Insurance in the Caribbean islands – what’s in the sector’s future?

Insurance in the Caribbean islands – what’s in the sector’s future? | Insurance Business America

Catastrophe & Flood

Insurance in the Caribbean islands – what’s in the sector’s future?

Climate change is expected to impact insurability in the region

Catastrophe & Flood

By

Kenneth Araullo

Climate projections for the Caribbean region foresee an upsurge in both the frequency and severity of weather events by 2050. Rising sea levels are anticipated to exacerbate vulnerabilities for coastal properties, intensifying the risks of flooding and erosion.

A new climate report from Moody’s RMS examines how the perpetual threat of hurricanes could potentially amplify in strength, posing substantial risks to infrastructure and communities. Predicted changes in rainfall patterns may lead to increased flood risks during precipitation, as well as prolonged dry spells and droughts.

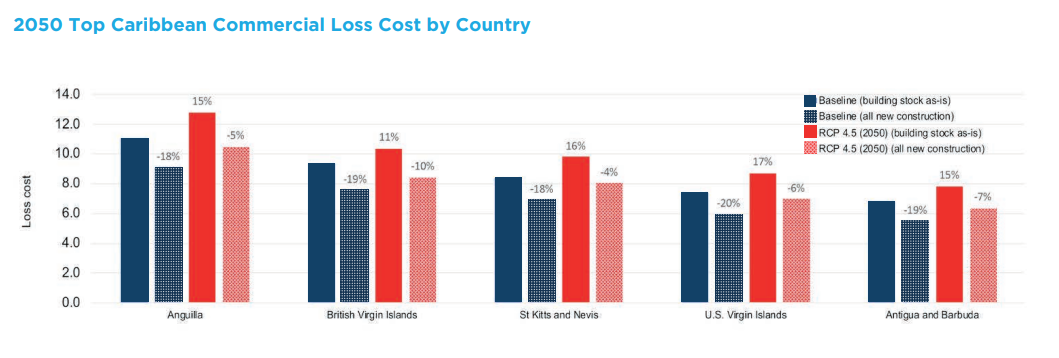

In assessing the potential impact, Caribbean nations facing higher risks are expected to experience a uniform increase in loss costs above 10%. For the most vulnerable areas, such as the US Virgin Islands, this increase may reach as high as 17%. Such models demonstrate that investing in building upgrades alone could significantly lower loss costs compared to existing risk values, underscoring the impact of investing in risk reduction and resilience-building measures.

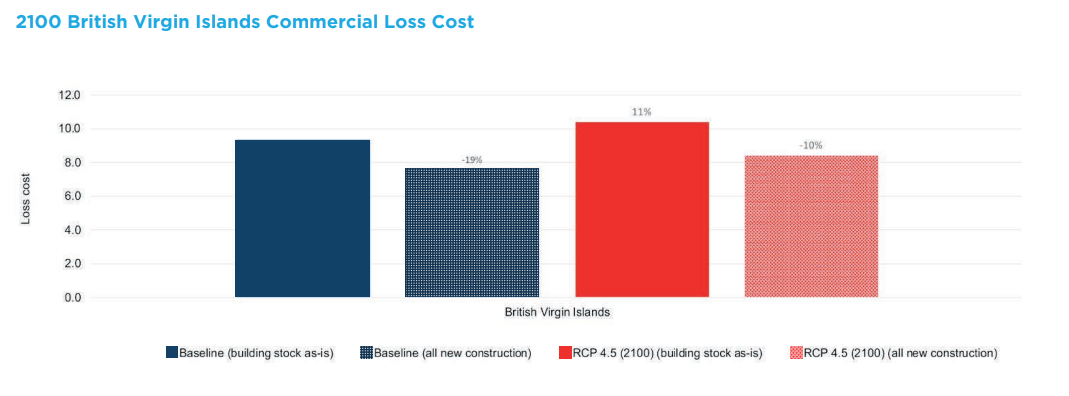

Looking ahead to the end of the century, protective measures geared towards mitigating risk in the built environment have the potential to mitigate the most severe increases in loss costs, resulting in only marginal rises from present-day values. In contrast, the absence of action could lead to substantial escalation in potential loss costs, reaching as much as 27% in specific scenarios, including a 19% increase for the British Virgin Islands.

The anticipated rise in future loss costs might motivate Caribbean nations to prioritize measures and innovative strategies that reduce risk and fortify resilience. Such modeling studies aid governments, businesses, property owners, and communities in evaluating and prioritizing risk reduction strategies. They demonstrate, in financial terms, the advantages of investing in measures to prevent future losses and enhance insurability.

Amidst the evolving impacts of climate change in the Caribbean, the concept of an insurability threshold becomes increasingly relevant. This threshold refers to the point at which insurance becomes either unavailable or excessively expensive due to heightened risks linked with specific events or conditions. The significance of insurability becomes more pronounced as the region faces potential loss cost increases ranging from 10% to 17%, particularly toward 2050.

The report also noted that various factors influence the availability and cost of insurance. Premiums not only reflect the anticipated frequency and severity of risks but also encompass other elements, including the expenses associated with underwriting and claims. Factors like the current global inflationary environment, leading to increased costs for repairs, materials, and labor, contribute to the rising costs of claims. Moreover, the supply of reinsurance capital is becoming more expensive.

Sustaining private insurance depends on insurers’ ability to collect adequate funds for their claims. Looking ahead, mapping out actions that aid in risk reduction can compensate for the anticipated rise in hazards due to climate change. Whether through increased risk-sharing or stricter building codes, employing risk modeling can assist in devising plans for Caribbean risk trajectories, ensuring insurance sustainability for the 21st century.

What are your thoughts on this story? Please feel free to share your comments below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!