Alternative capital reached new $96bn high at end of 2022: Gallagher Re

Alternative reinsurance capital, so the capacity deployed through insurance-linked securities (ILS) structures including catastrophe bonds, has experienced a return to growth in the second-half of 2022, ending the year 2% up at $96 billion, while traditional reinsurance capital shrank 14%, according to data from Gallagher Re.

In a report released today, broker Gallagher Re highlights that the decline in traditional reinsurance market capital continued through the second-half of 2022.

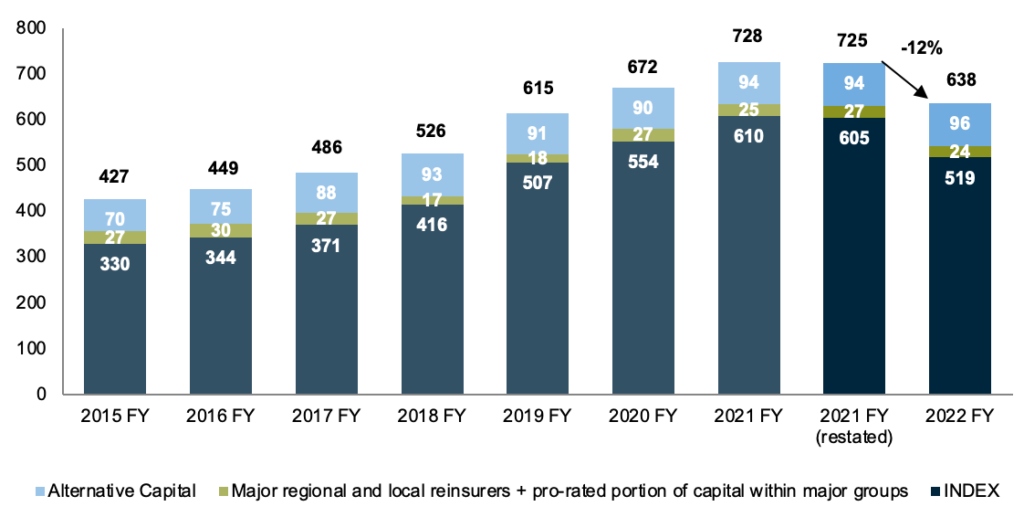

At the mid-year point, Gallagher Re had reported that total capital dedicated to the global reinsurance industry fell by around 11%, to $647 billion, down from $729 billion.

By the end of 2022, that total dedicated reinsurance capital figure had fallen a further 1.4% to $638 billion, but at the same time alternative capital, through ILS structures and the like, had risen from $94 billion at the middle of 2022 to $96 billion by the end of last year.

That’s a record level of alternative capital in the reinsurance industry, at the end of last year according to Gallagher Re’s figures.

While there will undoubtedly be trapped collateral within this number, it’s a positive reflection of the ILS market’s continued recovery after a number of catastrophe loss challenged years.

Citing a “conspicuous absence of new capacity, despite the potential attraction of much tightened pricing and terms and conditions,” Gallagher Re noted that the drop in traditional reinsurance capital has been entirely driven by the recent decline in the value of investments, across all major asset classes.

As a result, Gallagher Re said that it still believes “the global reinsurance industry’s capital position remains robust.”

Adding that, for the reinsurance sector, “in economic terms solvency remained strong and in fact generally increased during the year.”

However, the broker also pointed out that while the capital position of the industry is still strong, demand for reinsurance protection has continued to rise, with a sharp increase in 2022, principally driven by inflation.

This growth in alternative and ILS capital to a new record level, at least by the metrics of one broker, reflects the still growing importance of ILS structures and third-party capital sources in the global reinsurance industry.