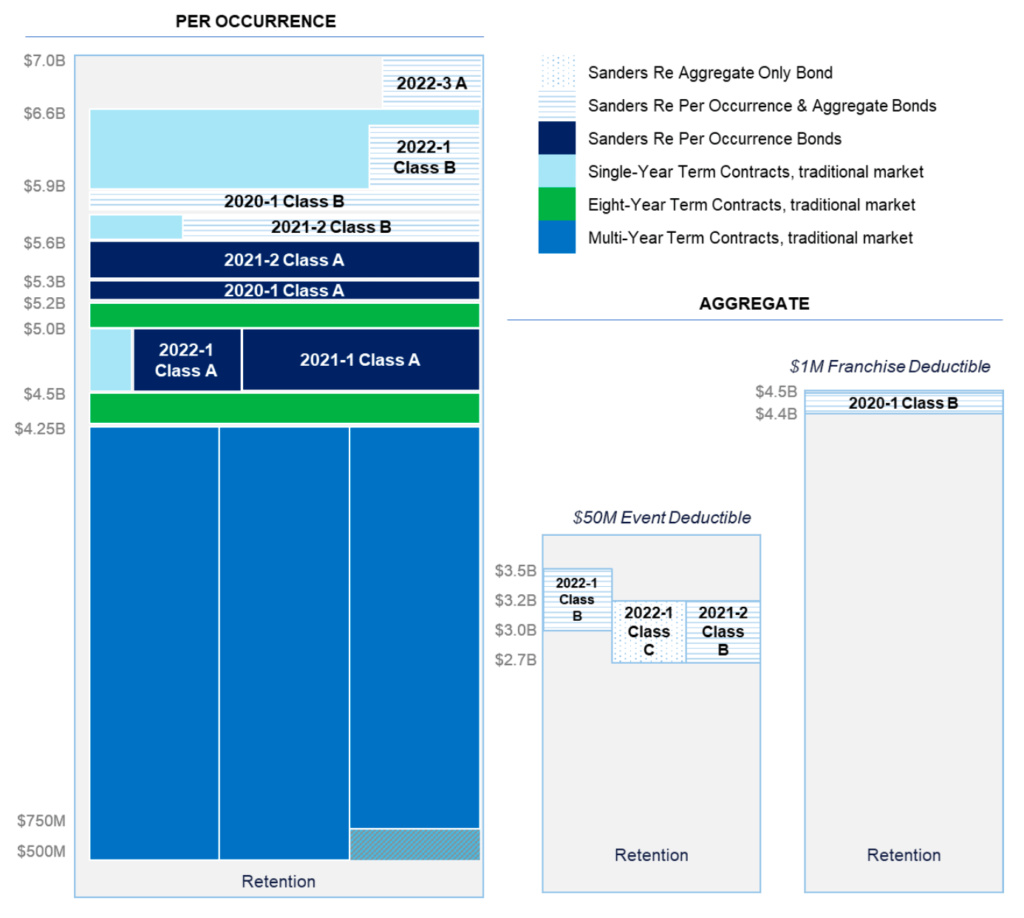

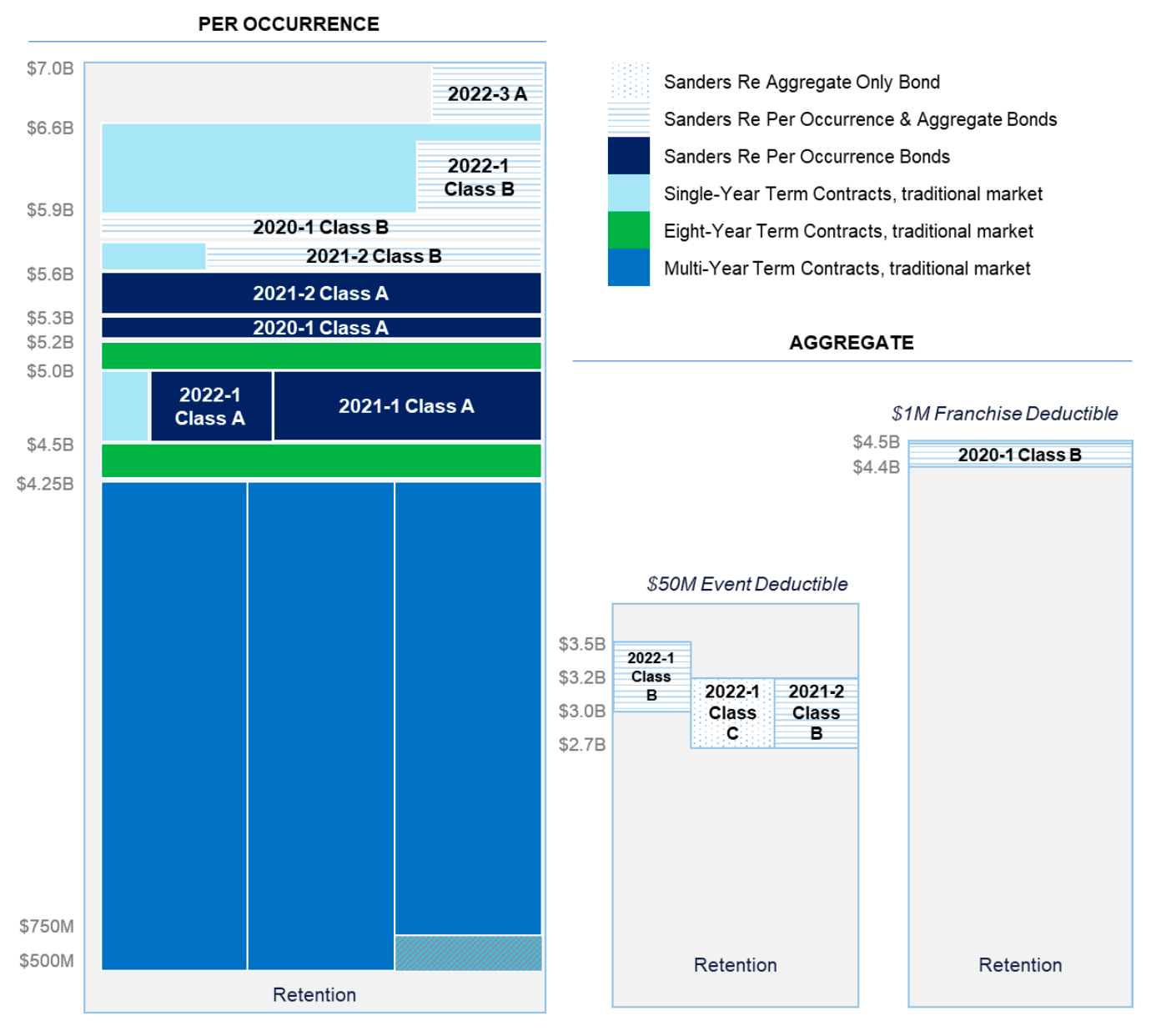

Allstate’s new cat bond lifts top of reinsurance tower to record $7bn

Having successfully placed a new $100 million Sanders Re III Ltd. (Series 2022-3) catastrophe bond in December 2022, US primary insurance carrier Allstate has lifted the top of its Nationwide Excess Catastrophe Reinsurance Program tower to $7 billion.

This is the highest level of catastrophe losses that insurer Allstate has purchased reinsurance protection to cover its losses to.

At the start and mid-year reinsurance renewals of 2022, Allstate’s Nationwide Excess Catastrophe Reinsurance reached to $6.6 billion, while at the beginning of 2021 it was just $5.763 billion and at the beginning of 2021 and 2020 only $4.984 billion.

So Allstate’s main US catastrophe reinsurance tower has grown by more than $2 billion, in terms of how high its coverage stretches, with the latest cat bond adding $400 million to the total, although only covering 25% of the losses through that layer for the company.

Allstate has confirmed, “In the fourth quarter of 2022, we increased coverage $100 million for the Program through the issuance of a catastrophe bond.”

Interestingly, Allstate’s retention at the bottom of this Nationwide cat reinsurance tower remains $500 million, a perhaps impressive feat given the challenging reinsurance market conditions and trend towards higher attachment points being enforced.

