A rude wake-up call

From the desk of CIO Paul Holba: In this latest update from the Empire Life Investments team, Paul Holba reviews the key market events impacting 2022 and beyond.

The first half of 2022 was turbulent, with major asset classes suffering from their worst first half of a year in decades. The year began with the world’s uneven emergence from the pandemic and supply chain disruptions affecting the global economy. Russia invaded Ukraine in February, spurring a major geopolitical event that pushed up prices of commodities, including energy and agricultural products. China’s zero-COVID policy has suppressed demand, weakened productivity, and spilled over into global supply chains.

![]() Download the PDF

Download the PDF

Rising inflation and tightening monetary policy has fueled the markets

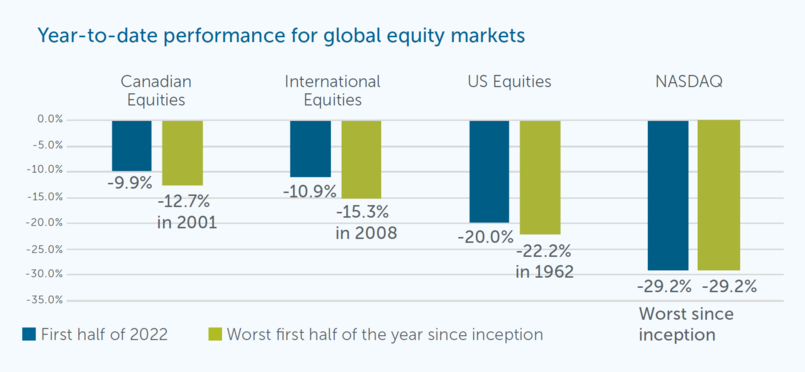

Accelerating inflation and rapidly tightening monetary policy fueled a months-long-rout among major asset classes, sending U.S. equities into bear territory. The tech-heavy Nasdaq Composite Index slumped 29.2%, and the S&P 500 Index fell 20.0% (in USD terms) for the first half of the year. In Canada, the S&P/TSX Composite Index outperformed with a decline of 9.9% and that was only because the Energy sector held up the average, with oil prices gaining more than 40%. International equities declined 10.9%, however, when accounting for weaknesses in that market’s underlying currencies against the Canadian dollar, the index declined 17.9%.

Source: Morningstar Research Inc. as of June 30, 2022, bonds represented: Global Bonds – Bloomberg Global Aggregate, Canadian Bonds – FTSE Canada Universe Bond Index, US High Yield Bonds – ICE BofA US High Yield, Long-term Canadian Bonds – FTSE Canada LT Bond index.

Source: Morningstar Research Inc. as of June 30, 2022, bonds represented: Global Bonds – Bloomberg Global Aggregate, Canadian Bonds – FTSE Canada Universe Bond Index, US High Yield Bonds – ICE BofA US High Yield, Long-term Canadian Bonds – FTSE Canada LT Bond index.

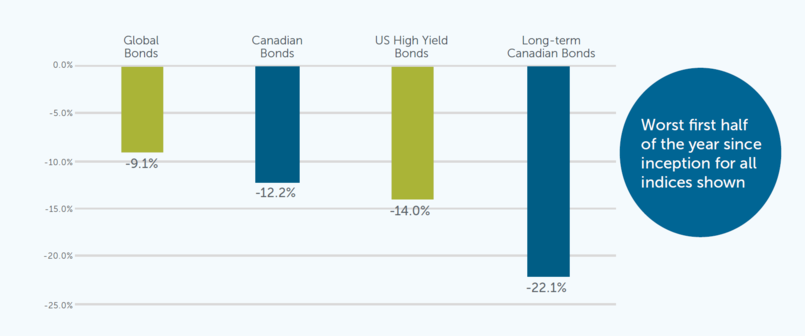

At the same time, the bond markets sold off sharply and bond yields increased across the curve as central banks around the world aggressively raised interest rates to combat the highest inflation since the 1980s. Losses across various bond sectors have mounted with Canadian bond markets underperforming Canadian equities. The FTSE Canada Universe Bond Index fell 12.2%, highlighted by a whopping 22.1% loss for the long-term index. Global bonds and US high yield bonds were also not immune to the challenging environment.

Source: Morningstar Research Inc. as of June 30, 2022, bonds represented: Global Bonds – Bloomberg Global Aggregate, Canadian Bonds – FTSE Canada Universe Bond Index, US High Yield Bonds – ICE BofA US High Yield, Long-term Canadian Bonds – FTSE Canada LT Bond index.

Speculative asset classes suffered even more, with Bitcoin losing 60% this year as the industry has seen a wave of liquidity concerns. About the only thing that rose in the first half were commodities prices. Oil prices surged above $100 a barrel, and U.S. gas prices hit records.

