2023 sets new record for billion dollar insured catastrophe loss events: Aon

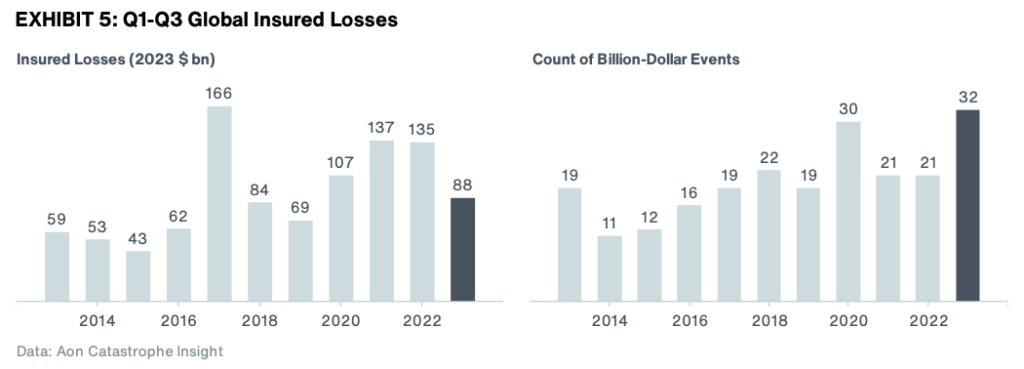

Across the first nine months of 2023 analysis from insurance and reinsurance broker Aon suggests there have already been 32 billion dollar insured catastrophe loss events, setting a new record, while severe convective storms (SCS) had driven over $60 billion of insured losses by end of September.

Severe convective storm (SCS) activity, particularly in the United States, has been responsible for the majority of insured losses from weather and catastrophe events around the globe, in 2023 so far.

SCS events account for roughly 70% of the US $88 billion in insured catastrophe losses that Aon estimates have occurred so far.

That suggests just over $60 billion of SCS losses around the globe, of which Aon estimates over $50 billion were in the United States.

2023 is turning into a year of frequency as well as severity, which were it not for the changes to reinsurer and ILS fund appetites would have resulted in a significant year of aggregate reinsurance and retrocession losses in the past.

So far, Aon has counted 32 billion dollar insured catastrophe loss events, which is already the highest annual total on record.

Of that, “relentless” severe convective storm activity in the United States was the main driver, contributing 21 individual billion dollar plus insured loss events.

In fact, the figure is likely to increase as well, as Aon notes that there were at least four individual billion-dollar insured loss events from SCS outbreaks in the US in Q3 alone, which the broker believes will likely increase to seven events because of ongoing loss development.

As little as two or three years ago, the much greater proliferation of aggregate reinsurance and retro, with lower attachments and deductibles, would have seen a year like this delivering a significant hit through to reinsurance capital providers, including ILS funds.

Now though, primary insurers are retaining the majority of these SCS catastrophe losses, especially the smaller, albeit over one billion dollar events.

Which is perhaps why Aon itself has been highlighting the need for innovation to address what are now being termed reinsurance protection gaps, for frequency and so-called secondary peril losses in the United States.

At $88 billion by the end of Q3 2023, global insured catastrophe and weather losses are already 17% higher than the 21st century annual average, Aon explained.

While economic losses year-to-date already total $295 billion, compared to a 21st century annual average of $310 billion.

Which with just 30% of catastrophe losses around the globe being covered by insurance, shows the need for more risk capital and innovation to deploy it creatively, to afford more protection.

It would be intriguing to understand what percentage of the insurance losses are now covered by reinsurance in 2023 and how that might compare to previous years, as that trend would also likely show a widening gap thanks to the retrenchment away from frequency and volatility.

All of which speaks to demand for reinsurance capital remaining high, but perhaps not set to be serviced by reinsurers and ILS funds that are reluctant to step back into taking on more frequency risk, which again calls for structuring innovation to try and create solutions that at least go some way towards providing an element of protection to those now retaining much more in frequency losses, in a world where the frequency of larger losses seems to be increasing, on the back of exposure growth and inflation.

Michal Lorinc, head of Aon’s Catastrophe Insight, commented, “Global natural catastrophes killed many people and caused significant structural and economic damage during the first nine months of 2023. Wildfire and Severe Convective Storm were once again highly prominent, and Aon’s research reveals that both are becoming increasingly costly to insurers, communities and governments.

“In the U.S., around 80% of SCS loss growth can be explained by exposure change – highlighting the need for insurers to understand underlying exposures in their portfolios.”