Allstate maintains a co-participation alongside each layer in the tower though, keeping a share of losses alongside its reinsurance partners.

Over recent years, Allstate has made relatively significant recoveries from its reinsurance partners, as well as from investors in its catastrophe bonds.

This has really shown the value of its robust reinsurance arrangements and the fact the insurer has been able to consistently grow the size of its main catastrophe program tower shows the firms appreciation for reinsurance and the important role this protection plays within its business.

The cost of that protection has risen though, as Allstate has disclosed that the total cost of its property catastrophe reinsurance programs, excluding reinstatement premiums, reached $788 million during 2022, significantly higher than the $556 million cost for 2021’s programs.

While the top of the reinsurance tower rose by $400 million year-on-year, by the end of 2022 thanks to the newest Sanders Re cat bond, the fact that cat bond only provides $100 million of cover across that layer, while Allstate’s reinsurance costs have risen so significantly, really drives home the harder market and the prices demanded by reinsurers and ILS investors that have taken their share of losses from the tower in recent years.

You can see Allstate’s Nationwide Excess Catastrophe Reinsurance Program tower, as it stood at the end of 2022, including the latest addition of the $100 million Sanders Re III Ltd. (Series 2022-3) catastrophe bond (seen at the very top of the per-occurrence tower), below.

.