Allstate aggregate cat bonds possibly at-risk, as annual cat losses hit ~$3.67bn

Annual aggregate catastrophe bonds sponsored by US primary insurance giant Allstate could come under some pressure, as the firms aggregated annual catastrophe losses across the Sanders Re cat bonds risk period soared to almost $3.67 billion after a heavy March hit from severe storms.

It’s important to note that we only have visibility of Allstate’s reported pre-tax catastrophe losses, not the official loss reports that are sent to cat bonds funds and investors.

With Allstate’s Sanders Re cat bonds, at least the ones most likely to be exposed, using a $50 million event deductible, it’s challenging to understand just how at-risk the aggregate cat bond tranches are.

But, what we do know is Allstate has now reported almost $3.67 billion of pre-tax catastrophe losses from across the annual risk period for the cat bonds, that runs from April 1st to March 31st.

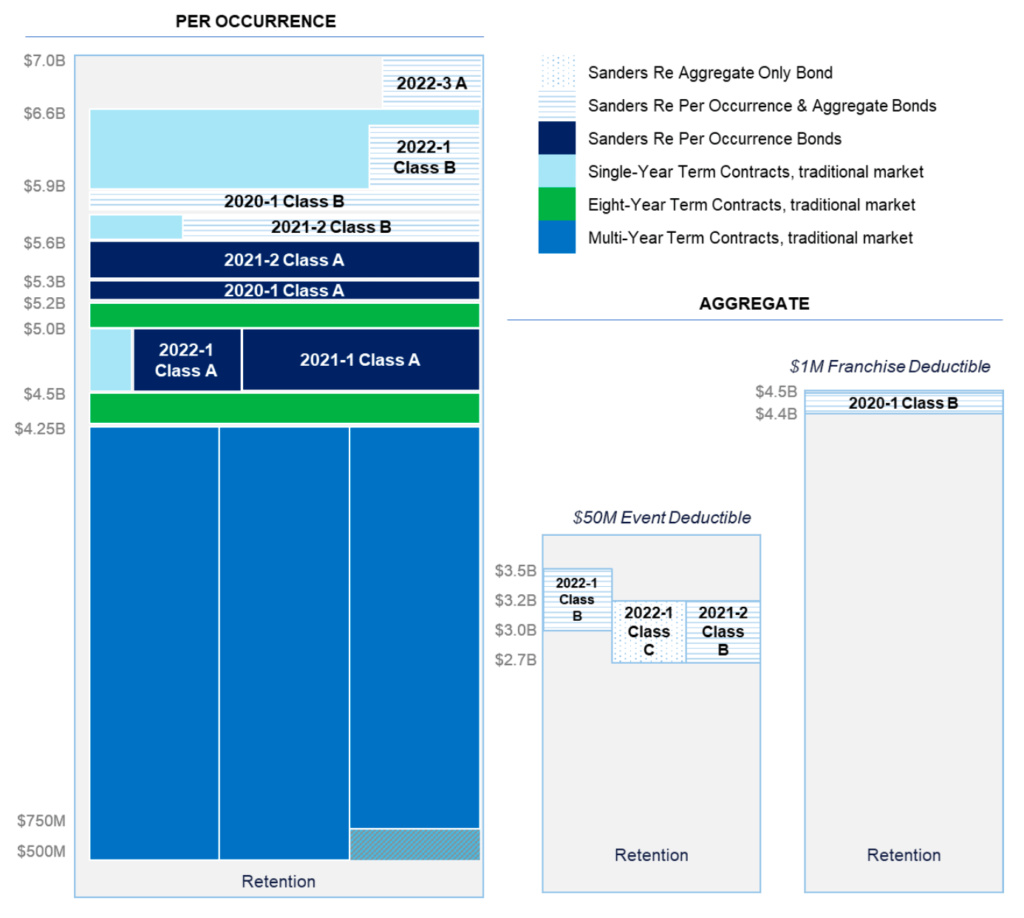

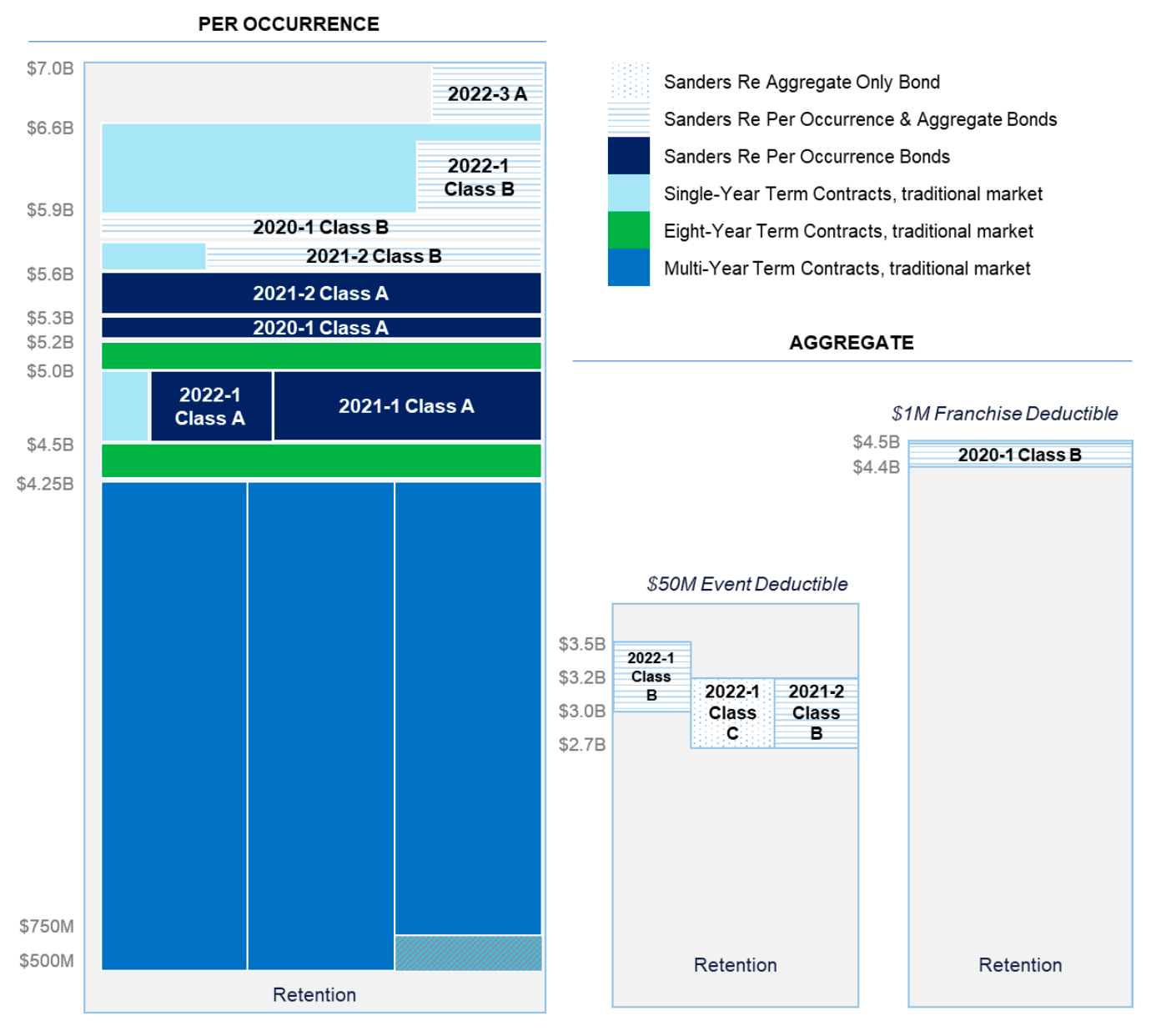

With the lowest down of Allstate’s aggregate cat bonds having an attachment point of around $2.7 billion, it seems March’s severe catastrophe loss load could pressure these bonds, at least in the secondary market.

Allstate reported today that it has suffered $1.26 billion of pre-tax catastrophe losses in March 2023, with the losses falling across 10 events.

But roughly 75% of this total came from just three wind events, with all those three likely to have eclipsed the $50 million per-event deductible that the lowest attaching Sanders Re aggregate cat bonds utilise.

Allstate’s catastrophe losses for the first quarter of 2023 totalled $1.69 billion, pre-tax, the insurer said today.

Allstate had previously announced that it aggregated roughly $1.1 billion of catastrophe losses through the second-quarter of 2022, so the first quarter of the annual risk-period for its aggregate reinsurance and cat bond covers.

