Life Insurance with Diabetic Neuropathy in 2022

Last Updated on December 31, 2021

Life insurance diabetes neuropathy used to be nearly impossible. However, as life insurance companies have evolved, they’ve begun to consider more people who are living with neuropathy. As you are aware, neuropathy is a pretty common form of a diabetes-related complication.

Neuropathy is one of the most common types of complications a person with Diabetes may develop over time. According to the National Institute of Neurological Disorders and Stroke, “More than 20 million people in the United States have been estimated to have some form of peripheral neuropathy, but this figure may be significantly higher—not all people with symptoms of neuropathy are tested for the disease and tests currently don’t look for all forms of neuropathy. Neuropathy is often misdiagnosed due to its complex array of symptoms.”

Can you get life insurance with diabetic neuropathy complications? It’s possible and rates may be less expensive than you can imagine. But before anyone can determine your eligibility for life insurance, you’ll need to share specific diabetes, and neuropathy history with a licensed agent.

Why do you need to share basic health information with an agent? It’s quite simple. Without knowing detailed health history there is no way to determine real and accurate quotes.

For most consumers, it probably does not make a whole lot of sense to receive a FAKE and INACCURATE quote like other websites provide. As an example. Many online quoters show Preferred Plus or Preferred rates. In reality, a person with diabetes and neuropathy will NOT qualify for those types of underwriting classifications.

Do you or someone you know suffer from diabetic neuropathy complications? This condition is quite common among diabetics – and often appears when your blood sugar has not been managed and kept under control for a length of time. It is a complication that many diabetics fear, as it results in nerve damage that is unrepairable. Sadly, almost half of all diabetics will suffer from some type of nerve damage.

Finding life insurance with diabetes can be difficult to begin with. Add a diabetes related complication, and you can find yourself with less options to choose from. Or in some cases, an insurance company may raise the rates by 25% to 50%.

If you don’t want to read this article in its entirety, simply begin the quote process on this screen. Or better yet, call us at (888) 629-3064.

What you need to know: What is neuropathy?

Diabetic Neuropathy may start as a tingling in either your hands, your feet, or even your legs. This tingling can also include numbness and pain in the feet or legs. In fact, with severe complications, neuropathy can affect your internal organs, including your stomach, your bowels, your heart, your bladder, and various other parts. Thankfully, as long as you continue to manage your blood sugar and keep it controlled and at an optimum level, you have a good chance of halting any further effects of the neuropathy.

There are two main types of diabetic neuropathy:

Peripheral Neuropathy. This type of neuropathy refers to the tingling, numbness, and pain or weakness you may feel in places, such as your hands or your feet.

Autonomic Neuropathy. This is the type of neuropathy that affects the nerve systems throughout the body. In fact, it means that this type affects the organs that are controlled by these nerve systems.

A few other types of diabetic neuropathy are:

Cranial Neuropathy. This type deals with nerves connected to the brain and deals with the function of eyesight, movement, hearing, and taste.

Focal Neuropathy. A group of nerves that will cause sudden weakness or pain. Usually on one side of the face.

Femoral Neuropathy. Often causes weakness in the front side of only one thigh.

Charcot’s Joint. Also known as neuropathic arthropathy, this painful condition is when your joints break down thanks to the nerves. Most often, Charcot’s affects the foot due to extended time of no feeling. The individual cannot feel pain based on joint position and, therefore, the joint becomes damaged.

As a diabetic, it is very important for you to manage your blood sugar appropriately. Maintaining a healthy lifestyle, despite your diagnosis, can make many processes in your life simpler – such as obtaining diabetic life insurance at a lower rate – and help you avoid debilitating conditions such as those that neuropathy can bring.

Don’t let the effects of diabetic neuropathy complications get you down and be detrimental to your quality of life – or discourage you from trying to attain affordable diabetes life insurance. If you have been searching, you have likely discovered that if you are offered a policy, the chances of it being affordable or without restrictions are slim to none.

Rest assured, we’ve got all the information you will need to get yourself covered today!

