“All Aboard on the Mobility Train!” – Insurers Must Hop on Board Customer Mobility Trends

Published on

February 16, 2023

Automotive is now all about mobility. And automotive insurance is in the midst of a big change. If you watched the Superbowl this past Sunday and you were like me waiting for all the commercials, you likely saw two particular ads that have a bearing on the future of automotive insurance. Netflix’s partnership ad with GM, promising to use more EVs in their shows, and the announcement of Dodge’s new EV truck — which means that now all three of the traditional U.S. big three automakers have electric trucks.

This highlights the rapid growth of EV and Autonomous vehicle use, but the growth of EV and autonomous trucks will likely be one of the “revolutionary” innovations of our time, even contributing to the continued rapid growth of truck sales in the future. This is just one storyline in the epic sweep of technological change in automotive circles, but this story has a twist that involves home insurance as well.

Two traditional concerns for truck buyers are:

Mileage range — is the gas tank big enough to reduce fill-ups?

Hauling and towing power — is there enough horsepower and torque to carry heavy loads easily?

For an electric truck to compete with a gas truck on both of these points, the EV batteries must be very large and powerful. In fact, they need to be so powerful that their power rivals backup battery systems for homes. The Ford Lightning has been compared to owning 7 Tesla Powerwalls (a home backup battery system).[i] Knowing this, engineers have created advanced electrical panels and systems that can handle bi-directional charging — charging that can feed power both into and out of the home. Both Ford and GM trucks will have the capability to do this; powering homes if the power goes out (for up to 21 days, according to GM), just like a backup battery or generator. GM also theorizes that many EV owners will be feeding power back onto the grid.

In fact, GM recently spun off GM Energy, a new business unit dedicated to “EV related products for residential and commercial customers.”[ii]

However, if you combine the growth of solar panels (for charging EVs) and the need for advanced electrical in existing homes, some of these mobility trends may create new home property risk. This is just one more way that the barriers are coming down in insurance lines of business.

Mobility — risk in motion

The automotive world is rapidly changing in all dimensions due to the shift in how other companies and industries are changing, such as ridesharing, the use of other mobility options such as electric bikes, autonomous vehicles, changing views of vehicle ownership, advancements in automotive technology, along with a growing plethora of transportation options like car sharing.

Companies outside insurance are coalescing around a shift to “mobility.” Mobility options are important, but they can be fulfilled by many means beyond traditional vehicle usage or ownership…a significant shift impacting business models from automotive companies to dealerships, rental car companies, ride-sharing companies, car-sharing companies, insurance companies, and more. Risk exists in all facets of mobility. Seattle, for example, is known for its high pedestrian injury and fatality rates. Urban dwellers are increasingly living without vehicles, yet they still move from place to place and they still incur risk.

Highly networked, data-driven, mobility business models are rapidly emerging, primarily outside of insurance. Automotive companies like Tesla, Ford, and GM are leading this shift along with ride-sharing platform companies like Uber. They are redefining the customer journey and the entire customer relationship across a broader set of transportation or mobility options. As a result, the threat for auto insurance is for insurers to continue a 100+-year-old viewpoint — seeing a policy as a transaction.

In Majesco’s recently-released Consumer Survey Report, Enriching Customer Value, Digital Engagement, Financial Security and Loyalty by Rethinking Insurance, we look at customer trends through the lens of insurer impact. We use these trends to consider how data use and a holistic view of the customer can help insurers grow more relevant to a changing mobility environment.

In today’s blog, we’ll look at the survey data and consider three ways in which insurers can meet customer demand:

Personalized pricing with data

Meeting the demand for value-added services

Expanding channel options

Personalized Pricing with Data

In the digital era of insurance, data is the fuel for optimization and innovation. New technologies, demographics, and behaviors are driving the explosion of data and will power the growth and leadership positions for insurers over the next 10 years. At the forefront of this is auto insurance.

