A Practical Guide to Second Home Insurance Coverage Options

Introduction

Second home insurance is essential for anyone owning a property separate from their primary residence. Whether it’s a vacation home by the beach or a rental property in the mountains, insuring your second home protects against unique risks and ensures peace of mind.

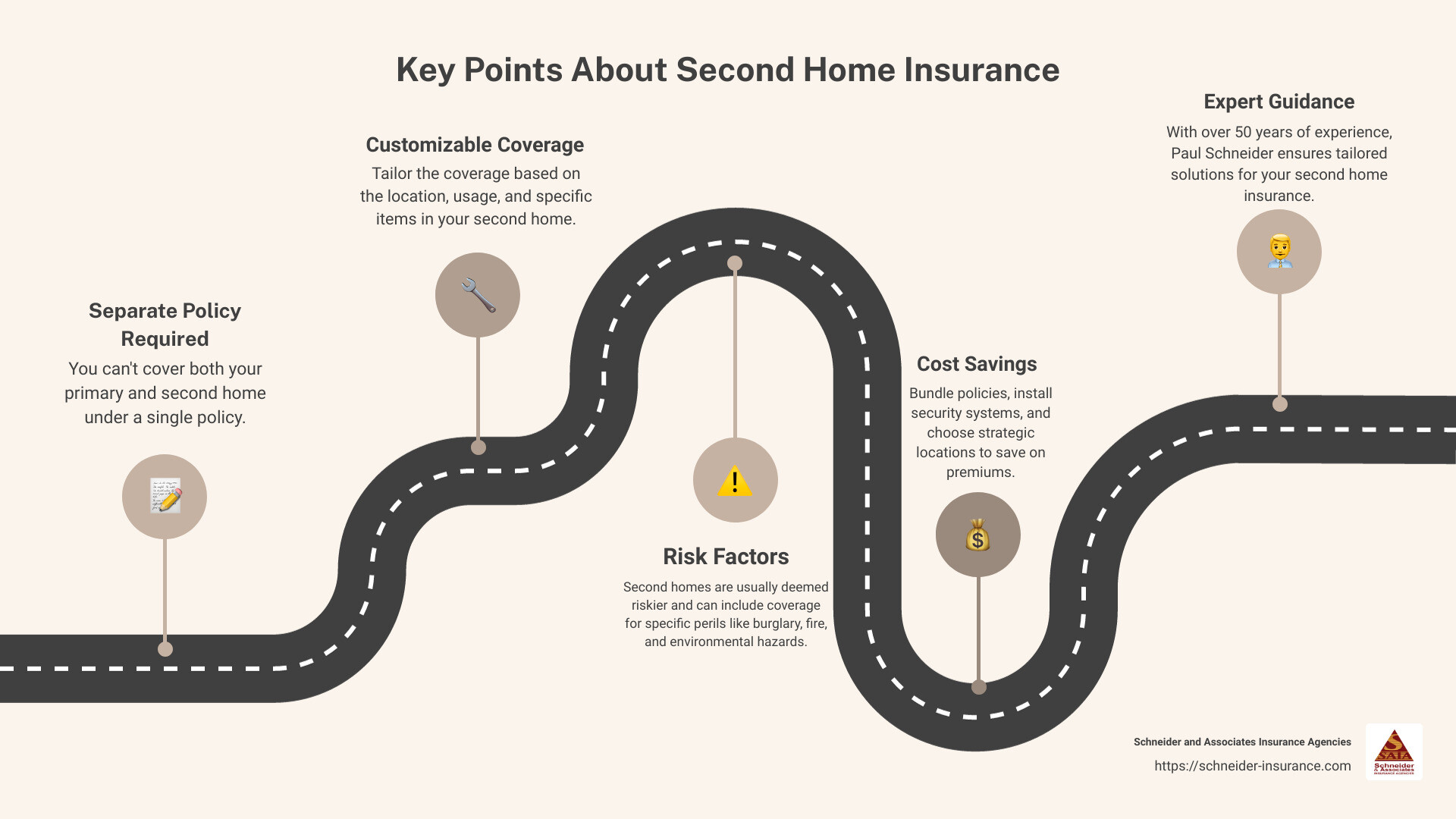

Key Points You Need to Know:

1. Separate Policy Required: You can’t cover both your primary and second home under a single policy.

2. Customizable Coverage: Tailor the coverage based on the location, usage, and specific items in your second home.

3. Risk Factors: Second homes are usually deemed riskier and can include coverage for specific perils like burglary, fire, and environmental hazards.

