Allstate’s Sanders Re aggregate cat bond retention eroded further

US primary insurer Allstate has issued an update on qualifying catastrophe losses for its aggregate Sanders Re catastrophe bonds, with additional impacts through to the end of 2023 meaning one of the exposed tranches now sees its retention ~82% eroded, while others are eroded by between 53% and 56%, this publication has learned.

We reported last week that Allstate had provided a corporate update on its pre-tax catastrophe losses through the end of 2023, adding a lighter quarterly total than it had in earlier quarters last year.

During 2023, Allstate has now reported just under $3.95 billion of pre-tax catastrophe losses across its business since April 1st of last year, the period that aligns with the annual aggregate risk period as it begins for the firm’s in-force Sanders Re catastrophe bond backed aggregate reinsurance.

But, as we said in our recent article, it’s challenging to know how much of this corporation-wide reported pre-tax catastrophe loss figure actually translates into qualifying aggregated losses for Allstate’s cat bonds, given differences in reporting thresholds and the deductibles applied to the cat bonds themselves.

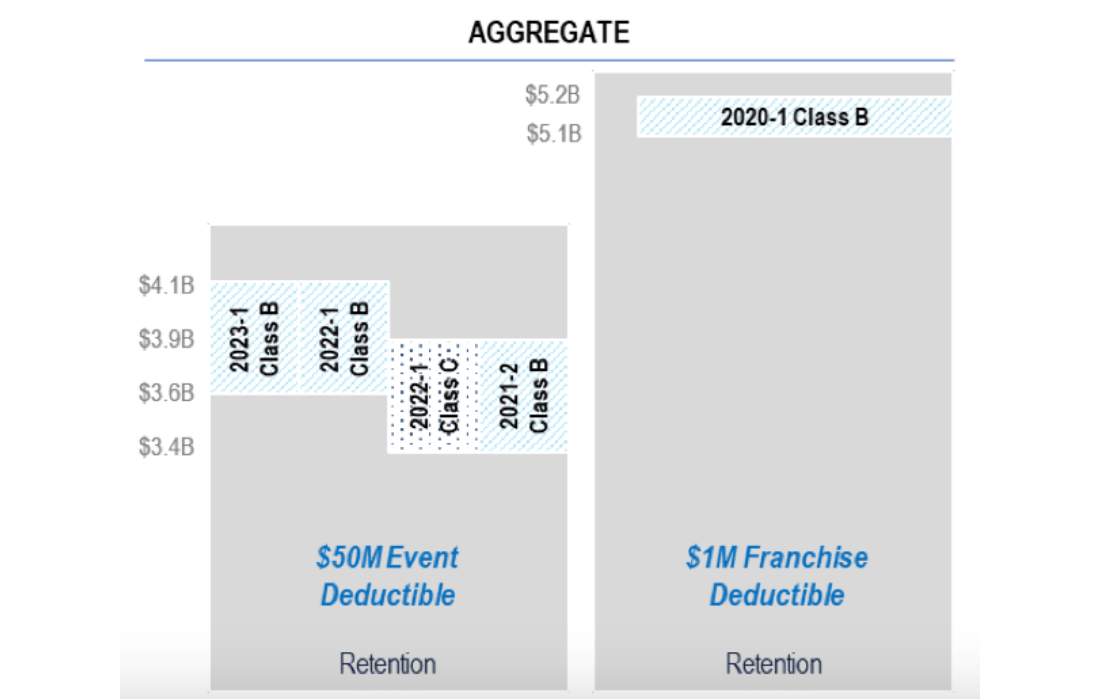

Not least because, under the terms of the Sanders Re cat bonds, the reinsurance coverage features different types of deductibles so the cat bonds do not aggregate losses from the ground-up, while also covering only certain perils and portfolios of Allstate’s underwritten risk.

However, we’ve now learned from sources that the latest cat bond specific loss figures from Allstate show that the insurer has now eroded over half the retention for its aggregate cat bonds that feature a $50 million per-event deductible, but more than 80% of the retention for the one remaining aggregate cat bond that features a $1 million franchise deductible.

Where the outstanding Sanders Re aggregate catastrophe bonds are concerned, the reported loss figure is higher for the cat bonds with the $1 million franchise deductible, as this includes losses from more smaller events, but much lower for the cat bonds with the $50 million event deductible as smaller events are excluded under their terms.

You can see where each type of Sanders Re aggregate cat bond sits in Allstate’s reinsurance tower in the diagram below:

The one remaining aggregate cat bond tranche with a $1 million franchise deductible is the $100 million Sanders Re II Ltd. (Series 2020-1) Class B tranche of notes.

These notes attach at $5.1 billion of aggregated qualifying losses reported by Allstate and after December the aggregated catastrophe loss figure reported for these notes is now $4.2 billion, so some 82% of the retention beneath these cat bond notes has now been eroded, it appears.

Given this is the tranche of notes with the $1 million franchise deductible and there is all of the first-quarter of 2024 to count any additional qualifying catastrophe losses, these notes seem at a relatively high-risk of attaching, being triggered and ultimately facing some losses before the risk period ends on March 31st.

The elevated risk faced by these cat bond notes was already marked into their pricing before this latest loss update from Allstate, with the notes marked at around 50 cents on the dollar as recently as Friday.

We understand that despite these new loss figures coming from Allstate last week, the pricing sheets do not seem to have changed much if at all, which is perhaps a little surprising given these Sanders Re 2020-1 Class B notes look to be facing elevated risk with the latest qualifying loss figure.

Moving on to the outstanding Sanders Re catastrophe bonds that provide aggregate reinsurance to Allstate but feature a $50 million per-event deductible.

We’re told the latest qualifying catastrophe loss total, to the end of 2023, for these event deductible aggregate Sanders Re cat bonds now stands at $1.9 billion and for the four tranches exposed to losses in the current annual aggregate risk period this means their deductibles are all now more than 50% eroded.

The four outstanding Sanders Re aggregate cat bond tranches with the event deductible all attach at between $3.4 billion and $3.6 billion of losses to Allstate.

They are, in order of issuance (oldest at the top):

These four tranches of notes have been marked across a relatively wide range of bids by different cat bond broker pricing sheets we’ve seen (largely in the 75’s to low 90’s range).

Again, we’re told that despite the updated loss figures, all four tranches have not seen their secondary market pricing sheet bids updated to reflect the growing erosion of their deductibles.

While the pricing sheets were perhaps unable to capture these loss updates from Allstate, given they only emerged late last week, we suspect there could be some movement in the secondary pricing indications for all five of these tranches soon.

With the rest of the first-quarter of 2024 still to go, for additional catastrophe losses to aggregate and qualify towards further erosion of the deductibles for these five catastrophe bond tranches of Allstate’s, at this stage it is too early to suggest whether investors will face any losses of principal, but the risk is certainly elevated, especially in the case of the 2020-1 Class B notes.

The first-quarter can prove to be costly, from a winter storm and severe weather front, so there is still a chance some of these cat bonds are triggered.

A year ago, for the first-quarter of 2023, Allstate reported pre-tax catastrophe losses of $1.69 billion, with $1.17 billion from March alone due to severe and convective weather events.

In 2022 Allstate’s first quarter catastrophe losses totalled $462 million, pre-tax, which shows how different the period can be, in catastrophe loss terms.

With severe winter weather across the United States in recent days and weeks, 2024 may already be proving quite costly to Allstate, potentially elevating the risk to these aggregate Sanders catastrophe bonds.

Details of catastrophe bonds facing losses, deemed at risk, or already paid out, can be found in our cat bond losses Deal Directory here.