APAC insurers see sluggish premium growth amid economic and regulatory hurdles

APAC insurers see sluggish premium growth amid economic and regulatory hurdles | Insurance Business Asia

Insurance News

APAC insurers see sluggish premium growth amid economic and regulatory hurdles

Data analytics firm unveil leading companies and underperformers

Insurance News

By

Roxanne Libatique

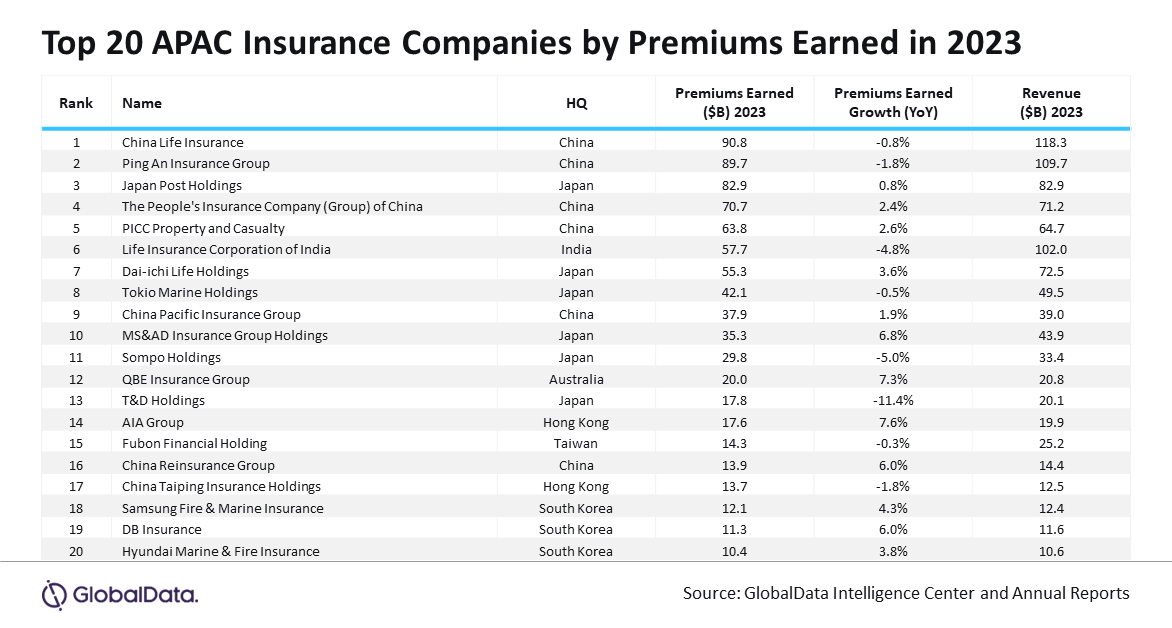

Insurance companies across the Asia-Pacific (APAC) region saw limited premium growth in 2023, with the top 20 publicly listed insurers reporting an average increase of just 1.3%, according to GlobalData, a data analytics firm.

Broader economic challenges, including inflation and the adoption of the new International Financial Reporting Standard (IFRS 17), played a role in constraining growth. At the same time, overall revenue for these companies increased by 5.5%.

“The new accounting standard has increased complexity, changed financial reporting, and affected capital requirements,” said Murthy Grandhi, company profiles analyst at GlobalData.

On the bright side, these changes have improved transparency, risk management, and comparability, according to GlobalData.

Leading insurers in the APAC region in 2023

Of the top 20 insurers, 12 saw positive year-on-year growth in premiums earned. Among the leading companies were AIA Group, QBE Insurance, and MS&AD Insurance Group.

AIA Group

AIA experienced a 7.6% increase in premium earnings.

This growth was attributed to a strategic shift in its product offerings, focusing more on long-term savings products and an increased contribution from its bancassurance operations in Mainland China.

QBE Insurance

QBE’s revenue grew by 10.2% in 2023, largely driven by higher premium rates and growth in targeted new business.

However, this was partially offset by its deliberate exit from property portfolios in North America and Australia, as well as a reduction in its exposure to other property lines.

MS&AD Insurance Group

MS&AD reported a 17.5% revenue increase, fuelled by a 4.2% growth from Mitsui Sumitomo Insurance Co and a 2% rise in revenue from Mitsui Direct General Insurance, both boosted by higher premium rates.

Underperformers in the APAC insurance market in 2023

Conversely, T&D Holdings and Sompo Holdings saw their premiums decline by 11.4% and 5%, respectively, largely due to stricter underwriting standards, particularly in regions more prone to natural disasters.

Challenges facing the APAC insurance industry

Grandhi said that insurers in the APAC region continue to face a challenging landscape.

Economic uncertainty and evolving regulatory frameworks mean insurers must remain flexible to capitalise on growth opportunities, particularly in areas like health and retirement insurance.

Grandhi also highlighted emerging risks related to electric vehicles (EVs) and cyber threats.

“Firms that can balance the demands of risk management with the pursuit of profitable growth, particularly in emerging markets, will be well-positioned to thrive in the years ahead,” he said.

The report further emphasised the role of climate change, which is driving changes in underwriting and pricing, while artificial intelligence (AI) is presenting new opportunities for operational efficiency and business development.

Despite the challenges, the insurance market in APAC continues to show room for growth, especially in areas where insurance penetration remains low.

The top 20 global insurers recorded a 6.2% rise in premiums earned, driven by greater awareness of insurance products and economic recovery in key markets. Total revenue for these companies also rose by 7.8%.

Companies like Progressive Corporation, UnitedHealth Group, and Humana were among the top performers.

Grandhi noted that the global insurance market faces ongoing challenges, including geopolitical fragmentation, economic instability, and the rising frequency of natural disasters. These factors, along with the increasing adoption of AI and emerging technologies, are reshaping the industry landscape.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!