Allstate shrinks Florida reinsurance tower again, but adds to Nationwide top-layer

At the mid-year reinsurance renewals, US primary insurance giant Allstate has shrunk its Florida excess-of-loss tower again, opting for a lower-level of protection in the state, but has continued to build-out its Nationwide protection, adding again to the top-layer of that tower.

It’s a little unusual for Allstate to add more coverage to its Nationwide catastrophe excess-of-loss reinsurance at the mid-year renewals, with that tower being completed for April 1st usually. Read all about that renewal for the insurer here.

But, in a sign of where the firm’s growth and priorities lie, as well as of affordability of cover, for the second year running Allstate has reduced its Florida specific reinsurance purchase, while remaining focused on ensuring protection across the rest of the United States.

It’s also notable how significant a role the insurers Sanders Re catastrophe bonds are now playing, with now the majority of the Florida reinsurance tower consisting of protection provided by the insurance-linked securities (ILS) market.

A year ago we reported that Allstate had shrunk its Florida reinsurance tower, and shifted all of its catastrophe bond coverage to make up the upper-layers of it.

It marked a reversal of sorts, as at mid-year 2022 Allstate extended the top of its Florida excess-of-loss catastrophe reinsurance tower by almost $600 million, to cover itself up to $1.8312 billion of losses.

Then, at the mid-year 2023 reinsurance renewals, Allstate pulled-back on Florida protection significantly, resulting in its catastrophe excess of loss reinsurance tower for Florida topping out at a much lower $1.285 billion as of June 1st 2023.

A further reduction has been seen at June 1st 2024, as Allstate’s 2024-2025 Florida Excess Catastrophe Reinsurance Program now only extends up to $890 million.

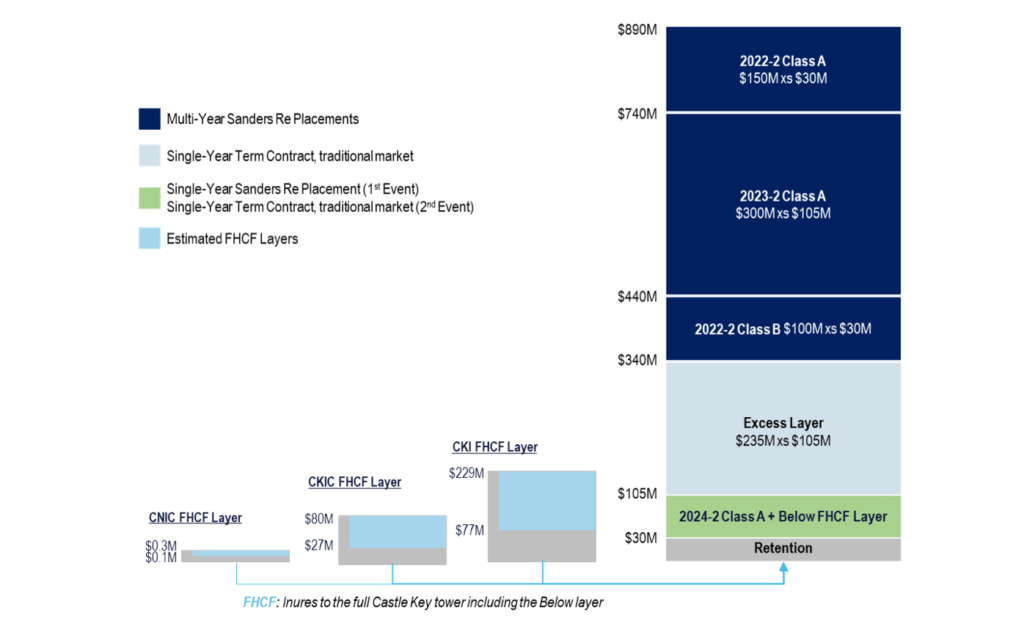

This year, the Florida tower consists of a $30 million retention, down from $40 million a year ago, after which a layer above attaches contains the $74.5 million Sanders Re II Ltd. (Series 2024-2) catastrophe bond alongside reinsurance that would fill the same layer should the cat bond be eroded by losses.

Above that, at an attachment of $104.5 million sits a $235 million layer of traditional reinsurance that inures to FHCF coverage.

While above that sits the three same catastrophe bonds from the 2023 tower, but with different attachment points this year.

There are two classes of notes from the Sanders Re III Ltd. (Series 2022-2) cat bond and one from the Sanders Re III Ltd. (Series 2023-2)issuance, providing another $550 million of reinsurance protection above $340 million in losses.

You can see the Allstate Florida excess reinsurance tower below, with the FHCF coverage alongside it:

When it comes to the changes to the Allstate Nationwide catastrophe excess-of-loss reinsurance tower for 2024 into 2025, changes are minimal but still notable for further building out of the top-layer as Allstate looks to cover more of its risks.

After its April renewal, Allstate had $100 million of placed limit in a layer excess of a $7.7 billion retention at the top of its tower, to run until March 31st 2025.

With the additional top-layer protection purchased at June 1st, this top-layer is now $190 million of limit, all expiring at March 31st 2025.

So Allstate has added an additional $90 million of reinsurance to that top-layer, to build it out to span 95% of losses at the top of its Nationwide catastrophe tower, the same percentage coverage that is in all the layers sitting beneath it.

You can see Allstate’s Nationwide catastrophe reinsurance tower in our article from after its April renewal. The only change is to the top-layer, which now spans the full-width thanks to this additional reinsurance contract that incepted at June 1st.

Also notable, at the June 1st 2024 renewal, Allstate has extended its California focused excess and surplus (E&S) earthquake reinsurance arrangement.

This was a three-year arrangement, but has now been extended to June 30th 2025 and it continues to provide reinsurance on a 100% quota share basis with no retention.

Allstate also renewed its reinsurance for the National General lender services portfolio at June 1st, to provide one year and one limit of reinsurance cover of $70 million in excess of a $70 million retention and one limit of $195 million in excess of a $140. The first limit retention has increased from $60 million and the first limit size is down from $80 million a year ago.

For the National General reciprocal reinsurance, has one year of cover providing one limit of $50 million in excess of a $15 million retention, one limit of $160 million in excess of a $65 million retention and one limit of $235 million in excess of a $225 million retention from the 2024 mid-year renewal, with all details the same as the prior year.

Allstate’s Kentucky earthquake reinsurance was renewed to provide $28 million of cover in excess of a $2 million retention, with one reinstatement of limits, and 95% placed, the same terms as the prior year.

That’s it for changes and updates to Allstate’s reinsurance arrangements after the mid-year renewals.

One point worth noting is that the Florida catastrophe bonds, in the upper-layers, all appear to be attaching a little lower down after resets. But it is challenging to work out exactly the details of how the probabilities of loss have changed, given the FHCF coverage and stated reinsurance layers beneath.

View details of every catastrophe bond ever sponsored by Allstate here.