4. Cost Savings: Bundle policies, install security systems, and choose strategic locations to save on premiums.

Hi, I’m Paul Schneider. With over 50 years of combined experience owning and running insurance agencies in Florida, I’ve helped countless clients find tailored second home insurance solutions. My expertise helps you navigate the complexities and unique risks associated with insuring a second property, so you can enjoy your home worry-free.

Let’s dive deeper into what second home insurance entails and why it’s crucial for your peace of mind.

What is Second Home Insurance?

Second home insurance is a specialized type of insurance designed to protect properties that aren’t your primary residence. This includes vacation homes, rental properties, and seasonal retreats. Because these homes are not occupied year-round, they come with unique risks that standard homeowners insurance doesn’t cover.

Definition

Second home insurance provides coverage for properties you don’t live in full-time. This could be a beach house you visit during summer or a mountain cabin you rent out during ski season. Unlike your primary home insurance, second home insurance is tailored to cover the specific risks associated with properties that are often unoccupied.

Secondary Home Insurance

Secondary home insurance is another term for second home insurance. It encompasses various types of secondary residences, whether they’re used for leisure, rental income, or both. This type of insurance is essential because secondary homes are more vulnerable to risks like burglary, vandalism, and natural disasters due to their intermittent occupancy.

Named Perils

One key aspect of second home insurance is that it often operates on a “named perils” basis. This means the policy will only cover specific events listed in the contract. Common named perils include:

FireTheftWindstormVandalism

For example, if you own a lake house, your policy might include coverage for flooding, which is a higher risk in such locations.

Coverage Types

Second home insurance typically includes several types of coverage to protect both the structure and the contents of your home. Here are the main types:

Dwelling Coverage

This covers damage to the physical structure of your second home, such as the walls, roof, and foundation. It’s essential for protecting your investment from risks like fire, wind, and other named perils.

Belongings Coverage

This type of coverage protects the items inside your second home, such as furniture, appliances, and personal belongings. If you keep valuable items like electronics or antiques in your vacation home, belongings coverage ensures they are protected.

Liability Coverage

Liability coverage is crucial if someone gets injured on your property. This coverage helps with legal fees and medical costs. For example, if a guest slips and falls at your beach house, liability coverage can protect you from financial loss.

Additional Riders

Depending on your second home’s unique features, you might need additional riders. These can cover specific risks associated with items like fire pits, hot tubs, in-ground pools, ATVs, and boats. Adding these riders ensures comprehensive protection tailored to your property’s needs.

Understanding the basics of second home insurance helps you make informed decisions and ensures your secondary residence is adequately protected. Up next, we’ll explore why second home insurance is typically more expensive than primary home insurance.

Why Second Home Insurance is More Expensive

Second home insurance often comes with a higher price tag compared to your primary residence. Here’s why:

Risk Factors

Second homes are usually vacant for extended periods. This increases the risk of unnoticed issues like leaks, fires, or vandalism. According to the Insurance Information Institute, 98.1% of homeowner claims in 2018 were due to property damage, including theft. An empty house makes for an easy target.

Burglary

When you’re not around, your second home becomes more vulnerable to break-ins. A property left unoccupied is a magnet for thieves. Installing a security system can help, but the risk remains higher than for a primary residence, driving up insurance costs.

Fire

Fire risks are another concern. Whether it’s a remote cabin susceptible to wildfires or a beach house with a fire pit, the potential for fire damage is significant. The cost to insure against these risks can be steep. For example, a log cabin in the mountains needs extensive coverage for wildfires and snowstorms, as these natural elements pose a substantial threat.

Location-Specific Risks

The location of your second home plays a big role in insurance costs. Homes in areas prone to natural disasters, like hurricanes, floods, or earthquakes, will see higher premiums. Take the example of a Florida beach house, which is at higher risk for hurricanes and flooding. A standard homeowners policy wouldn’t suffice; a tailored policy is necessary to cover these specific risks.

Waterfront Location

Second homes in picturesque but risky areas, like beach houses or lakefront cabins, are more prone to natural disasters. For instance, a home on the California coast is at higher risk for wildfires and earthquakes. According to research, premiums for such homes can be two to three times higher than those for primary residences.

Limited Coverage

Second home insurance often provides limited coverage compared to primary home insurance. Insurers assume you keep fewer valuable items in a vacation home. However, the limited coverage can still be costly due to the higher risk factors involved. It’s crucial to read the fine print to understand what is and isn’t covered.

