Allianz Group announces revenue of £5.6bn in UK

Authored by Allianz

Full year results for Allianz Group reveal that the organisation continued to grow in the UK in 2022, achieving a total revenue of £5,612.8m.

Allianz’s insurance businesses in the UK:

Highlights:

Allianz Global Corporate & Specialty UK continued its trend of positive development, increasing gross written premiums (GWP) by almost 30%, with a strong performance across all lines driven by new business.Allianz Partners continued its successful growth journey, increasing revenue to £337m, capitalising on recent new business wins, positive market recovery and rate increases across the travel market.Euler Hermes rebranded to Allianz Trade, increasing awareness and further strengthening its presence in the UK market. Trade credit insurance performed well, realising good growth driven by strong new business generation, high customer retention and higher volume.Allianz Holdings continued to achieve growth across the business demonstrating the strength and balance of its product portfolio.

Allianz Holdings:

Commenting on the figures, Colm Holmes, CEO Allianz Holdings, said: “Undoubtedly 2022 was a tough year for the industry and trading performance was impacted by several large weather events and ongoing inflationary pressures which have impacted profitability. Despite these challenges, we have still achieved growth across our business and these results demonstrate that we have the scale and diversity to withstand even the most difficult of market conditions.”

Business Performance:

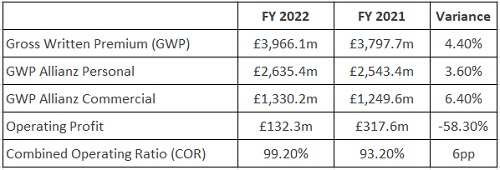

During a year of economic uncertainty and challenging trading conditions, Allianz Holdings delivered growth across the business with a 4.4% increase in revenue to £3,966m (FY2021: 3,798m). Operating profit fell by 58% to £132m (FY2021: £318m) and the Combined Operating Ratio (COR) deteriorated to 99.2% (FY2021: 93.2%), driven mainly by the impact of double-digit claims inflation, several significant weather events and the company’s exposure to the motor market.

All parts of the business continued to be impacted by the rapid rise of inflation. Overall, Allianz experienced gross inflation of 9.5%¹, which was ahead of predictions and pricing assumptions at the beginning of 2022. The motor market in particular faced a combination of challenges including labour shortages, rising repair costs and supply chain pressures, all of which continue to present an issue.

The total cost of the damage caused by the extreme weather events of 2022, including the February storms, subsidence from one of the hottest and driest summers and the December ‘Freeze event’ was £106m – net of reinsurance. Allianz’s prudent approach to reinsurance has benefitted the business and managed the overall impact.

From a Personal Lines perspective, Allianz delivered an increase in revenue with GWP up 3.6% to £2,635m (FY2021: £2,543m), with a strong performance from Petplan which delivered GWP of £657m (FY2021: £597m) and Flow delivering growth in line with expectations, reflecting the strength and diversity of Allianzʼs product portfolio. The business also saw strong retention following the implementation of the FCA General Insurance Pricing Practices.

Meanwhile, Allianz Commercial achieved growth of 6.4% with GWP of £1,330m (FY2021: £1,250m). This was due to the Mid-Market business performing well and delivering a 14.3% increase in revenue with GWP of £653.7m. In addition, the Engineering Inspection business saw strong levels of growth with net income of £94m (FY2021: £88m).

2022 also saw Allianz continue to build on its strength in the Electric Vehicle (EV) market and maintain its position as one of the largest insurers of electric vehicles in the UK. ElectriX, a new service from LV= which helps drivers lease, charge and insure an electric car, performed well and is set for good growth in 2023. Meanwhile, Allianz Commercial expanded on its EV offering for fleet customers with the launch of a new inspection service for car chargers, which means that all of its engineer surveyors are now trained to inspect mode 3 electric vehicle charging equipment located in commercial and industrial locations.

Customer and People

Throughout 2022, broker and customer satisfaction remained at exceptionally high levels, with research² confirming Allianz is no.1 in the market for Commercial Mid-Market, Petplan, LV= and Engineering Inspections.

From a people perspective, Allianz Holdings was ranked 14th in the Inclusive Top 50 UK Employers list, in recognition of its continued dedication to workplace diversity and inclusion.

The business also bolstered its leadership team throughout 2022, with executive appointments including Allianz Holdings chief operating officer Ashish Patel and chief compliance and corporate affairs officer Alison Rayner, who joined the business in February 2023. Allianz Commercial also appointed David Carey to the newly created position of managing director, mid-market, effective from April 2023.

ESG

As part of its commitment to shape a more sustainable future, particularly in light of weather events becoming more extreme due to climate change, Allianz Commercial continued the successful roll out of the Allianz Net Zero Accelerator programme, assisting brokers in measuring and reducing their carbon footprint and helping them on their journey to net zero.

Following the launch of Green Heart Standard to make the supply chains more sustainable, in 2022 more than 45,000 repairs were carried out in carbon neutral bodyshops, equating to 66% of LV= customer repairs. Allianz also extended its existing relationship with vehicle salvage specialist Synetiq, as LV= entered into a new agreement which will see the insurer’s bodyshop network increase the number of green parts used to repair vehicles.

From a humanitarian perspective, Allianz also provided support to Ukraine, with employee fundraising efforts in the UK contributing to Allianz’s global donation of more than 12 million Euros. Allianz also provided extended home and motor insurance cover under the UK Government’s Homes for Ukraine scheme, one year’s free car insurance for Ukrainians living with host families in the UK and free pet insurance for Ukrainian refugees.

Outlook:

Commenting on the outlook for the year, Colm Holmes concluded: “Our focus for the year ahead is to continue supporting our customers and partners navigate these difficult market conditions by delivering market-leading products and excellent service, underpinned by technical excellence. 2023 will undoubtedly present further tough trading conditions and the market will need to continue to manage inflationary pressures, increasing interest rates and support customers to mitigate risks such as underinsurance. I’m confident that Allianz remains in a position of strength thanks to our diverse and resilient portfolio of business.”