What you need to know: Life Insurance can be a struggle for diabetics

Finding life insurance diabetic neuropathy can be difficult. Many insurance companies will decline an application from someone with the diagnosis without looking any deeper to see how well it is managed, etc. Other companies are more willing to accept those with individuals with diabetes but may immediately deny anyone who has symptoms of complications – including neuropathy.

Companies will want to know the severity of the neuropathy, treatment history, and will also want to know of any other diabetes related complications. Depending on this, your options may be reduced as far as insurance carriers, when compared to people with diabetes who do not have neuropathy.

People with type 2 diabetes and suffering from neuropathy will have a slightly easier time finding coverage. Where as an individual with type 1 diabetes who has neuropathy will have fewer companies willing to offer coverage to them.

Best case scenario, your neuropathy is considered mild, and an insurance company will not excess extra rates to your premium. Worst case scenario is the neuropathy is moderate to severe, and you’ll pay extra for the life insurance, or declined all together.

Life insurance companies are going to have different underwriting guidelines, and they will all view your particular health profile differently. No two companies are the same, and this is why it’s always a good idea to have your agent run your complete health profile past multiple underwriters.

Shopping around, filling out application after application for a life insurance diabetic neuropathy policy, can leave you feeling exhausted and frustrated. Good news: It doesn’t have to be this way! It is possible to find life insurance, despite your diabetic conditions or your complications. And, it can be affordable, too! Just make sure you work with an agent who is knowledgeable about all things diabetes, and life insurance.

When you work with Diabetes Life Solutions, you are working with agents who understand the diabetes community. Our founders have applied for life insurance, with Diabetes, and know first hand how difficult finding coverage can be. We advocate on your behalf, and try to obtain the best possible rates, when it comes to life insurance. No need for multiple exams, countless applications, and added headaches.

So, don’t give up on your search. Contact an informed and experienced independent agent from Diabetes Life Solutions who specializes in cases such as yours. These agents can help you in a number of ways. For instance:

By providing you a service, relieving you from the stress and hassle of trying to find adequate and affordable diabetes life insurance. By understanding that there is a need, regardless of your condition. By sharing a wide knowledge base of the struggles faced by those individuals with diabetes and diabetic complications in the world of insurance. By having a network of many different insurance companies who understand and cater to those with diabetes or diabetic complications.

All of these characteristics are needed in order to successfully assist a diabetic with receiving the best possible choice for insurance.

What are the possible outcomes of a life insurance application?

Life insurance companies offer the same service but vary greatly in who they choose to insure and how they view those with diabetes. Though, it is important for you to understand that this affects individuals with all sorts of health conditions – not just those with diabetes or diabetic complications. So, you are not alone.

Life insurance companies have a system of risk classifications they use when assessing your application. Depending on where they place you on that classification list will determine what your response may be. When you apply for life insurance diabetic neuropathy, the reaction you receive from each company may be different.

Here are a few of the most common application responses:

Declined immediately.

There are some insurance companies that scan your application and if there is anything that signals a diabetic complications, such as neuropathy, they are automatically declined. To be honest, their reason for doing so may be nothing more than they just don’t want to have to deal with the risk. Many people with diabetes are declined life insurance due to having neuropathy. In some cases a person may have just applied to the wrong life insurance company.

It is important that you do not take this denial personally, as it is just their policy. And, thankfully, there are many other insurance companies to choose from – so you don’t have to settle at all. If a specific company is going to automatically decline you, based off your Diabetes history, you would obviously want to work with another carrier. Our agents will not waste your time, and have you submit an application that will result in an immediate decline.

You must sit tight through a waiting period.

Waiting periods are tough when it comes to anything – whether it is in reference to insurance or to see your favorite celebrity in their latest movie release. Unfortunately, though, waiting periods for insurance are far too common – especially for those with diabetic complications.

So, what does it mean if you receive this response when you have applied for coverage? It means that you must wait for a stated period of time before your policy will go into full effect. These types of policies are referred to as guaranteed acceptance life insurance policies.