Named Perils

Most second home insurance policies are based on named perils. This means they only cover specific risks listed in the policy, such as fire, windstorm, and theft. However, other risks, like flood damage, often require a separate policy. This is especially true for homes in high-risk areas.

Understanding these reasons can help you make informed decisions about your second home insurance. Next, we’ll discuss the different types of coverage available for your second home.

Coverage Options for Second Homes

When it comes to second home insurance, understanding the various coverage options is crucial. Let’s break down the main types of coverage you’ll need:

Dwelling Coverage

Dwelling coverage is the backbone of your second home insurance policy. It protects the structure of your vacation home, including walls, roof, and any attached structures like a garage. This coverage is usually based on the replacement cost of your home. That means it covers the cost to rebuild your home from the ground up if it’s destroyed by a named peril like fire or windstorm.

However, it’s crucial to note that named perils policies only cover specific events listed in your policy. So, if your home is damaged by something not on that list, you’re out of luck. Always read your policy carefully and consider additional coverage for risks like earthquakes or floods.

Belongings Coverage

Personal property coverage protects the belongings inside your second home. This includes furniture, electronics, and other personal items. But here’s the catch: coverage is usually limited. For instance, your policy might only cover a portion of the total value of high-end electronics or jewelry. For these items, you might need separate policies or riders to ensure full protection.

Liability Coverage

Liability protection is crucial if you have guests over. This coverage protects you if someone gets injured on your property and decides to sue. It covers guest injuries and the associated legal expenses. In some cases, your primary residence’s liability insurance might extend to your second home. But it’s wise to double-check. You might also consider a personal umbrella policy for extra liability protection.

Additional Riders

Additional riders can provide extra coverage for specific items or risks not included in your standard policy. These might include:

Fire pitsHot tubsIn-ground poolsATVsBoats

These items pose unique risks and may require special coverage. For example, a hot tub can increase the risk of injury, while an ATV might be prone to theft. Adding riders ensures these items are adequately protected.

Understanding these coverage options can help you tailor your second home insurance to fit your needs. Next, we’ll look at the factors that affect the cost of insuring your second home.

Factors Affecting Second Home Insurance Costs

When it comes to second home insurance, several factors can impact the cost. Understanding these can help you make informed decisions and potentially save money. Let’s dive into the key aspects:

Location

Location plays a huge role in determining insurance costs. Homes in areas prone to natural disasters like floods, wildfires, or hurricanes will have higher premiums.

Flood-prone areas: Homes near lakes, rivers, or oceans often require separate flood insurance policies. Standard homeowners insurance usually doesn’t cover flooding.Wildfire risk: Properties in remote or mountainous areas are more susceptible to wildfires, leading to higher insurance costs.Storm surge: Beachfront homes face risks from hurricanes and storm surges, which can significantly raise premiums.

Choosing a location with fewer risks can help lower your insurance costs. Homes in gated communities or areas with lower crime rates can be cheaper to insure.

Property Type

The type of property and its amenities also play a big role in insurance costs:

Single-family homes: These typically have higher premiums compared to condos or townhouses because they lack shared security features.Condominiums: Often cheaper to insure because the homeowners association usually covers the building’s exterior, reducing your insurance needs.Pools and hot tubs: While great for relaxation, these amenities increase liability risks and can drive up your insurance costs. Additional liability coverage is often recommended.

Older properties usually cost more to insure. Insurers consider the likelihood of structural issues and outdated systems:

Older homes: May require more maintenance and are seen as higher risk, leading to higher premiums.Newer homes: Typically better maintained and built to modern standards, often resulting in lower insurance costs.

Security Measures

Taking precautionary measures to mitigate risk can also impact your insurance premiums. Setting up a security system can fend off burglary, while smart home devices can safeguard your home against other threats.

Security systems: Installing a security system can help lower your insurance costs. These systems can deter theft and provide peace of mind.Smart home devices: There is an array of smart home devices, including water leak sensors, smoke detectors, and motion sensors. The more security and devices you have, the more opportunity for potential savings.

You can also save by being strategic about the second home you choose. For example, picking a residence at a more secure location or finding a home that is part of an HOA could qualify you for savings and help you remain claimless.

Understanding these factors can help you better budget for your second home insurance and ensure you have the right coverage. Next, we’ll discuss tips to save on your second home insurance.

Tips to Save on Second Home Insurance

Bundling Policies

One of the easiest ways to save on second home insurance is by bundling your policies. If you already have insurance for your primary residence, consider getting your second home policy from the same insurer. Many companies offer discounts when you bundle multiple policies together. According to industry data, bundling can save you up to 25% on your premium.