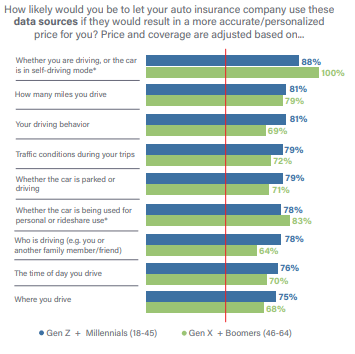

Interestingly, there is strong alignment between both generational groups in using new, non-traditional sources of data for personalized pricing for auto insurance as represented in Figure 1. Connected devices (and other data sources) enable pricing based on mileage, usage, and driving behavior, which could lower premiums and address the financial top-of-mind issue for consumers.

Acceptance is on the rise.

Gen Z and Millennials’ interest in using every data source (all sources received positive approval of 75% or higher) reflects the openness of this generation to personalize insurance with their data. Gen X and Boomers who are rideshare drivers or use self-driving capabilities have exceptionally high levels of interest in using vehicle data for pricing. With the automotive companies moving in this direction, the pressure will be on for insurers to offer similar pricing options.

With the work options shifting to remote/hybrid and less driving as a result, consumers are increasingly interested in pricing based on actual vehicle usage and driving behavior, rather than the traditional approach. The work option changes continue to dramatically reduce the number of miles driven, spurring increased interest in data-driven and behavior-based insurance.

Figure 1: Interest in new data sources for auto insurance pricing

Demand for Value-Added Services

Gen Z and Millennials are strongly interested in value-added services included with their auto insurance, reflected in the 80% or higher response on all 10 items, as seen in Figure 2. Gen X and Boomers share their highest levels of interest with Gen Z and Millennials on five of these items. Three of these focus on safety-related alerts: detecting a crash and alerting emergency services; alerts about road conditions, traffic, and weather; and alerts about vehicle recalls. The other two focus on keeping their vehicle in safe operating condition and in compliance with license and registration renewals. Increased use of vehicle safety technology puts more emphasis on prevention and less on traditional indemnification.

With all the changes to vehicles and their use, insurers need to proactively rethink traditional auto insurance from a distinct transaction to a part of a broader customer mobility solution that adapts and changes in real time based on customer needs and behaviors.

Figure 2: Interest in value-added services with auto insurance

Expanding Channel Options

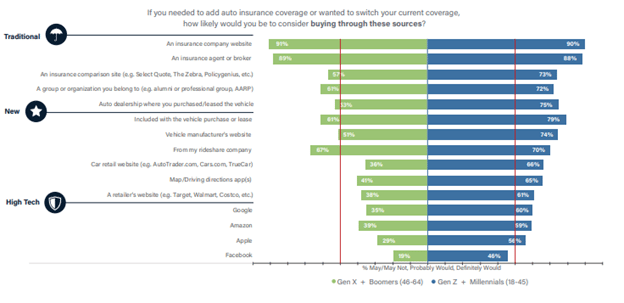

Traditional channels remain dominant in auto insurance purchasing, with a preference for company websites and agents/brokers reaching the 90% level for both generation segments. (See Figure 3.) All other channels drop under 80%, yet nearly all channels have a high level of interest. Vehicle purchase/lease is the next highest for Gen Z and Millennials at 79% and 61% for Gen X and Boomers. The strong showing of this channel is another highlight of the growing popularity of embedded insurance, which is a great fit for vehicle purchasing, renting, and leasing.

Once again using a 50% reference line highlights the dramatic gaps between the generation segments across the channel options. Gen Z and Millennials’ interest exceeds 50% on 14 of the 15 channel options (93%), while Gen X and Boomers have only 8 of 15 (53%) exceeding 50%, highlighting the need for expanded channel options to reach the younger generation when and where they want.

The new and high-tech channels all reflect embedded insurance opportunities for the younger generation, a growing area of focus for insurers and automotive companies. The new and growing spectrum of channel options now available, especially the exciting opportunities for embedded insurance, will give innovative insurers and their partners tremendous opportunities for growth, with new markets, new offerings, and satisfied, loyal customers.