Does this mean you are not covered during the waiting period? Yes. Generally, however, if you pass away during this time, your insurance company will only pay out the full death benefit in the event of an accident. If your death is not an accident and, say, from natural causes, your insurance company will not pay out anything on your policy.

The length of the waiting period will vary from company to company. However, the most common time-frame is approximately two years. If you were to pass away in the first two years of the policy, your beneficiary receives all premiums paid, plus a 10 percent interest.

Insurance companies who view you as a high-risk client will often impose the waiting period requirement on your policy. It is then usually referred to as a modified plan. You only want to apply for these types of policies, as a last resort.

Many people who have a form of diabetes neuropathy can still qualify for an immediate death benefit policy. Don’t feel that having a diabetes complication will eliminate you from a traditional form of life insurance diabetic neuropathy coverage. Most likely you’ll have plenty of whole life insurance and term life insurance options to choose from

Your premium will be higher.

Perhaps you expect it because of your condition or maybe you don’t, but it is very common for diabetics or those with complications to be advised that they can obtain final expense insurance— but it is at a higher rate. Life insurance companies may rate you as a substandard risk, and add table ratings to your health profile. The more table ratings your policy is assigned, the higher the life insurance premium.

Whether right or wrong, it is a frequent practice among insurance companies when it comes to dishing out policies to those they claim to be a higher risk. Many times, this higher rate comes at a cost of 20% to 50% more than someone who doesn’t have the health complications that you do.

You are golden – and insurable – just like everyone else!

Most people want to feel normal – and feel like everyone else. And, despite your diabetic complications, you should feel that you can be treated just like everyone else. This is even true when it comes to diabetes and life insurance.

No, you are not in perfect health, but does that have to mean you must pay the price because of it? Of course not! Believe it or not, there are insurance companies out there that will not charge you a higher premium and will not force you into accepting a waiting period restriction on your policy.

The insurance companies who choose to be fair in their policies still may view those with diabetic neuropathy as an elevated risk. However, they have likely constructed their business model to accept the risk that these clients pose. If your neuropathy is minor, and being controlled, it may not be an issue at all, with specific life insurance companies. Isn’t it comforting to know that it is possible for you to obtain affordable coverage with all the benefits you need? The key is to find the handful companies that function in this manner. Not only can you be approved for life insurance diabetic neuropathy, but you can rest assured knowing the life insurance policy will pay out to your family. Your policy does still cover you with a diabetic complication.

What you need to know: Medications and insurance companies

What you need to know: Medications and insurance companies

If you are applying for diabetes life insurance, you will have a choice about completing a physical medical exam. However, underwriters will almost always require you to answer some general health questions in order to provide you with the solid coverage – at the price you are hoping for. And while having a form of a diabetes related complication, only a few companies will not require one. Generally for the lowest rates possible, we’d recommend completing the paramedical exam. But again everyone’s circumstances are different, and the recommendations will vary from person to person.

These questions will likely ask you about:

They will also ask you for a list of the medications you have been prescribed, as well as your prescription history. This will help the underwriter put together a picture of your overall health – providing them with your risk level.