Outperforming in a hostile environment

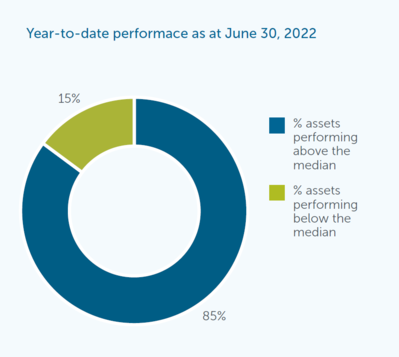

Source: Empire Life, Morningstar Research Inc. as of June 30, 2022

Although Empire Life’s investment mandates could not avoid losses in this challenging market environment, our time-tested investment philosophy focusing on bottom-up research, investing in attractively valued high-quality businesses helped us preserve capital compared with our peers. Over 80% of segregated fund assets under Empire Life’s management delivered

performance that was above category median (first or second quartile) on a year-to-date basis. Many of Empire Life’s multi-asset solutions, such as Emblem GIFs, Monthly Income GIF, and Asset Allocation GIF, benefitted from a more defensive positioning (lower equity allocations) in light of increased economic risks and its impact on security level valuations. At the sector level, increased investments in Energy stocks across multiple strategies supported performance in an environment of elevated oil prices.

Active management at the security level has also played a material role in relative performance. For example, Empire Life’s large-cap Canadian equity strategies were significantly underweight Shopify vs the index. Shopify’s first-half loss of ~77% was the largest performance detractor to the S&P/TSX Composite – contributing about half of the index’s loss. Although we consider Shopify a strong business, its lofty valuation deterred meaningful positions to date but is increasingly becoming attractive as its stock price comes down.

Although bond markets have had the worst drawdown in more than 40 years, all Empire Life fixed-income funds outperformed their peers, and we believe are well positioned for the long term. Over the last year, our fixed income strategy has kept duration relatively short and diversified with a combination of floating rate instruments, preferred shares and real return bonds.

Although we believe inflation is not permanent, it has remained stubbornly persistent and broad based. As a result, central banks around the world continue to maintain hawkish stances and try to balance combating inflation without hampering growth. We believe that strong employment and consumer demand should prevent a recession in the near term, but there are economic indicators, including consumer sentiment and businesses and manufacturing activities, pointing to greater uncertainty and a slowdown in activity.

The Empire Life investment team is well positioned and ready to take on any economic scenario, helping to see investors through market volatility and focus on their long-term financial objectives.

The value of your guarantees

It’s important to remember that your choice to purchase a segregated fund contract provides you with a level of protection that isn’t available with most other investment products. Some of the key features and benefits of a segregated fund contract,

like the valuable maturity and death benefit guarantees, opportunity for resets, and the ability to provide a guaranteed lifetime income, help provide protection to both you and your loved ones, regardless of how markets are currently performing.

When markets are performing well, resets of your guarantees help lock-in market gains; when markets are declining your beneficiaries remain protected through the death benefit guarantee, (either 75% or 100%, depending on the type of contract you have purchased). Additionally, if you own a Guaranteed Withdrawal Benefit (GWB) contract, your current or future income

is also protected from market downturns, giving you the peace of mind knowing you’ll have a predictable stream of income you can count on assuming no excess withdrawals have been made.

The path to opportunity is seldom straightforward

2022 has rudely reminded investors of the potential volatility that is inherent in stock and bond markets. As odd as it sounds now, it can be viewed as an opportunity. An opportunity to add to high-quality investments at more attractive valuations. An opportunity for individual investors to really assess their risk tolerance with the support of their financial advisors. An opportunity to partner with an investment manager helping to create long-term wealth. An opportunity to learn more about how you are protected with the features and benefits of your segregated fund contract. History has shown us that markets eventually recover, but it’s seldom a straightforward path. We are here to be a part of your journey.

This article includes forward-looking information that is based on the opinions and views of Empire Life Investments Inc. as of the date stated and is subject to change without notice. This information should not be considered a recommendation to buy or sell nor should they be relied upon as investment, tax or legal advice. Information contained in this report has been obtained from third party sources believed to be reliable, but accuracy cannot be guaranteed. Empire Life Investments Inc. and its affiliates do not warrant or make any representations regarding the use or the results of the information contained herein in terms of its correctness, accuracy, timeliness, reliability, or otherwise, and do not accept any responsibility for any loss or damage that results from its use.

Past performance is no guarantee of future performance.

Empire Life Investments Inc., a wholly owned-subsidiary of The Empire Life Insurance Company, is the Manager of Empire Life Mutual Funds and the Portfolio Manager of Empire Life Segregated Funds. The units of the Funds are available only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such units. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund and segregated fund investments. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value. A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Segregated Fund policies are issued by The Empire Life Insurance Company.

July 2022