For example, if you insure both homes with Schneider and Associates Insurance Agencies, you could see a reduction in your premiums. Bundling not only streamlines your insurance management but also makes it easier to keep track of your policies and payments.

Security Systems

Installing security systems can dramatically lower your insurance costs. Here are some options to consider:

Alarm Systems: Installing a centrally monitored alarm system can deter break-ins and alert first responders immediately.Fire Detection: Smoke detectors and fire alarms are crucial for early fire detection. Some systems even notify local fire departments directly.Break-In Detection: Motion sensors and smart locks can further secure your property against theft.

Smart home devices are another effective way to cut costs. Water leak sensors, smoke detectors, and motion sensors can alert you to potential issues before they become costly problems. These devices can lower your risk profile, making you eligible for additional discounts. Some insurers offer up to 15% off for homes equipped with these smart devices.

Strategic Property Choice

The location of your second home plays a big role in your insurance costs. Here are some tips:

Avoid High-Risk Areas: Properties in flood-prone or wildfire-prone areas generally have higher insurance premiums.Opt for Gated Communities: Homes in gated or secure communities often benefit from lower insurance costs due to reduced crime rates.Choose HOA Properties: Homes that are part of a Homeowners Association (HOA) can also be cheaper to insure. HOAs often provide added security and maintenance, which can reduce the risk of claims.

By implementing these tips, you can effectively manage and potentially reduce your second home insurance costs. Next, let’s delve into insurance considerations if you plan to rent out your vacation home.

Frequently Asked Questions about Second Home Insurance

Is insurance on a second home cheaper?

No, insurance on a second home is generally more expensive than on a primary residence. This is because second homes are often vacant for longer periods, increasing the risk of burglary, vandalism, and unnoticed damage. For example, a small leak in an unoccupied home can turn into significant water damage before anyone notices it.

Fact: According to the Insurance Information Institute, homes in high-risk areas like Florida’s swamplands or California’s earthquake zones often need additional coverage, such as flood or earthquake insurance, which can further increase costs.

Can I have 2 home insurance policies at the same time?

Yes, you can have two home insurance policies at the same time, one for your primary residence and one for your second home. Each property is unique and requires its own policy to cover specific risks associated with its location and usage.

Tip: Bundling your primary and secondary home insurance policies with the same insurer can often lead to discounts, making it a cost-effective option.

What is the difference between seasonal and secondary home insurance?

Seasonal home insurance is designed for properties that are used only during certain times of the year, such as summer cabins or winter lodges. These policies often cover named perils specific to the season when the home is in use.

Secondary home insurance, on the other hand, covers homes that are used more regularly throughout the year but are not the owner’s primary residence. These policies are broader and cover a wider range of risks, including those that might occur when the home is unoccupied for extended periods.

Example: A lake house used only in the summer might have seasonal home insurance focusing on risks like fire and lightning, while a city apartment used on weekends throughout the year would need secondary home insurance covering burglary, vandalism, and liability.

By understanding these differences, you can choose the right type of insurance for your specific needs.

Next, we will explore how to effectively manage and potentially reduce your second home insurance costs.

Conclusion

Insuring a second home might seem complex, but with the right knowledge and guidance, it doesn’t have to be. At Schneider and Associates Insurance Agencies, we understand the unique challenges and risks associated with second home insurance.

Having proper coverage is crucial. It protects not just the structure of your home but also your belongings and liability. Whether it’s a cozy cabin in the woods, a beachfront property, or a city apartment, the right insurance ensures you’re covered against unexpected events.

Why is this important?

Most second homes are vacant for long periods, increasing the risk of burglary, vandalism, and other damages. According to the research, in 2018, 98.1% of homeowner claims were due to property damage, including theft. This highlights the importance of securing your second home with comprehensive insurance.

Our Approach

At Schneider and Associates Insurance Agencies, we offer personalized solutions tailored to your specific needs. We take into account factors like location, property type, and usage to provide you with the right coverage without unnecessary extras.

Our local agents are familiar with the specific risks and requirements of different areas, allowing us to give you expert advice and support. We pride ourselves on our local touch and dedication to helping you navigate the complexities of insuring a second home.

Ready to Protect Your Second Home?

Don’t leave your second home vulnerable. Get a quote today and let us take care of your insurance needs. With Schneider and Associates Insurance Agencies, you can enjoy your property with peace of mind.

For more insights and tips on second home insurance, check out our latest articles on our blog.

/image.png