Alternative reinsurance capital grew 4% to $94bn in 2021: Gallagher Re

Alternative reinsurance capital, so the capital that is largely supplied by insurance-linked securities (ILS) fund managers, grew by 4% to reach $94 billion in 2021, according to broker Gallagher Re.

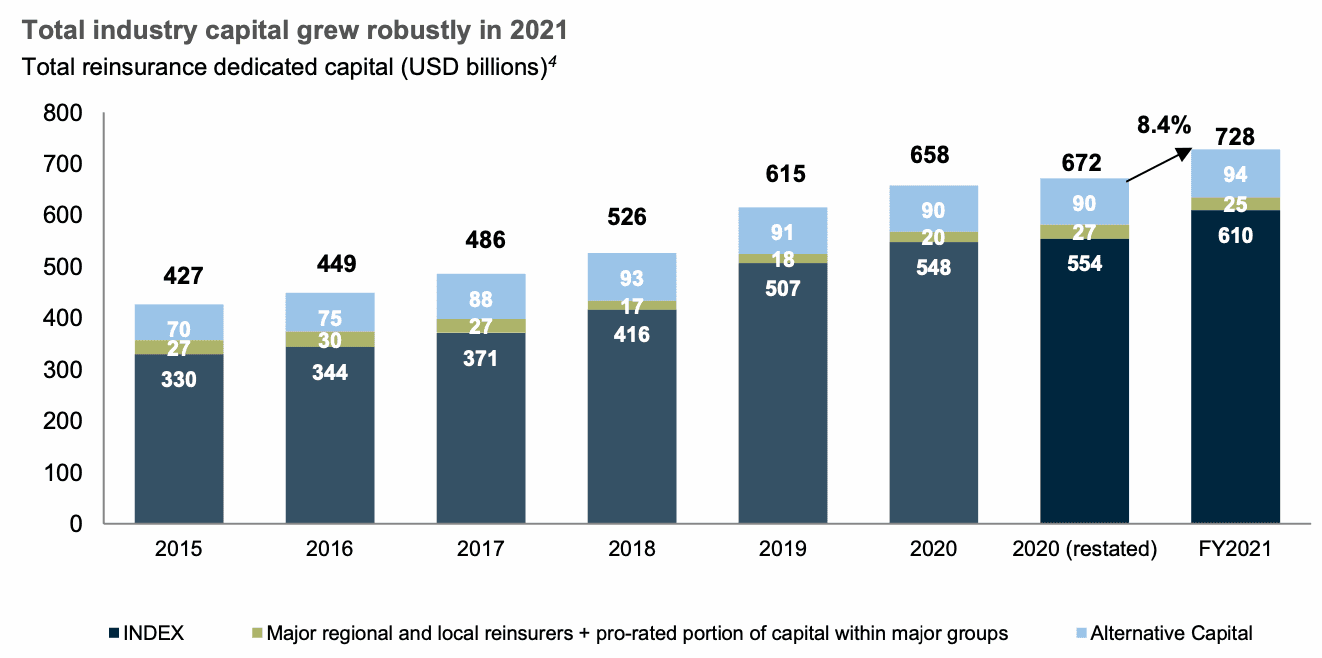

This was significantly outpaced by reinsurance capital from more traditional sources, with overall total dedicated capital in the reinsurance sector, including the alternative or ILS component, expanding by 8.4% during the last year.

By Gallagher Re’s measure, alternative reinsurance capital at $94 billion is a new high, having now recovered after a number of years where the total had stagnated since 2018.

Traditional reinsurance capital, made up of the Index of reinsurers Gallagher Re tracks, whose capital grew 10% during the year, as well as other major regional and local reinsurers and a share of major groups, whose capital actually shrank slightly.

Overall, dedicated global reinsurance capital has now grown three years in a row, as the reinsurance market and now ILS managers take their opportunity to expand into the firming rate conditions.

Traditional reinsurance capital growth was largely due to strong equity investment returns, which powered an expansion of the asset side of their capitalisation and Gallagher Re noted that the majority of this came from National Indemnity.

Which perhaps makes the growth on the alternative and ILS side all the more important, as this segment is not powered by returns generated in traditional asset classes and so is a true reflection of investor appetite and demand for the alternative reinsurance product range.

Commenting on the growth seen in alternative capital and ILS, Gallagher Re said, “2021 non-life ILS market capacity resumed growing and reached its highest ever level at USD 94 billion, driven by significant growth of the catastrophe bond space. The overall ILS market experienced a period of rebalancing in 2021, with capital allocation shifting away from less liquid ILS structures, with investors instead preferring the transparency and liquidity available through the catastrophe bond instrument.”

However, Gallagher Re notes that ever since 2014 there has been, “a clear trend of capital, or ‘supply’, growing faster than demand and this was again apparent in 2021.”

Although the true picture here is nuanced and Gallagher Re also notes that if you look at aggregate annual losses, according to AIR, the reinsurance capital base exceeded supply from 2014 through 2019, but in 2020 that reversed and then in 2021 premiums outgrew capital but this is expected to have been “driven more by price than exposure.”

Still, it’s encouraging to see one measure of alternative or ILS capital showing relatively strong growth in 2021, as that trend should persist through 2022, especially as the catastrophe bond market has had another busy start to the year.

Overall reinsurance sector capital has now grown some 70%, or 6% per annum, since 2015, to reach this new high of US $728 billion, according to Gallagher Re’s estimate.