APRA sees increased concern on climate risk

As Australia sees more frequent and more severe weather events, it’s not surprising that four of five financial institution boards oversee climate risk regularly, according to the Australian Prudential Regulation Authority’s (APRA) latest climate risk self-assessment survey.

The survey, issued in March 2022, was designed to provide insights into how APRA-regulated entities align their practices with the expectations set out in the Prudential Practice Guide CPG 229 Climate Change Financial Risks. CPG 229 was released in November 2021 to guide APRA-regulated entities in managing the financial risks and opportunities that may emerge from climate change.

According to 64 medium-to-large institutions that answered the survey, APRA-regulated entities generally align with the regulator’s guidelines, especially in governance and disclosure. However, climate risk remains an emerging discipline compared to other traditional risk areas, with only a few respondents (63%) indicating they have fully embedded climate risk across their risk management framework.

Read more: APRA chair steps down

APRA’s latest survey also found that:

Nearly 40% of the respondents said climate-related events might have a material or moderate impact on their direct operations;

Nearly three-quarters of the respondents (73%) said they had one or more climate-related targets. However, 23% do not have any metrics to measure and monitor climate risks; and

Over two-thirds of the respondents (68%) said they have publicly disclosed their approach to measuring and managing climate risks, with 90% aligning their disclosure to the Taskforce for Climate-related Financial Disclosures (TCFD) framework.

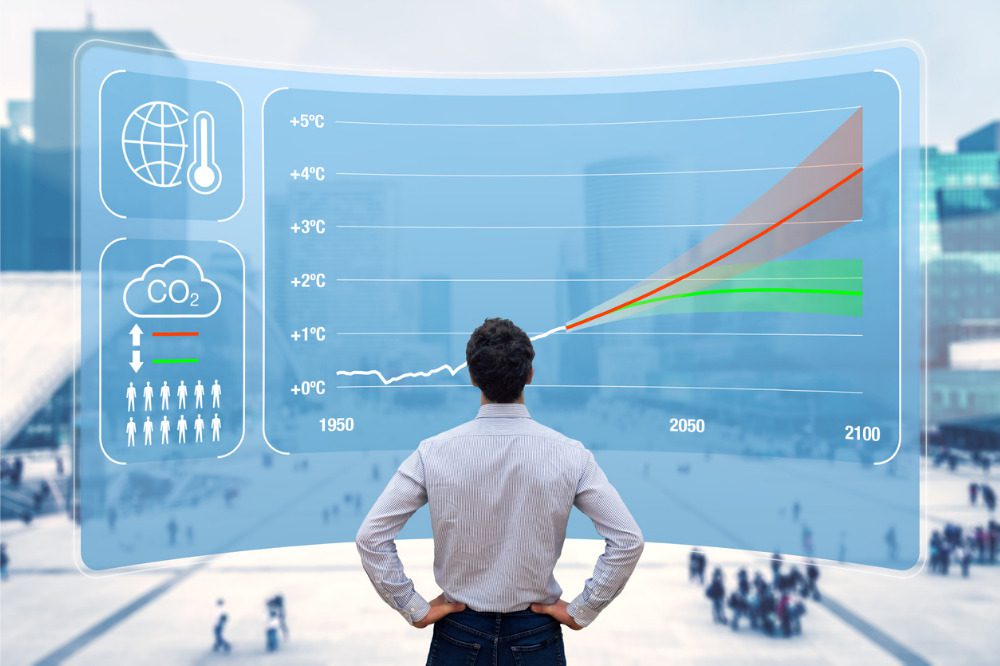

APRA Deputy Chair Helen Rowell said the new data emphasises that there is more work to do as climate change and the global response to it create financial risks for insurers, banks, and superannuation trustees – whether physical damage from floods or bushfires or asset price volatility as consumer and investor demands evolve.

“The survey findings indicate that most survey participants are taking this issue seriously; however, they also underline that this remains a relatively new and evolving area of risk management, especially with regards to setting metrics and targets,” Rowell said. “With stakeholder expectations on climate risk only going to rise further in coming years, we urge all regulated entities – not only those involved in the survey – to consider the findings and reflect on their preparedness.”