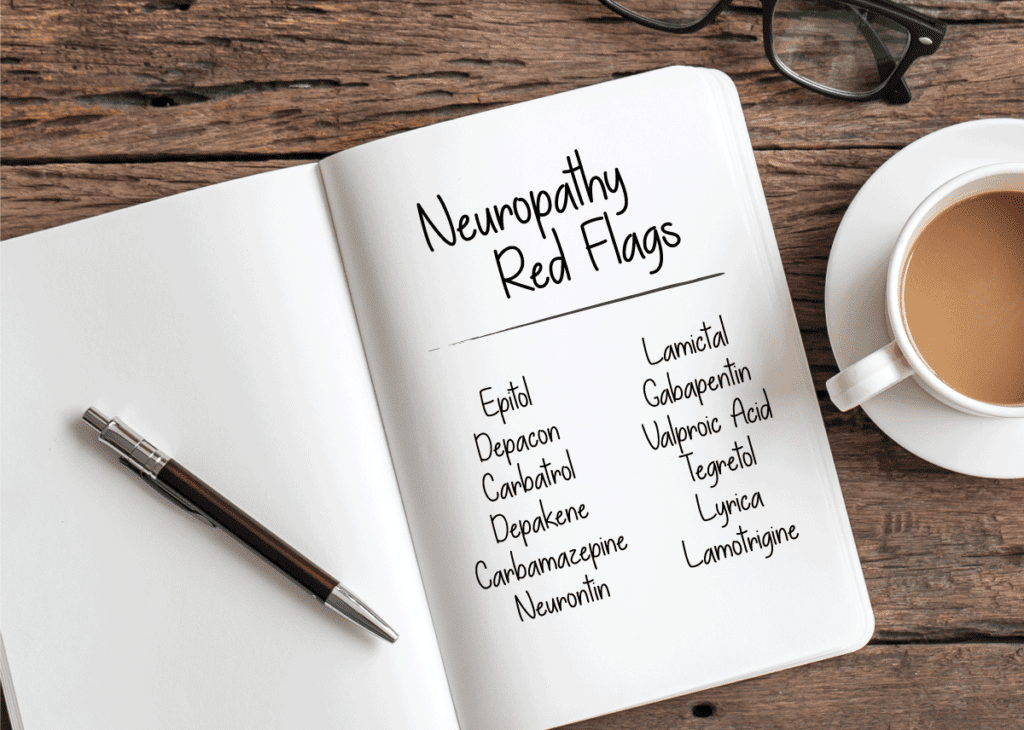

Prescription medications can tell a lot about the health of a person. And, if you are diabetic, there will be medications that they will be on the lookout for that will let them know if you have had or are having diabetic complications, including neuropathy.

For diabetes, they will expect to see that you have been prescribed a drug, such as Glyburide, Glipizide, or Metformin. However, if the underwriter sees any of the following, he or she will likely get the red flag that you have been diagnosed with neuropathy.

If you are on any of this medication, don’t panic. You can still find affordable life insurance diabetic neuropathy policies.

What you need to know: How to get the best policy with Neuropathy

First and foremost, you will want to find yourself a good, independent agent who has a deep understanding of not only life insurance companies, but diabetes, its complications, and how both are viewed by each company. Your insurance agent should have options and should know, based on your application, which company will be the best fit for you.

You never want to apply over and over again to various companies trying to obtain the insurance on your own. Without the experience, you will likely find yourself on a forever route to dead ends. It is exhausting and time-consuming. Don’t waste your time and energy when an agent has all of the answers and connections for you!

Your independent agent will:

Discuss all your health and gather some basic medical information to provide to the insurance companies.

Compile a list of companies that are the most likely to offer you the best policy, based on the medical conditions and diabetes history that you provided the agent.

Help you decide between a whole life insurance or term life insurance policy. They will also share with you any no medical exam life insurance options you may have.

Submit your application to these companies based on the information you provided.

Obtain offers from the insurance companies once they view your complete health profile.

Discuss with you each option – including the cost of the premium, the coverage you will receive, and whether or not there is a waiting period or any other restriction on the policy.

Handle the purchasing of the best policy to meet your needs.

The only person you will have to deal with is your personal agent. No insurance companies, no extra paperwork, and no confusing or misunderstood policies to read through. Sounds great, doesn’t it?

Finding life insurance diabetici neuropathy doesn’t have to be difficult. Let us do the hard work on your behalf. We make applying for life insurance as seamless as possible for our clients. Your assigned agent will provide a first class experience to you.

If you are ready to move forward with the help of an agent who understands what you are going through, then contact us today! Diabetes Life Solutions was founded because we’ve been where you are today. Our mission is to help those in the Diabetes community obtain the best policy possible. Our mission is to help those in the Diabetes community obtain the best policy possible. We understand these struggles and want to make the life insurance application process as easy as possible. All it takes is a quick call to 888-629-3064. We love working with the diabetes community, and look forward to earning your business.

What you need to know: Medications and insurance companies

What you need to know: Medications and insurance companies