A Homeowners Guide to Replacement Cost and Market Value

If a disaster strikes and your home is damaged or destroyed, do you know what it would cost to restore your home to the condition it was in before the disaster? Let’s discuss the replacement cost of your home – what it is and what’s included – and how this is different from the market value.

While replacement cost and market value are both ways to determine the value of your home, they are used for different reasons.

Replacement cost is the price to rebuild your home to its pre-loss condition in the event of a total loss.

Market value is the calculated price of your home if you were to list it on the market to sell.

So, what else should you know about replacement cost?

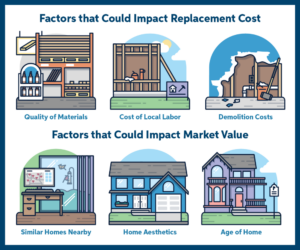

Replacement cost is essentially what it would take to rebuild or replace your home if it was completely destroyed due to a catastrophic event like a tornado, fire or earthquake. This is not to build a home that’s bigger or better, but rather, one that is identical to your home before the damage occurred. If the replacement cost value of your home is too low, you may not have enough coverage to fully rebuild or repair your property. On the other hand, if the value is too high, you might be paying too much in premiums. The replacement cost is listed on your insurance declarations page.

To determine the replacement cost, your insurance agent uses an estimating tool, called a replacement cost estimator to obtain important characteristics about your home, which may include items such as:

Square footage

Style of home

Number of floors

Type of roof

Year it was built

Kitchen style

Number of bathrooms

This tool also considers the current localized costs of labor, building materials and additional expenses such as building permits.

The goal is to establish a replacement cost that allows you to restore your home back to the condition it was in before the unforeseen event happened.

How is replacement cost different from market value?

The replacement cost and market value are both ways to determine the value of your property, but their uses are very different.

Market value refers to the current price at which the home would sell.

Market value is often higher than replacement cost because the market value includes the cost of the land the home is built on; replacement cost does not include this.

Market value is determined by your home’s:

Location

Condition

Demand

Zip code

Overall, market value is based on the current market conditions and the features of your home and is used at the time you want to sell.

As a homeowner, there’s a lot for you to keep track of and understand, which is why we are here to help. Contact your local independent Bolder Insurance advisor today to learn more about the replacement cost of your home or to ask any other questions related to your homeowners insurance policy.

This article provided by Auto-Owners Insurance, a Bolder Insurance partner.

Disclaimer: This article is not expert advice. The analysis of coverage is in general terms and is superseded in all respects by the Insuring Agreements, Endorsements, Exclusions, Terms and Conditions of the Policy. Some of the coverage mentioned in this material may not be applicable in all states or may have to be modified to conform to applicable state law. Some coverages may have been eliminated or modified since the publishing of this material. Discounts may not be available in all states. Limitations and conditions may apply. Premiums will be based on benefits chosen. Please check with your local Independent Auto-Owners Insurance Agent for details.