The company then disclosed $763 million of cat losses for the third-quarter of the year thanks largely to hurricane Ian. But with Ian covered under a different Florida specific reinsurance tower, we need to subtract that event, which left perhaps around $100 million from Q3 2022.

Allstate then announced $779 million of pre-tax Q4 catastrophe losses, with winter storm Elliott the main driver.

Add on the first-quarter 2023 burden and you get close to $3.67 billion, which is a larger amount than the attachment level of the lowest-down aggregate Sanders Re cat bonds, but as we said it’s impossible to know just how the qualifying aggregated cat loss total sits for the cat bond program, given the use of event deductibles.

It’s safe to assume the annual aggregate catastrophe loss run-rate for the purpose of the catastrophe bonds is a fair amount lower than the $3.67 billion, but is it low enough to keep those aggregate cat bond layers from attaching?

The aggregate cat bonds in question are already all slightly marked down on secondary cat bond broker pricing sheets, implying some threat of loss was anticipated.

We should either see those exposed cat bonds marked down further, or recover towards near-par, as the annual aggregate risk period was reset from the start of this month.

You can see Allstate’s reinsurance tower for the risk period to April 1st below, with the aggregate tower on the right showing the Sanders Re catastrophe bond tranches that attach and provide reinsurance recoveries to Allstate once its aggregate qualifying catastrophe losses surpass $2.7 billion.

We reached out to Allstate for comment bu there was no response as of going to print. We’ll update you if we hear anything further.

Find details of every cat bond sponsored by Allstate in our Deal Directory.