APRA kicks off consultation on tweaks to prudential framework

APRA kicks off consultation on tweaks to prudential framework | Insurance Business Australia

Insurance News

APRA kicks off consultation on tweaks to prudential framework

Revisions form part of framework’s routine maintenance

Insurance News

By

Roxanne Libatique

The Australian Prudential Regulation Authority (APRA) has initiated a consultation process for a series of minor revisions to its prudential framework.

The updates target authorised deposit-taking institutions (ADIs), general insurers, life insurers, private health insurers, and registrable superannuation entity (RSE) licensees.

These revisions form part of APRA’s routine maintenance of the prudential framework, aiming to ensure technical adjustments and clarifications are made without delaying more significant policy reviews.

The regulator has confirmed that the proposed updates do not introduce material changes to existing policies.

Scope of proposed changes to prudential framework

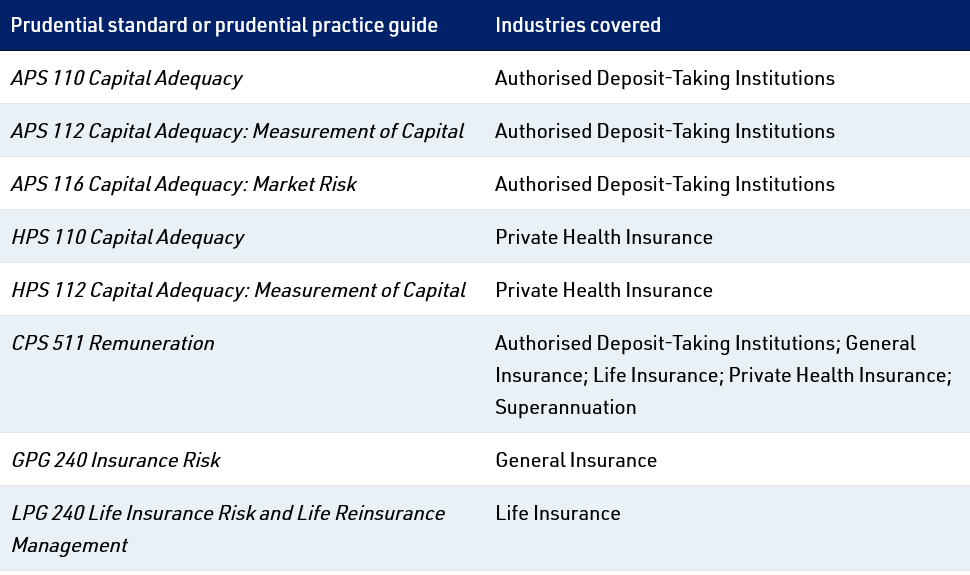

APRA is consulting on amendments to several prudential standards and practice guides, aimed at clarifying technical provisions across different financial sectors.

The changes, primarily technical, seek to improve clarity without altering the intent of the existing framework.

Unless confidentiality is specifically requested, submissions will be published on APRA’s website.

The final updates are expected to be implemented before the end of 2024.

Confidentiality and freedom of information

APRA has advised that submissions may be subject to the Freedom of Information Act 1982 (FOIA).

Confidentiality must be explicitly requested, with respondents providing confidential information in a separate attachment.

The regulator will handle FOIA requests in line with the Australian Prudential Regulation Authority Act 1998, which protects certain confidential materials from disclosure.

This new standard consolidates key definitions applicable to ADIs, general insurers, life insurers, and private health insurers into a single document.

CPS 001 replaces five previous standards and aims to enhance consistency across different sectors.

The consolidation does not introduce new definitions but removes outdated terms and resolves overlaps within the previous framework. New definitions for “general provisions” and “specific provisions” have also been incorporated, following prior APRA guidance.

The standard will come into effect on Oct. 1, and is designed to complement APRA’s digital Prudential Handbook, launched earlier this year. The handbook offers a centralised resource for regulated entities, providing easier access to definitions and their application.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!