Allstate moves top of our catastrophe bond sponsor leaderboard

With the recent settlement of its latest cat bond issuance, US primary insurance firm Allstate has now moved to the top position in Artemis’ catastrophe bond sponsor leaderboard, with an impressive almost $2.86 billion in risk capital outstanding.

Allstate closed on its latest catastrophe bond just this week, having successfully doubled the size of the Sanders Re III Ltd. (Series 2024-1) issuance while marketing, to secure $400 million in catastrophe reinsurance from the capital markets.

This latest deal has now propelled Allstate into first position in Artemis’ leaderboard of catastrophe bond sponsors.

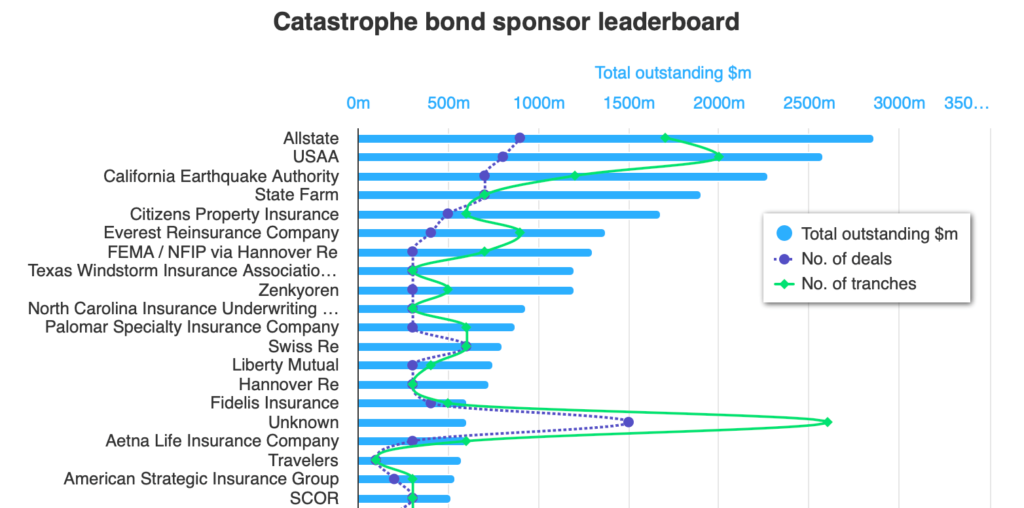

The leaderboard lists cat bond sponsors by the amount of risk capital they have outstanding from their in-force catastrophe bonds and also lists the number of deals and tranches this figure is spread across.

Last year, Allstate sat in third position in the catastrophe bond sponsor leaderboard for much of 2023, moving into top for a short time, but then falling back into second place again as different cat bonds were issued and matured.

With its latest successful visit to the cat bond market securing it $400 million in reinsurance, Allstate has now moved to the top of the leaderboard, as you can see below or by clicking here or on the image to visit an interactive version of the full chart.

Allstate currently has almost $2.86 billion of cat bond risk capital outstanding from the Sanders program of deals.

There are now 9 separate cat bond issues within that, with the risk capital spread across 17 tranches of cat bond notes.

Coming in second in the leaderboard currently is USAA, another prolific catastrophe bond sponsor.

USAA currently has nearly $2.58 billion of cat bond backed reinsurance protection outstanding, from 8 issuances and 20 tranches of notes.

In third place is the California Earthquake Authority (CEA), with an impressive $2.27 billion of cat bonds providing it with quake reinsurance protection, across 7 deals and 12 outstanding tranches of notes.

It is interesting that the top two spots are occupied by catastrophe bond sponsors that have benefited from reinsurance recoveries from some of their cat bond deals over the years.

These two insurers, Allstate and USAA, have grown their catastrophe bond protection steadily over the years, now sitting in a position where they aren’t growing so fast as their approach of staggering maturities now sees cat bonds rolling off and maturing, while new come into replace them.

All of which is a great example for other potential cat bond sponsors that might look to the stature of these major US insurers and recognise that, if catastrophe bonds are considered a good addition to the reinsurance towers of Allstate and USAA, maybe they should be seriously considered by every other insurer that has a sufficiently large need for protection.

Find all of Artemis’ catastrophe bond market charts and data here, or via the Artemis Dashboard.

All of our charts are updated as new catastrophe bond issues complete, and as older issuances mature, based on the data in Artemis’ extensive catastrophe bond Deal Directory.

Download your copy of our brand new catastrophe bond market report, reviewing Q4 and full-year 2023 cat bond issuance.