Alternative capital expected to have reached $105bn by end of 2023: Fitch

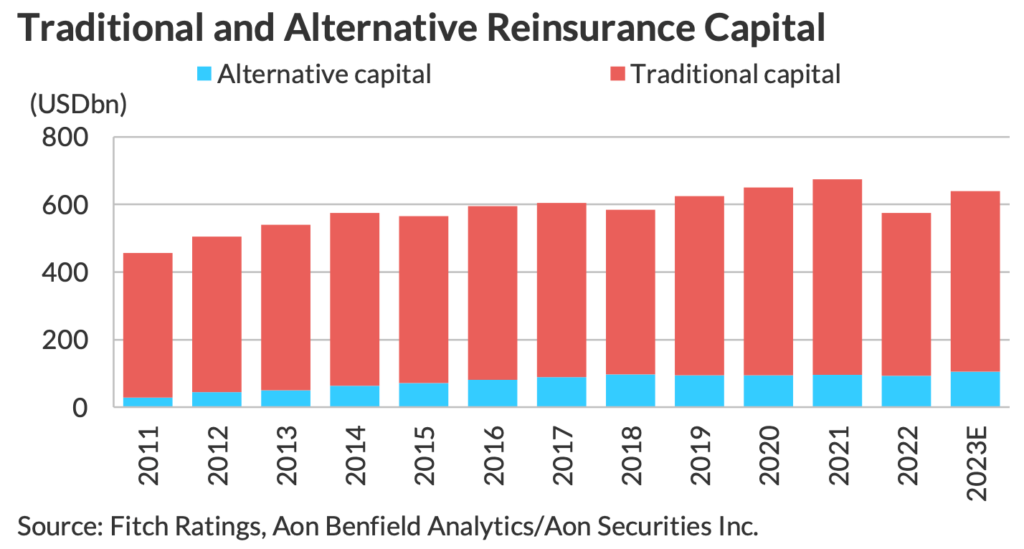

Fitch Ratings has estimated that alternative reinsurance capital, largely deployed in insurance-linked securities (ILS) formats, will have reached $105 billion by the end of 2023, once the final figures are known.

The rating agency commented on industry capital levels this week, “Available capital from traditional reinsurers and alternative capital providers grew in double digits in 2023. Reinsurers benefited from strong earnings generation, the stabilisation of financial markets and – for some – the move to the accounting standard IFRS17.

“Catastrophe bonds witnessed a record issuance last year due to very attractive returns on the back of the absence of large loss events, attractive pricing and a strong investment return on collateral pools. The rise in available capital supports our view of increasing reinsurance capacity in 2024.”

Fitch said that it, “Expects alternative capital to have grown by 13% in 2023, to around USD105 billion, due to a record issuance of catastrophe (cat) bonds last year.”

The rating agency added, “Strong inflows were triggered by very attractive returns for cat bond investors in 2023, in turn stemming from the absence of large loss events, strong pricing, and a strong investment return on collateral pools.”

It is a very reasonable estimate, given broking group Aon had pegged alternative capital in reinsurance as having reached $103 billion by the end of September 2023.

There is increasing evidence that insurance-linked securities (ILS) managers have grown their capital in time for the January 2024 renewals, with rising assets under management (AUM) reported by some ILS managers.

Fitch believes conditions are increasingly more conducive to ILS managers raising more funds, saying that, “Concerns due to poor performance over the past five years, and the poor reliability of catastrophe models, have increasingly faded over 2023.”

Adding, “We believe this will continue in 2024 despite tighter cat bond pricing, which will exercise increasing margin pressure, particularly on upper layers of property cat protection.”

The rating agency also said, “Within the alternative capital space, collateralised reinsurance programmes and sidecars stabilised assets under management in 2023, putting an end to a trend of net outflows that started in 2019.

“We believe these forms of alternative capital deployment, similarly to cat bonds, also benefitted from a favourable claims development and strong collateral returns.”

Which continues to paint a picture of recovery in the ILS market and growing investor interest, something borne out in our discussions with ILS managers and their latest reported AUM figures (where we have them).