American coming back home, but lost with all the plan options

Hi everyone!

I recently accepted a new job and have received a list of health plans I can choose from. For reference, I am an American but I’ve lived abroad during much of my adult life and only now am in a position of being back state-side and having to choose a plan.

I have a few medicines I have to get renewed yearly, used just in allergy emergencies. Late 20s male, active and healthy from what I can tell, I like to do complete bloodwork yearly to at least check that. However I’ve seen friends and prior partners at my age and younger get bad cancer and having the best healthcare given one’s options is definitely something I prioritize.

I’m okay paying a little more to make sure I can get great care, but I really want to avoid those nightmare bills where people call ahead to a provider to check if they are covered, get the yes answer and then it turns out it wasn’t covered at all, and are left with a crazy bill way past the maximum out of pocket and spend months fighting to get the claim covered afterwards.

6 Different packages are offered, I will be in the Bay Area California, with Employee pays in parentheses:

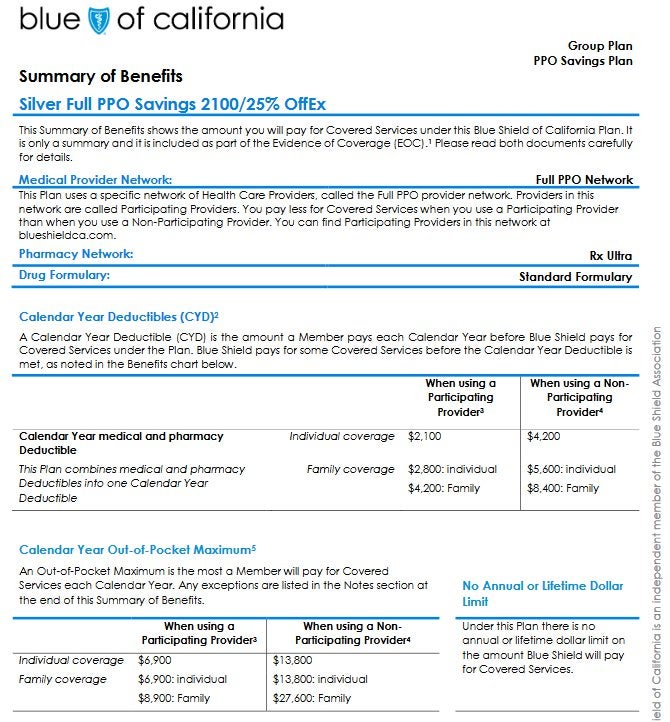

Blue Shield of California – Silver Full PPO Savings 2100/25% (HDHP) (566 prem, $0 a month)

Blue Shield of California – Platinum Full PPO 250/15 OffEx (736 prem, $81 a month)

Blue Shield of California – Platinum Access+ HMO 0/25 OffEx (606 prem, $0 a month)

Blue Shield of California – Gold Full PPO 0/25 OffEx (654 prem, $0 a month)

Kaiser Permanente of California – Platinum 90 HMO 0/20 (545 prem, $0 a month)

Kaiser Permanente of California – Silver HDHP HMO 2500/20% (384 prem, $0 a month)

Right now I’m thinking either (5) Kaiser Platinum 90 HMO, (3) Blue Shield Platinum Access+ HMO, or (4) Blue Shield Platinum Full PPO (has additional $81 cost). The link at the bottom of this post goes into more detail on each plan.

HMOs seem to be more protective of extra costs from what I’ve read online, at the expense of potentially having to go through a few primary doctors till one finds one one likes / who is willing to give referrals. I have a really hard time understanding (3) Blue Shield’s HMO as it has a much lower maximum out of pocket compared to Kaiser’s (2.5k vs 4.5k), however I wonder if it is potentially easier to goof up since it isn’t like Kaiser who has their own hospitals and everything.

It sounds like (2) might be a good option if I want to visit a much broader net of care providers, but once again, I don’t want to end up in a position where care wasn’t even considered in the maximum OOP for out-of-network in that PPO and bam 100k bill. Reading on a page in that plan, there was a mention of things above the “allowed amount” are not covered at all. I’m having a hard time understanding what an allowed amount is in the context of having maximum out of pockets and stuff.

I would gladly appreciate any help, I have attached some images below and well as a list of their PDFs (linked directly under each image) to help give context. I am really lucky to not have any mental health needs, which I’ve read that Kaiser sometimes has problems with, so right now I don’t have to think about that aspect.

If you were in my position, which plan would you choose and why? Thanks everyone! I really appreciate it.