Figure 3: Interest in channel options for auto insurance

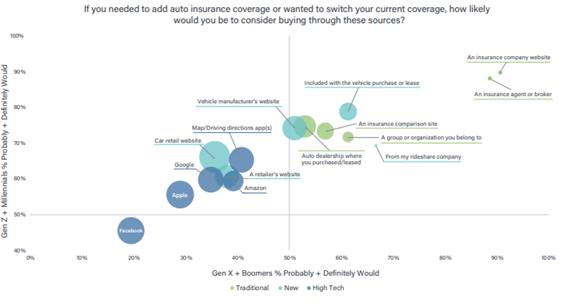

In Figure 4, we can see these trends from the perspective of generational alignment. Traditional insurance company website and agents/brokers channels (in the upper right-hand corner) show both their strength of preference and high level of agreement between the generations. The chart also highlights the appeal of 6 other channels for the auto insurance market: rideshare company, affinity groups, embedded with the vehicle purchase/lease, comparison sites, auto dealerships, and vehicle manufacturers’ websites.

Figure 4: Generational alignment on interest in channel options for auto insurance

Ease of channel use against GAFA brands

Of course, channel interest is also a reflection of current perceptions. In every case, the respondent is somehow considering how easy or valuable they perceive a channel to be. This is one of the reasons that we commonly ask questions regarding Google, Amazon, Facebook, and Apple. If these common customer brands are perceived as simple for other transactions, will that be accounted for when a customer considers where they might purchase their auto insurance?

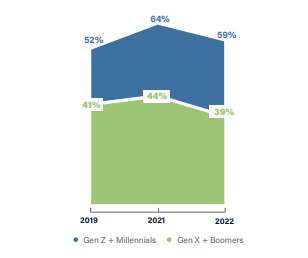

In Figure 5, we see an interesting trend regarding Amazon. It has achieved growing interest over the past several years with Gen Z and Millennials as a channel option for auto insurance. Interest increased by 12 percentage points in 2021 over 2019 but settled slightly lower at 59% in this year’s survey. In contrast, Gen X and Boomer interest in Amazon as an auto insurance channel is slightly lower and has remained steady, but still should be considered an important and useful channel for a sizable portion of the Gen X and Boomer market.

Figure 5: Trend in interest in Amazon as a channel for auto insurance

Holistic approaches to insurance ecosystems

The combination of technology and customer expectations is directly impacting insurance by altering the traditional ecosystem of agents and brokers, to new channel ecosystem options such as embedded, automotive, transportation businesses, big tech, and more. By doing so, it breaks down business and market boundaries to make the ecosystems fluid, based on customer needs and expectations for both the risk product and other value-added services that were identified in this research. This creates greater value for insurers through new revenue streams and access to a broader market through the multiplier effect.

Insurers must consider these impacts, however, outside of a singular line of business. Majesco’s report not only links all personal lines, but it highlights the idea that insurance is now, more than ever, part of a holistic approach to financial wellness that should be looked at as a whole…just as often as it is looked at through a singular line. Our example of EVs “engaging” with the home in a symbiotic electrical system is a case in point — the boundaries are falling. How is the risk profiles changing with the use of these new mobility options? It’s no longer black and white.

Who we are as mobile people — switching seamlessly through transportation modes and life/work needs — must be acknowledged by insurers through personalization, relevant products, and a complete understanding of how and where we wish to buy.

For a complete look at customer sentiments and insights regarding insurance needs, products, services, and channels, be sure to read Majesco’s thought-leadership survey report, Enriching Customer Value, Digital Engagement, Financial Security and Loyalty by Rethinking Insurance.

[i] Csere, Csaba, Can Your EV Power Your House?, Car and Driver, May 11, 2022.

[ii] Newcomb, Doug, GM establishes new unit to help connect EVs with the power grid, Automotive News, October 11, 2022.