Easy Employee Group Health Benefit for Wildland Firefighters

Start offering an easy and inexpensive employee group health benefit this year. MASA Medical Transport is an employee benefit that pays for emergency Air, Ground, non-emergency inter-facility, and repatriation transportation for your employee, their spouse, and children under the age of 26 years old for $14/month.

This can be a true benefit supplied by you the employer or it can be paid for by your employee out of their monthly paycheck.

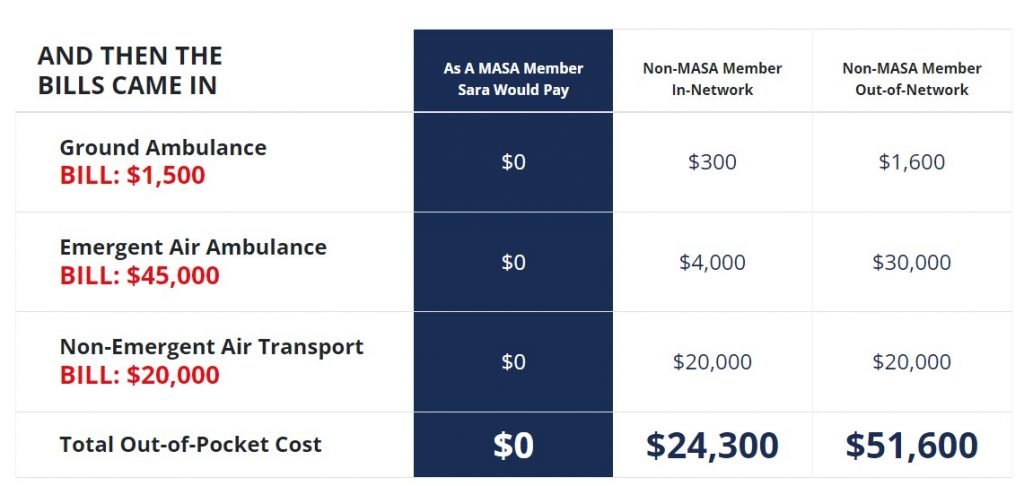

After your group health plan pays its portion, MASA Medical Transport works with providers to deliver its members $0 in out-of-pocket costs for emergency transport.

There are NO NETWORKS, regardless of whether the provider is in or out of a given group healthcare benefits network MASA covers your employees for the emergency Air and Ground transportation anywhere in the US or Canada. Yes, anywhere your employee travels for work or for play they have this coverage in the US and Canada. The coverage also covers their entire family for $14/month!

Most Health Insurance Plans

Do Not Cover Emergency Transport

Our Memberships shield you from extremely high charges due to commonly denied ambulance claims. Estimates from the US Department of Labor say that at least 14% of all submitted medical claims are rejected each year. That’s 1 out of 7 claims, which amounts to over 200 million claims per year. Considering 1 out of 10 people will make an emergency call every year, the threat of excessive emergency bills is very real.

Two Cost-Effective Plans for a Group Health Benefit

While our critical benefits are included in both memberships, Platinum members enjoy nine additional services. Within the 13 Platinum benefits, four feature worldwide coverage. Emergent Plus offers 4 key benefits, specifically designed to fill dangerous gaps in modern health insurance.

You can manage your employee’s membership for an easy online portal making adding or removing employees simple as your staffing needs change.

4 Ways You Can Be Left with a Huge Emergency Transportation Bill

Out-of-Network Providers

There are over 10,000 ambulance companies operating in the United States and most health insurance will only cover a limited number of in-network providers. The truth is, there’s no guarantee that participants will get picked up by an in-network provider. In fact, The New York Times reported that 71% of ground ambulance rides are billed by out-of-network providers. Essentially, that means you there is a 50/50 chance of being left responsible for a majority of the bill.

MASA memberships cover all emergency transportation providers in the United States and Canada, so there is never a need to worry about which ambulance company is called.

Insurance Will Judge the Reason for Your Trip

We know that insurance will only pay for an ambulance if a trip is deemed “Medically Necessary.” As a quick refresher, let’s remember that medical necessity is established when any other transportation method (besides an ambulance) would endanger the patient’s life.

Let’s say symptoms commonly associated with a heart attack prompt an emergency call that results in an ambulance ride to the hospital. If the health insurance decides the cause of the symptoms (perhaps indigestion, heartburn, or a panic attack) doesn’t meet their requirements for an ambulance, they could deny the claim and leave thousands of dollars as out-of-pocket costs.

Insurance Will Only Pay the Usual, Customary and Reasonable Rate

Even if picked up by an in-network ambulance and the claim is accepted by the insurance, we know to expect that the carrier will only pay the Usual, Customary, and Reasonable Rate.

You’re Still Responsible for Copays and Deductibles

Even if bills fall within the Usual, Customary, and Reasonable Rate, we know most insurance plans require the individual to cover copays and deductibles.

Depending on the plan, with deductibles as high as $8,000 and regardless of other variables, employee participants can automatically be on the hook for hundreds to thousands of dollars to fulfill an insurance plan’s requirements.

MASA MTS will take care of all out-of-pocket costs, including copays and deductibles.

MASA Group Health Benefit Case Study

It started as a normal day. Jim and his family attended a local festival when his daughter, Sara, suddenly began experiencing horrible abdominal and back pain after a fall from earlier in the day. His wife Heather called 911 and Sara was transported to a local hospital when it was decided that she needed to be flown to another hospital. Upon arrival, Sara underwent multiple procedures, and her condition was stabilized. After further testing, it was discovered that Sara needed additional specialized treatment at another hospital, requiring transport on a non-emergent basis.

Based on a true story. Names were changed to protect identities and compliance with HIPAA. Benefit is dependent on Membership enrolled. Out-of-pocket dollars vary dependent on provider, distance, health plan design, current status of deductible and out-of-pocket max. These figures are an example of the costs one may incur. More and more health plans are covering interfacility transports on a non-emergent basis.

Based on a true story. Names were changed to protect identities and compliance with HIPAA. Benefit is dependent on Membership enrolled. Out-of-pocket dollars vary dependent on provider, distance, health plan design, current status of deductible and out-of-pocket max. These figures are an example of the costs one may incur. More and more health plans are covering interfacility transports on a non-emergent basis.

Learn more about this Employee Group Health Benefit by contacting Bancorp Insurance at 800-452-6826 or visit us online at bancorpinsurance.com

Bancorp’s insurance experts are available to provide you with a free review and consultation. Contact Us – Bancorp Insurance Call 800-452-6826

Disclaimer: This content is provided for general information purposes and is not intended to be used in place of consultation with our agents.