AmCoastal extends reinsurance tower to $1.2bn thanks to new cat bond: CEO

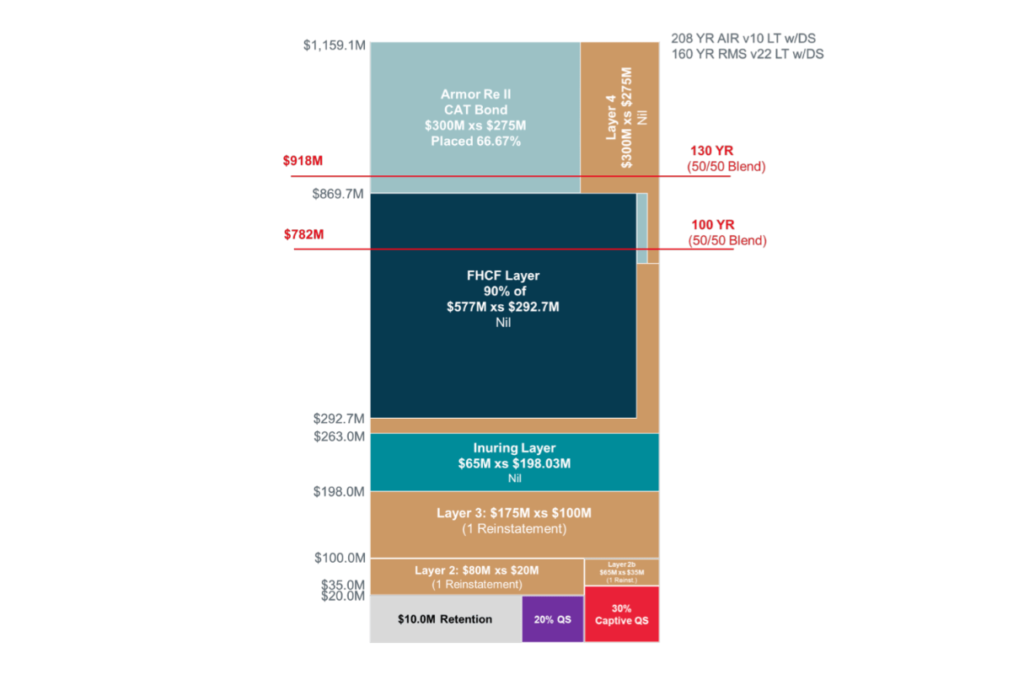

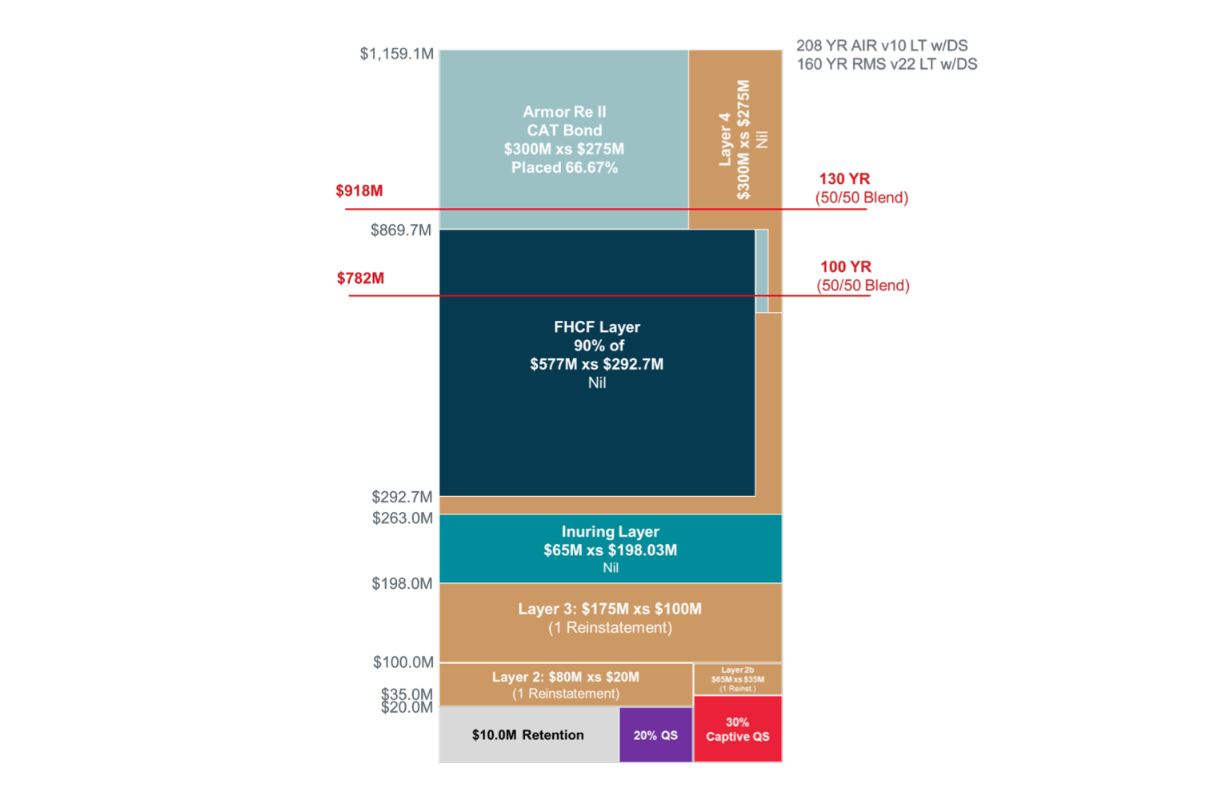

Thanks to the recent successful issuance of its latest catastrophe bond, American Coastal Insurance (AmCoastal) has extended the top exhaustion point of its main catastrophe reinsurance tower to roughly $1.2 billion for 2024, according to CEO Dan Peed.

As Artemis had reported, AmCoastal successfully secured an upsized $200 million Armor Re II Ltd. (Series 2024-1) Florida named storm cat bond in April, finalising the deal with a risk spread within the lower-half of the initial range of price guidance.

The insurer has now disclosed that the catastrophe bond occupies roughly two-thirds of the top-layer of the main AmCoastal catastrophe reinsurance tower for 2024.

During the insurer’s earnings call yesterday, CEO Dan Peed commented on the reinsurance renewal saying, “We have increased our multi-year reinsurance commitments, enhancing stability. Our 2024 catastrophe reinsurance program was marketed with a structure that further protects the balance sheet.”

Adding that, “We have been able to increase the expected exhaustion point with the successful placement of AmCoastal’s multi-year cat bond which was oversubscribed at the lower end of the expected coupon range.”

AmCoastal President Brad Martz went into more detail on the reinsurance tower renewal, explaining, “As of today, we have secured over 90% of the total limit being sought, and the placement is progressing in line with our expectations.”

He said that AmCoastal had three goals when it began planning its reinsurance renewal for the 2024 hurricane season, to increase the overall protection, improve cost efficiency, and maintain similar levels of retention.

“I believe we will achieve all three this year,” Martz said.

“For American Coastal, we are seeking to purchase roughly $265 million more limit from the private market this year, which will stretch our exhaustion point up closer to $1.2 billion, for the 208-year return time compared to the expiring program of 167-year return time as estimated by the AIR hurricane model.

“$200 of the additional open market limit was secured in a new three-year catastrophe bond that closed in April,” he commented.

Martz also noted that AmCoastal’s quota share reinsurance is being reduced from 40% to 20%, which should drive “a material increase in net premiums earned, partially offset by higher net losses, as we retain more of those.”

The goal with the new reinsurance strategy is to “retain more of our gross underwriting margin,” Martz said.

He added that, “We expect to have both towers fully-placed well before June 1st and we will provide more information on the final limits, retentions, and costs, once both programs have been completed.”

You can see the new AmCoastal 2024 reinsurance tower below.

You can read all about AmCoastal’s new Armor Re II Ltd. (Series 2024-1) catastrophe bond transaction and every other cat bond ever issued in our Artemis Deal Directory.