Allstate reports $731m of Q1 cat losses, but Sanders Re aggregate cat bonds appear safe

US primary insurer Allstate added $343 million of catastrophe losses in the month of March, taking its Q1 2024 cat loss total to $731 million, suggesting further erosion of the retention under the firm’s aggregate reinsurance cat bond coverage, although the data suggests that the tranches of notes do appear safe from actual losses.

As we wrote previously, by the end of 2023, Allstate had reported just shy of $3.9 billion of pre-tax cat losses since April 1st of the same year, which is the annual risk period that aligns with its annual aggregate cat bond coverage for its in-force Sanders Re cat bonds.

In January, Allstate reported pre-tax cat losses of $325 million, which increased the aggregated cat loss total to around $4.2 billion.

February cat losses came in below the $150 million reporting threshold, but Allstate has today announced that cat losses in March totalled $343 million, 80% of which relates to one hail event, which takes total cat losses for the first quarter of 2024 to $731 million.

Add the Q1 2024 total to the $3.9 billion recorded in the annual risk period which aligns with its in-force Sanders Re cat bonds, and it appears that Allstate has racked up aggregated qualifying losses of some $4.68 billion.

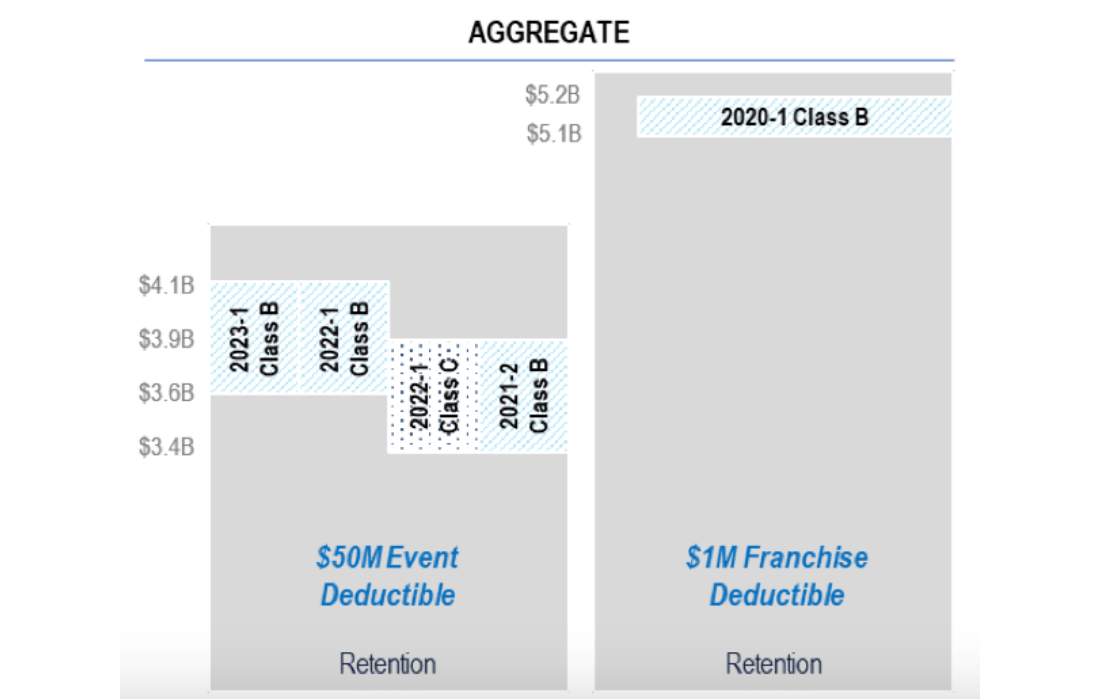

As we’ve discussed before, the $100 million Sanders Re II Ltd. (Series 2020-1) Class B tranche of notes, which features a $1 million franchise deductible, attach at $5.1 billion of aggregated qualifying losses, and sources told Artemis previously that after the January cat losses, some 82% of the retention beneath had been eroded.

At the same time, we reported that the Sanders Re cat bonds that provide aggregate reinsurance to Allstate but feature a $50 million per-event deductible had seen their retentions eroded by more than 50%, and these notes begin to attach at $3.4 billion of qualifying losses.

With qualifying losses close to $4.7 billion after the activity in Q1 2024, were every event to have qualified it would have seemed that Allstate had eroded approximately 92% of the retention that sits below the Sanders Re II Ltd. (Series 2020-1) Class B tranche of notes, which attaches at $5.1 billion.

For the Sanders Re catastrophe bonds that provide aggregate reinsurance to Allstate but feature a $50 million per-event deductible, sources told Artemis that by the end of 2023, qualifying losses for these event deductible aggregate Sanders Re cat bonds stood at $1.9 billion, meaning that their deductibles were all more than 50% eroded.

Given the lowest attaching are at $3.4 billion, and with the additional $731 million of Q1 2024 cat losses, which if all is included takes qualifying losses to more than $2.6 billion, it appears these cat bond notes are safe from triggering, although without seeing the official event reports we cannot 100% confirm that.

In fact, the $2.6 billion might well be too high for an aggregate loss figure for these cat bond tranches, as we don’t know how many of the events were actually above $50 million, but at the level of losses reported and where the aggregated loss figure was at year-end 2023, it seems these bonds won’t face losses from the now ended annual aggregate risk period.

Exactly how close the notes were to being triggered is difficult to understand, in part because of the different types of deductibles that feature, meaning that the cat bonds do not aggregate losses from the ground-up, while the notes also cover only certain perils and portfolios of the primary insurer’s underwritten risk.

But what is clear is that the record level of severe convective storm activity in the US in 2023, which has continued into 2024, came close to completely eroding the $5.1 billion retention for the franchise deductible notes.

As a reminder, you can see where each type of Sanders Re aggregate cat bond sits in Allstate’s reinsurance tower in the diagram below:

For the first-quarter of 2023, Allstate reported pre-tax catastrophe losses of $1.69 billion, with $1.17 billion from March alone due to severe and convective weather events. So, while wind and hail events in the US have again been the driver of global insured losses in the first quarter of the year, they’ve come down by around 57% year-on-year for Allstate.

During Q1 2024, Allstate also recorded some favourable prior year reserve reestimates for prior events, which dropped the quarterly cat bill to $328 million.