.

What other factors affect the cost of private health insurance?

While age plays a part in helping health insurers work out your premium, it’s not the only factor. Your health insurance provider will also consider:

Where you live – if you live somewhere with high hospital running costs, you can expect to pay more.

Your lifestyle – smoking and regularly drinking alcohol over the recommended limit can increase your premium as there’s a greater chance of developing an illness.

The policy you choose – the more your policy covers, the higher your premium is likely to be.

Numerous factors impact the cost of health insurance, including your age.

Can I continue with company private health care if I retire?

This depends on your health insurance provider. If you’re part of a group health insurance scheme, your existing provider may offer some continuity with a personal health insurance plan.

If this is an option available to you, don’t assume that a new policy will cover everything your previous work scheme covered. Double-check the terms and compare other policies to help ensure you get the best package for your needs.

Do I need private health insurance?

There are multiple benefits to private health insurance. You can expect to access treatment far quicker compared to the NHS. Plus, depending on your level of cover, you’ll also be able to choose where you’re treated and by who.

That said, private healthcare doesn’t cover everything, so you should weigh up the pros and cons before committing to a plan.

What does private health insurance cover?

You’ll be able to choose your level of cover, so your own policy will depend on what you’ve selected. Typical policies include:

Inpatient treatment if you need to stay in hospital overnight.Day-patient treatment if you need to stay for part of the day but not overnight.Access to GP advice 24/7, usually via video or telephone.Cancer treatment and care (the types of treatment you can access may vary depending on the package you choose).

If you’re looking for more information about your private health insurance options, these guides may help:

Can I get cover if I have a pre-existing medical condition?

Private health insurance usually excludes pre-existing medical conditions. This means anything you’ve suffered from in the past five years or had symptoms of will not be covered.

In most cases, insurers will reinstate cover if you’ve been symptom free for a certain period of time, usually two years. You can find out more in our guide to pre-existing medical conditions.

How do I choose the right private health insurance plan?

Private health insurance should benefit you, so when you compare policies, consider:

What you actually want to be covered for – do you just want faster access to care or is cancer treatment really important to you.What features you want – for example, do you want to be able to choose your consultant and hospital or are you happy to work from a list supplied by your insurer.Whether you want additional therapies – a number of health insurers also offer physiotherapy and alternative or complementary treatments alongside medical care.What other options there are – if you can’t find a policy that gives you what you want, you may decide to self-insure instead. Alternatively, a cash plan may be all you need if you just want to keep everyday healthcare costs down. You can often reduce your premiums by haggling with your provider.

You can often reduce your premiums by haggling with your provider.

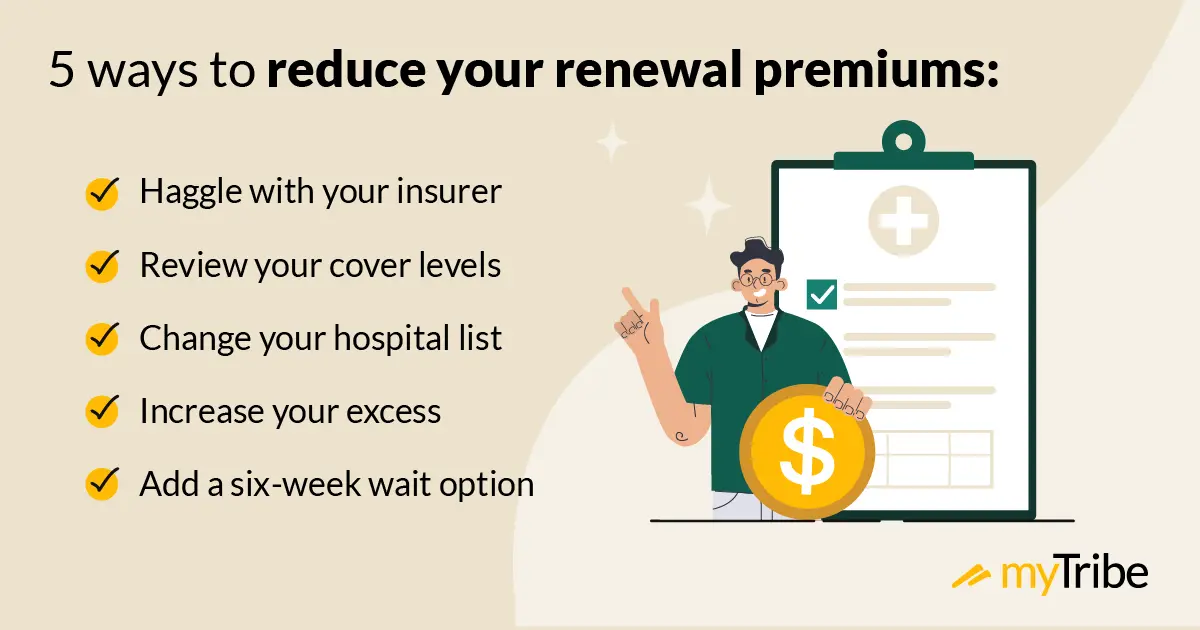

How can I cut the cost of private health insurance?

Private health insurance can feel like an expensive option, but it doesn’t have to be. You can keep costs as low as possible by:

Only buy what you need

Basic policies typically cover the essentials, such as inpatient and day-patient treatment, as well as virtual GP access. If this is all you need, you’ll pay less than policies with extensive features.

Limiting your hospital network

Private health insurers work with a network of hospitals so you can choose where you’re treated. The wider the network (for example, if it’s nationwide), the more you can expect to pay. If you’d prefer to be treated locally, you can keep costs down by limiting the network of hospitals to just your region.

Limiting your choice of consultant

As well as your hospital network, health insurers also offer you a choice of consultant, either from an unrestricted list or a restricted (guided) list.

Opting for an unrestricted list means you can choose any consultant you think is best for your needs. As you might expect, this is the more expensive option.

Guided lists are where your insurer provides a list of consultants for you to choose from (they will all be specialists in their relevant fields).

Choosing a guided list can help keep your PMI premium down as your insurer will have selected consultants who work within the budget available.

Increasing your excess

Increasing your excess can reduce your overall premium. Nevertheless, remember that you must pay your excess if you want a claim to go ahead. With that in mind, it shouldn’t be so high that it becomes prohibitive.

Staying active

Some insurers offer incentives and discounts if you take an interest in maintaining your health. For example, Vitality health insurance policies offer points if you’re active. Those points can be exchanged for rewards such as cinema tickets and vouchers.

Using a specialist broker

Specialist brokers are experts in their field and can help you find health insurance to fit your needs and your budget.

If you’re interested in finding out more, contact us. We can put you in touch with a regulated broker who can explain what’s available and your options.

Disclaimer: This information is general and what is best for you will depend on your personal circumstances. Please speak with a financial adviser or do your own research before making a decision.