AM Best / Guy Carpenter project ILS capital to grow 3% to $99bn in 2023

Third-party capital in reinsurance, so what would often be termed alternative capital or insurance-linked securities (ILS) market capacity, is now projected to grow by over 3% in full-year 2023, to reach approximately $99 billion by year-end.

This is according to the latest analysis by rating agency AM Best and reinsurance broker Guy Carpenter, who tend to provide combined updates on third-party and ILS capital levels in the reinsurance industry about twice a year.

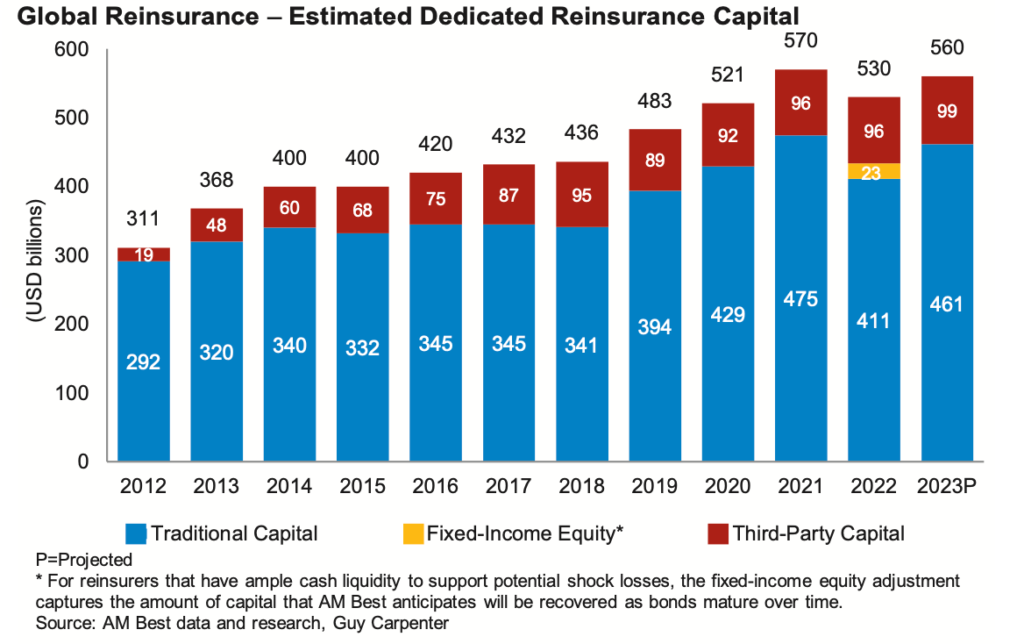

Having completed their latest analysis of third-party and ILS capital levels in reinsurance, the pair estimate total global reinsurance capital will reach $560 billion at year-end.

That remains $10 billion below the end of year 2021 figure of $570 billion, but it’s a strong recover from 2022.

Insurance-linked securities (ILS) market capacity, measured as third-party capital in global reinsurance, is the one bright spot of the chart below, having either grown or been flat each year since 2020.

Previously, the AM Best and Guy Carpenter estimate for third-party reinsurance capital had stood at $95 billion for end of year 2022 back in last August, but actually ended the year providing $96 billion of capacity to the ILS sector.

AM Best provided an estimated breakdown of that third-party capital at the end of 2022, seen below:

$34.5 billion of catastrophe bonds outstanding.

Between $6bn and $7bn of reinsurance sidecar capacity.

$5bn to $7bn of industry loss warranty (ILW) capacity.

Collateralized reinsurance of $45 billion to $50 billion.

The $3 billion of growth in third-party reinsurance capital could all have fallen to the catastrophe bond market over the course of 2023, although we would actually imagine that the cat bond component has grown more than that, while some of the other ILS segments have shrunk slightly.

For example, our measure of risk capital outstanding for the 144a catastrophe bond market and the private cat bond transactions we track in our Deal Directory, currently stands at $41.8 billion.

So, it seems likely that the collateralized reinsurance component has likely shrunk somewhat, while sidecar and industry-loss warranty (ILW) capacity may be at the lower-ends of the previous ranges AM Best had stated, with all of the growth coming from the catastrophe bond side of the ILS market this year.

Of course, private ILS strategies have been raising new capital, but for many ILS fund managers this is still replacing capital that was lost in recent catastrophe years, or has been trapped and so not deployable.

A measure of deployable and active ILS capital would be extremely useful, but also practically impossible to calculate given the lack of transparency on trapped collateral in the industry.

“Today, ILS is an integral part of the market. Working with traditional players as a partner, third-party capital has been accepted as a key component of most major reinsurers’ strategies. The absence of a meaningful influx of capital is not specific to the traditional sector but rather is shared with the ILS side. After the impressive five-fold increase between 2012 and 2018, alternative capacity has been flat at roughly USD95 billion,” AM Best commented in its new reinsurance sector report.

Going on to say that, “Capitalization levels remain solid, but investor fatigue in both the traditional and ILS markets is real.

“Given the short-term and floating-rate nature of the underlying securities, ILS funds have not been materially affected by higher interest rates. However, total volumes have stalled since 2018.

“AM Best does not expect material new additions to net alternative capacity over the short term, even with much better pricing terms. Years-long disappointing operating results and rising interest rates have created conditions that make other options more attractive than reinsurance, especially on a risk-adjusted basis.”