AI insurance agents? No thanks, consumers say

AI insurance agents? No thanks, consumers say | Insurance Business America

Technology

AI insurance agents? No thanks, consumers say

Americans are overwhelmingly uncomfortable with the thought of dealing with AI insurance agents, according to a new survey

Americans are overwhelmingly uncomfortable with the thought of dealing with AI insurance agents – good news for the country’s 1.6 million human insurance agents, according to a recent survey by online insurance agency GetSure.

“AI is coming to insurance distribution and has the potential to do wonders for the customer experience,” said Rikin Shah, founder and CEO of GetSure. “Getting this right, however, will require open dialogue with consumers, and that’s exactly why we ran this survey.”

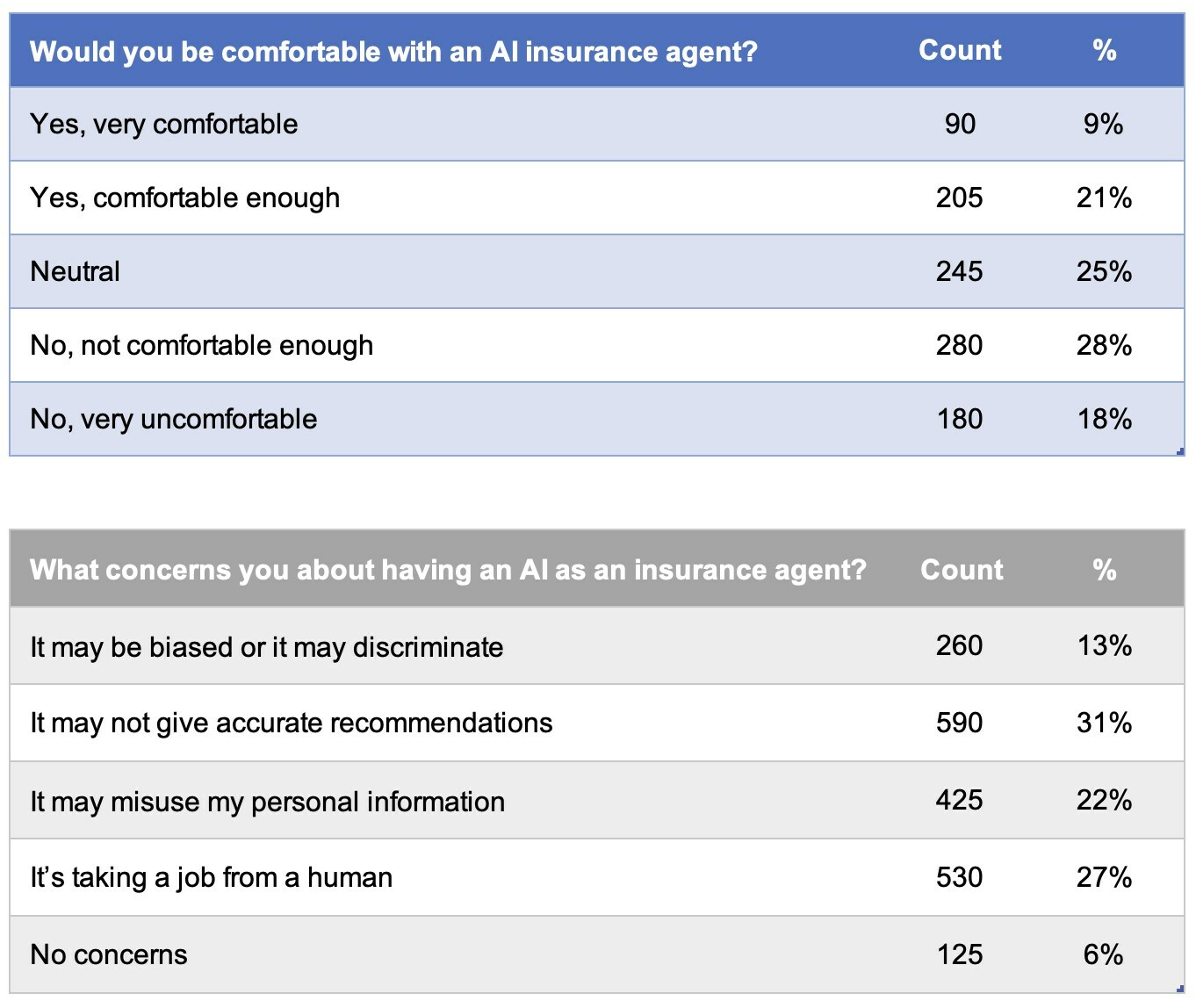

The survey polled 1,000 Americans about their feelings on working with an AI insurance agent, GetSure said in a news release. The survey found that just 9% described themselves as “very comfortable” with the idea of AI insurance agents, while 70% did not feel comfortable. Even the promise of discounted rates didn’t move the needle much, with 55% of respondents saying they would still prefer a human agent over a computerized one.

“That’s a strong statement,” Shah said. “Consumers are telling us loud and clear that you couldn’t pay them to work with an AI.”

Survey respondents’ top three concerns about working with an AI insurance agent were:

Inaccurate recommendations (59%)

Job loss for humans (53%)

Misuse of personal information (43%)

Despite their reluctance to work with computerized agents, most Americans seem to have resigned themselves to the thought that AI is the future of the insurance industry, the survey found. A full 68% of survey respondents said they expected the majority of US insurance agents to be AI within 20 years.

“We understand the concerns and reservations consumers have about AI in insurance,” Shah said. “And we’re committed to maintaining an open dialogue with our customers, listening to their feedback, and continuously improving our products.”

Have something to say about this story? Let us know in the comments below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!