Allianz Group announces revenue of £3.28bn

Allianz’s insurance businesses in the UK:

Highlights:

Allianz Partners continued to strengthen its position in core markets by increasing revenue to £211m, driven by the expansion of new partnerships and a strong recovery of consumer demand, particularly in Travel.Allianz Trade in the UK had a good first half to the year, achieving excellent client retention against a backdrop of heightened economic uncertainty.Allianz Commercial (previously Allianz Global Corporate & Specialty UK) growth was in part driven by the change in accounting standards following IFRS17. Excluding this effect, growth was circa 11%, achieved through new business, higher than expected retentions and strong rates.Allianz Holdings delivered growth across the business with around a 7% increase in revenue and particularly strong performances in Engineering, Casualty and Animal Health.

Allianz Holdings delivers growth in first half of 2023

*Financial results are based on the new IFRS 9 and IFRS 17 accounting standards which have been adopted as of 1 January 2023. Comparative periods have been adjusted to reflect the application of the new accounting standards.

Commenting on the figures, Colm Holmes, CEO Allianz Holdings, said: “In the first half of the year, the industry continued to experience tough market conditions and inflationary pressures, similar to what we saw throughout 2022. Despite the difficult environment, our focus has remained on ensuring we provide our customers with great products and a fantastic service while at the same time maintaining a strong approach to technical discipline and making sure our pricing remains sustainable. Delivering profitable growth is a key priority for us and the strength of our brands and diverse portfolio of our business has ensured we’ve continued to trade well.”

Business Performance

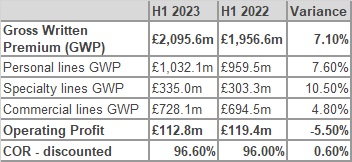

Allianz Holdings delivered growth across the business with around a 7% increase in revenue to £2,095.6m (HY2022: £1,956.6m) in the first half of the year. Operating profit fell by 5.5% to £112.8m (HY2022: £119.4m), predominately driven by inflation with the Combined Operating Ratio (COR) on a discounted basis increasing slightly by 0.6% to 96.6% (HY2022: 96.0%).

The commercial lines of the Allianz business delivered growth of around 5% year-on-year with gross written premiums (GWP) of £728.1m (HY2022: £694.5m) with a strong trading performance particularly across its Engineering and Casualty portfolios. The recently created Allianz Commercial also delivered growth with GWP up 13.6% to £1569.7m (HY 2022: £1,381.5m). Meanwhile, from a Personal Lines perspective, Allianz achieved revenues of £1,367.1m (HY2022: £1262.8m) with Animal Health performing very well.

All parts of the business continued to be impacted by inflationary pressures which has had a subsequent impact on rates, with both the personal and commercial motor markets and home insurance bearing the brunt of the challenging market conditions due to labour shortages, rising repair costs and supply chain pressures, all of which continue to present an issue. While improvements have been made with rate strength during the first half of the year, the impact of this will take time to materialise. As a result of the impact of persistent inflation, the focus has remained on sustainable pricing and managing claims costs to off-set as much as possible the impact to customers.

Customer and People

In the last six months, the business strengthened its senior leadership team with several key appointments to the Allianz Holdings management board, including Ulf Lange, chief financial officer, Alison Rayner, chief compliance and corporate affairs officer, Nadia Côté, commercial managing director, Serge Raffard, personal managing director and Kieran O’Keeffe, specialty managing director.

The launch of the newly created Allianz Commercial business, which was achieved by bringing together Allianz Global Corporate & Specialty (AGCS) UK and Allianz Holding’s UK Commercial, was also a key strategic move for the company and is already delivering positive results – as seen by the GWP figures – with brokers starting to experience the benefits of one strategy and one trading face to market. Led by Nadia, the leadership team was bolstered with the appointment of David Carey who joined Allianz as managing director for mid-market. In addition, Nick Hobbs moved into the expanded role of chief distribution officer for Allianz Commercial in the UK.

With the Consumer Duty coming into effect from 31 July 2023, a significant amount of work has been done to ensure the business is ready for the new regulation. Culturally, Allianz has always put customers at heart of the business and aimed to ensure that all products and services meet consumer’s needs which has resulted in the company being in a good place following implementation.

Broker and customer satisfaction also remained at exceptionally high levels, with research¹ confirming Allianz is no.1 in the market for Commercial Mid-Market, Petplan, LV= General Insurance and Engineering Inspections.

Environmental, Social, and Governance

As part of its commitment to shape a more sustainable future, throughout the first six months of the year the business continued its efforts to improve the way it operates with Fleet policies enhanced to reduce repair times and prescribe the fitting of green parts, while encouraging the use of approved repairers.

Meanwhile, the Personal Lines business grew its repair network capability in both home and motor with the aim of reducing lifecycles, being more efficient and delivering better customer outcomes. Steps were also taken to help more people make the transition to electric cars, with Allianz launching an electric vehicle salary sacrifice scheme for all UK employees.

Finally, as a Worldwide Partner of the Olympic & Paralympic Movements, the first half of the year also saw Allianz launch its Path to Paris fundraising campaign with an ambitious target to raise over £100,000 for its corporate charities over the course of a 12-month fundraising relay to Paris, where the Olympic Games will commence in July 2024.

Outlook

Commenting on the outlook for the rest of the year, Colm Holmes (pictured) concluded: “There is no doubt that the industry will continue to face very difficult trading conditions. Inflation is not going away anytime soon and, all the time it persists, it will continue to impact our business and customers and we will need to remain disciplined when it comes to rates, particular in motor and home.

“Despite these market challenges, I’m proud of what Allianz has achieved. Our trading has remained robust and our focus will remain on being technically excellent, ensuring our pricing models are sustainable and offering competitive solutions for our customers. I’m confident that our diverse and resilient product portfolio puts Allianz in an excellent position to achieve our ambitions and with the support of my new leadership team we will be able to ensure that our business continues to navigate these difficult headwinds.”

Authored by Allianz