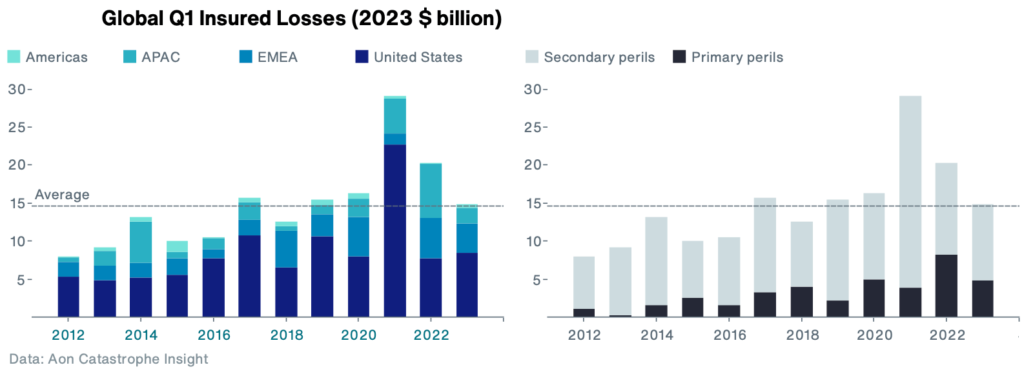

Aon estimates Q1 2023 global insured catastrophe losses at $15bn

Insurance and reinsurance broker Aon’s Impact Forecasting division has issued a preliminary estimate for first-quarter 2023 insured global catastrophe losses, putting the total at around US $15 billion and saying severe convective storms were the main driver.

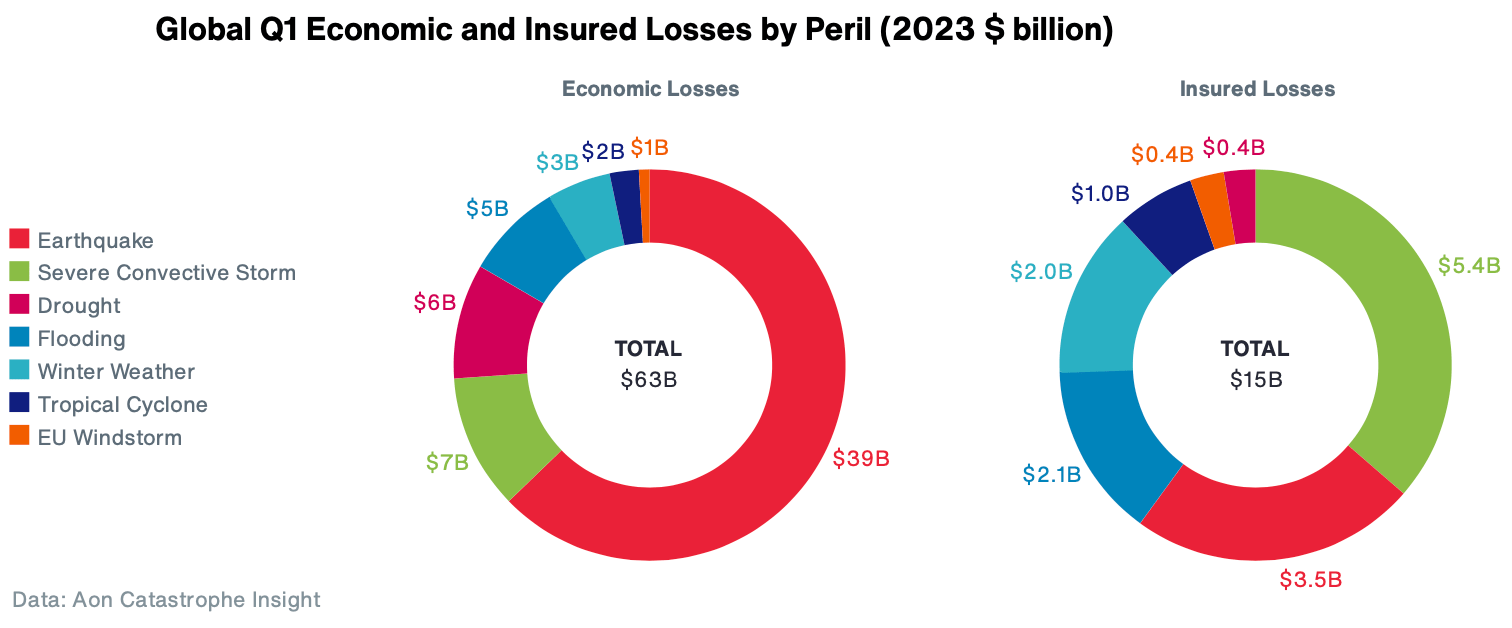

Total economic losses from global natural disasters in Q1 of 2023 are estimated to reach at least $63 billion by Aon.

The devastating earthquake in Türkiye and Syria are the main contributor to economic losses, with approximately $39.1 billion of the bill falling to that event.

The economic loss tally from natural disasters is well above the average, when compared to the 21st Century baseline ($53 billion) and significantly higher than the median ($38 billion), Aon notes.

Global losses to private and public insurance entities of $15 billion are currently estimated, which is close to both the average and median of the last 10 years.

However, Aon warns that potential loss development will likely drive that insured loss figure higher as well.

In fact Aon cautions that “robust loss development” is expected to continue throughout the rest of the year from the natural disasters and weather catastrophes seen in Q1 2023.

Events in the United States are estimated to have driven 58% of the insured losses and EMEA 25%.

A number of larger events occurred, including the earthquake in Türkiye and the outbreak of severe convective storm activity in the United States on March 1-3, each of which are expected to result in insured losses in excess of $3 billion, Aon said.

On the events in New Zealand, Aon estimates that the combined insured loss from the Auckland flooding and Cyclone Gabrielle are close to $2 billion.

Aon currently estimates that $5.4 billion of the insured losses are from US severe convective storm activity, a figure that could also rise as some of this activity is very recent.

European Windstorms meanwhile, had the least costly season since the winter season of 1995/1996, Aon also notes.

It’s worth also noting that broker BMS Group suggested the total insured losses for severe convective storms in Q1 could see significant development, with as much as $9.5 billion from that peril alone, which would significantly boost Aon’s figure if that development occurs.