A-Plan’s Energy Saving Hacks

The price of food, council tax, car fuel and energy is shooting up. Off all the price rises, YouGov reports that energy bills are having the greatest impact on our finances, so now is a good time to think about how we use energy as we face the 54% increase – and plan for a costly Winter 2022!

Rather than wait until then, now is the time to start making changes.

1. Turn off standby mode

When you leave electrical appliances on but unused, they enter ‘standby mode’. While the device looks like it isn’t using up any energy, it is using electricity in the background, referred to as ‘phantom power’. Although the device appears turned off, it is still using up to 5% of the power it consumes while it is turned on.

This mounts up when you consider how many devices are left in standby. Up to 40% of gamers leave their consoles on standby, and 75% of people leave their TV in standby mode, so there are savings to be had!

Even prior to the increased fuel rates, the Energy Savings Trust estimated that £80 of our annual energy bill is made up of standby power!

Appliances like microwaves, washing machines, dishwashers, TV’s, computers, and games consoles all use power in standby. Turn these devices off at the wall and switch your computer to ‘sleep mode’ to save money.

2. Switch to energy efficient devices

According to the BBC, £68 million is wasted across British households due to overfilled kettles. Only boil what you need, or save up to 30% energy by purchasing an environmentally friendly kettle (Vektra is a well-known brand) which can keep water hot for up to 4 hours to save re-boiling costs!15% of a home’s energy usage is down to lighting. One of the fastest ways to reduce your energy bills is to install LED energy-efficient lighting. LED lights display full brightness as soon as they are switched on. It is still important to switch lights off if you’re not using them. The ‘old fashioned’ lightbulbs, or ‘incandescent’ light bulbs, only convert 5% of energy into visible light, so you are paying more, for less light!If you regularly have baths, switch to showers for quick energy savings, as there is less water to heat. Even better still is to use an energy-saving shower head to reduce your water usage by an additional 30%!If you are buying white goods this year, it has never been more important to check the energy efficiency labels. Refrigeration, in particular, costs the UK £2bn every year in electricity as they are never switched off. Always aim for an ‘A’ rating.

3. Save energy washing your clothes

Household laundry contributes significantly to your energy bills. There are ways to reduce your costs:

Wash at 30 degrees – the Energy Savings Trust estimates the average household can save £28 a year just by lowering the temperature of your washing machine.Only use your washing machine once a week, where possible.Switch your tumble dryer for a drying rack or line to save up to £55 a year.Reduce your ironing by hanging creased clothes in the bathroom, the steam will remove creases.

4. Reduce costs of staying warm

Improving the insulation of your home is a weekend DIY or handyman job that could make Winter 2022/23 that little more comfortable, financially, and personally.

With many likely to only consider this closer to winter, and availability of tradesmen becoming limited due to demand at that time, this could be a sensible project to tackle this Spring.

If your home is not effectively insulated, 30% of your heat is lost through its walls and 25% of your heat is lost through the roof. Insulate your walls and attic to save in the long run!Draught-proofing your home is one of the best ways to cut energy costs, blocking cracks, gaps and holes in windows and doors through which heat can escape. Shutting doors can also help keep the heat in a room.Heat can also easily escape from water tanks and pipes if they are not properly insulated. Get your pipes checked and install sleeves where needed. A better-insulated water tank will remain hotter for longer and will need reheating less often, saving you money on bills.You may be eligible for Government backed energy-savings improvements grants for insulation or repairing or replacing your boiler. Find out more about the ‘Affordable Warmth Obligation’ at Gov.uk.Lowering your central heating thermostat by just 1 degree can reduce your heating bill by up to 10%! Set your thermostat at the lowest comfortable temperature to stop it burning energy unnecessarily to reach higher temperatures.Lowering the temperature of your boiler is also recommended. The Heating and Hot Water Council found that households can save up to 8% on their gas bill buy turning down the flow temperature on their combi boiler.

5. Consider solar

Many new build homes now come with varying version of solar panels, paving the way for the future of energy. If your home doesn’t have solar panels, spiraling energy costs may inspire you to future proof your home and consider solar panels.

On average, a single panel can produce up to 300 watts of energy and depending on the size of solar panels you have, will cost around £5,000. Some of this can be offset by exporting solar energy back to the National Grid. If you are in a position to install solar, it could be a great investment for the future – sunlight will remain free while energy bills are going to continue to rise.

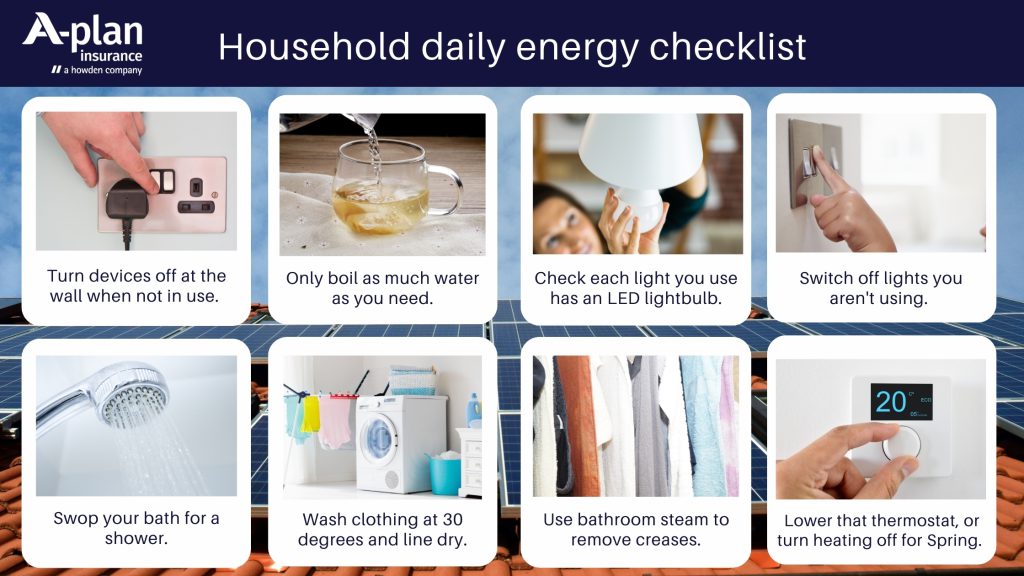

Daily energy saving tips:

It’s changing habits that can be the hardest element of costs savings to conquer. Why not pop this handy reminder on the fridge for the family to follow (printable version here):

This blog is part of A-Plan’s Inflation Buster series, read our previous money saving blogs: Direct Debits you didn’t know about, Top 5 Inflation Busters, and Discount Clubs.

From energy calculators to grants, we also recommend the Energy Saving Trust website and Simple Energy Advice.

If you would also like to find ways to reduce your car, home or any other insurance premium, we can advise you on that too. Pop in or call your local branch.