Allianz grows to £5.4bn in the UK

Authored by Allianz

Full year results for Allianz Group show that the organisation is continuing to grow its business in the UK, achieving total revenue of £5.4bn in 2021 and growth of 2%. These combined figures position Allianz as one of the largest General Insurers in the UK.

Allianz Global Corporate & Specialty (AGCS) benefitted from good rate momentum in the market as well as strong new business, with Financial Lines, Energy & Construction and Entertainment driving the business. Improvement in economic conditions and new client wins drove Allianz Partners’ growth, while Euler Hermes achieved strong retention rates in its trade credit insurance business with top line development being limited by the low insolvency environment. The soft motor market impacted the premium income for both the Commercial and Personal sides of Allianz Holdings’ book, leading to a small decline from the previous year.

Chris Townsend, Member of the Board of Management of Allianz SE, responsible for Global Lines including Allianz Global Corporate & Specialty and Euler Hermes, Reinsurance, Anglo Markets, Middle East and Africa, said: “As Allianz Group, we continue to grow our property and casualty business in relevant markets around the globe. The 2021 results for our UK operations demonstrate that this is a key market for Allianz and indicate that we are well positioned for profitable growth. This success is based on a clear customer focus and excellent portfolio management.”

Sirma Boshnakova, Member of the Board of Management of Allianz SE, in charge of the Allianz Partners Global line, added: “I am very pleased with the great performance of Allianz Partners in the UK and the strong collaboration of our teams with the other UK businesses. Together we are taking our peace-of-mind solutions to the next level for our customers and business partners.”

Allianz Holdings improves profitability across diverse and resilient portfolio

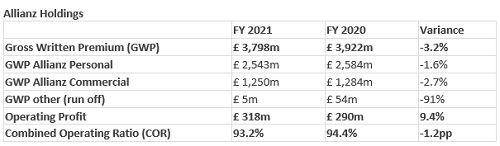

Allianz Holdings plc announces a 9.4% increase in Operating Profit, to £318m, in its results for the full year ending 31 December 2021.

Combined Operating Ratio also improved by 1.2 percentage points to 93.2%, while Gross Written Premium (GWP) fell slightly to £3.8bn.

Commenting on the figures, Colm Holmes, CEO Allianz Holdings, said: “The figures we are releasing today show that Allianz continues to deliver strong results, even in the most difficult of market conditions. We know that 2021 was another tough year for people and businesses, as the pandemic continued to impact every aspect of our day-to-day life, but we have been there to support our customers when they needed us the most. Our results show the importance of having a balanced portfolio of business across Personal and Commercial lines, through direct and intermediated channels, as well as having the technical expertise to steer our way through turbulent market conditions.”

Business performance

In another year of market uncertainty and challenging trading conditions, Allianz Holdings maintained a steady performance and delivered a robust set of results, thanks to the strength and diversity of its product portfolio.

Gross Written Premium fell back slightly, driven in the main by the impact of the soft motor market on both Allianz Personal and Allianz Commercial, as a result of Covid.

The continued impact of economic uncertainty on businesses, remediation of unprofitable lines and underwriting action on property accounts, added to the effects of the soft motor market, saw Allianz Commercial GWP decline by 2.7%. However, the business returned to growth in the fourth quarter.

In terms of claims, motor frequency is progressively returning to pre-pandemic levels but a major trend in this area has been general inflation and supply chain disruption, increasing the cost of motor and property repairs. Allianz Commercial continued to manage Business Interruption claims effectively, making an interim or final payment on 96% of accepted BI claims, compared to an industry average of 78%.

The robust performance across the business resulted in Combined Operating Ratios of 91.3% for Allianz Personal and 96.1% for Allianz Commercial.

Customer service

Allianz’s commitment to outstanding customer service was again recognised in 2021, as LV= GI was named Insurance Provider of the Year by Which? and achieved an ‘Excellent’ rating on Trustpilot, while Allianz Commercial received the Gracechurch Marque for the sixth consecutive year for its claims service. LV= Britannia Rescue was ranked number one for breakdown services by What Car? and Allianz Legal Protection (ALP) was named Insurance Provider of the Year at the Personal Injury Awards. Meanwhile, Petplan received five-star product ratings from Defaqto and Feefo.

Innovation, both in terms of new opportunities and customer-service developments, remained a strategic priority throughout 2021. Allianz Personal’s Flow and Britannia Rescue businesses strengthened their self-serve credentials, while Allianz Commercial enhanced its motor fleet products for electric vehicles and its Claims Hub enabled live updates for brokers. Digital simplification intensified at Petplan, with 85% of claims submitted online.

Looking after the environment

As part of its climate commitments, Allianz supports the adoption of green parts for motor repairs, in both personal and commercial lines. Under the Green Heart Standard, 75% of LV= GI bodyshops are now carbon neutral and all 25 sites are to offer electric cars as courtesy vehicles. Across the business, Allianz’s sustainable procurement charter prioritises suppliers who are committed to sound Environmental, Social and Governance (ESG) practices, and the Allianz Net Zero Accelerator is going to help brokers measure, reduce and offset their 2021 emissions.

Outlook

Looking ahead to 2022 and beyond, Colm Holmes commented: “Allianz is in a great position to build its position in the UK, based on the strong platform of a diverse and resilient portfolio of profitable business. To maximise our potential, we must continue to work closely with our brokers and other business partners, and listen to feedback from our Personal customers. We need to understand their requirements and deliver market-leading products and service. Our growth will be intelligent and sustainable, offering smart but simple-to-use digital solutions to support our customers in this ever-changing world.”