These are the most expensive states for auto insurance

These are the most expensive states for auto insurance | Insurance Business America

Guides

These are the most expensive states for auto insurance

Location-specific factors drive up premiums in the most expensive states for car insurance. Find out if your state is one of them in this guide

Car insurance costs more in some states than in others. In fact, where you live is one of the biggest factors dictating how much premiums you need to pay.

To give you an idea of the difference, Insurance Business outlines the most expensive states for car insurance, as well as the places where coverage is cheapest. We will also explain why rates vary by state and break down the different location-specific factors that impact auto insurance premiums.

Read on and find out where your state ranks when it comes to car insurance rates in this guide.

The average cost of full coverage car insurance nationwide is $1,682. The premiums you pay, however, can be significantly higher or lower, depending on where you reside.

The table below lists the most expensive states for car insurance based on the data gathered by this website. The rates are for a hypothetical 40-year-old male driver with a clean record and good credit history.

The 10 most expensive states for car insurance in the US

Rank

State

Average annual premiums

Diff. from natl. average ($)

Diff. from natl. average (%)

1

Florida

$2,560

$878

52%

2

Louisiana

$2,546

$864

51%

3

Delaware

$2,137

$455

27%

4

Michigan

$2,133

$451

27%

5

California

$2,115

$433

26%

6

Kentucky

$2,105

$423

25%

7

Missouri

$2,104

$422

25%

8

Nevada

$2,023

$341

20%

9

New York

$2,020

$338

20%

10

Nebraska

$2,018

$336

20%

Florida tops the list of the country’s costliest states for auto premiums, with average annual rates more than half the national average. The Sunshine State’s geographic location makes it susceptible to hurricanes and other weather-related calamities, pushing up insurance rates.

It also doesn’t help that the state has among the highest number of uninsured drivers in the US. This makes costly lawsuits more likely. However, there are still ways to access cheap coverage. If you want to know how, you can check out this guide to the best car insurance in Florida.

Like Florida, Louisiana and Delaware have long coastlines, making these states prone to extreme weather events.

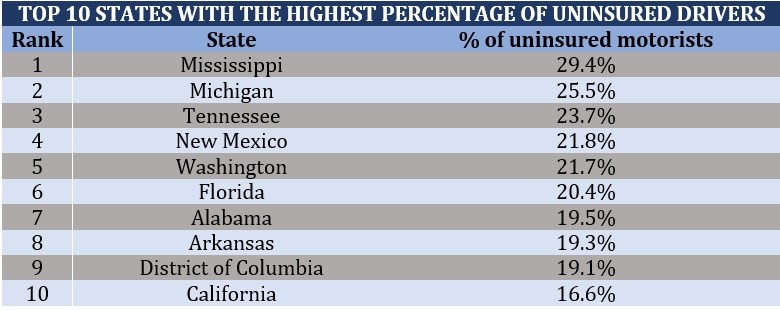

Michigan and California, meanwhile, are among the top 10 states with the largest percentage of uninsured motorists at 25% and 17%, respectively. The figures are based on the latest data from the Insurance Information Institute (Triple-I).

We will discuss the different location-specific factors that impact car insurance premiums in more detail later.

At the other end of the spectrum are the cheapest states for car insurance. Motorists in these states benefit from more relaxed auto insurance laws, less urban population, and safer roads. Here they are ranked based on average annual premiums.

The 10 cheapest states for car insurance

Rank

State

Average annual premiums

Diff. from natl. average ($)

Diff. from natl. average (%)

1

Ohio

$1,023

-$659

-39%

2

Maine

$1,116

-$566

-34%

3

Idaho

$1,121

-$561

-33%

4

Vermont

$1,158

-$524

-31%

5

Oregon

$1,244

-$438

-26%

6

Indiana

$1,256

-$426

-25%

7

Hawaii

$1,306

-$376

-22%

8

New Hampshire

$1,307

-$375

-22%

9=

Iowa

$1,321

-$361

-21%

9=

Virginia

$1,321

-$361

-21%

Ohio shares much of its northern border with Michigan, but not its cheap car insurance rates. A saturated and competitive auto insurance market, along with relatively safe roads, keep auto premiums low in the Buckeye State.

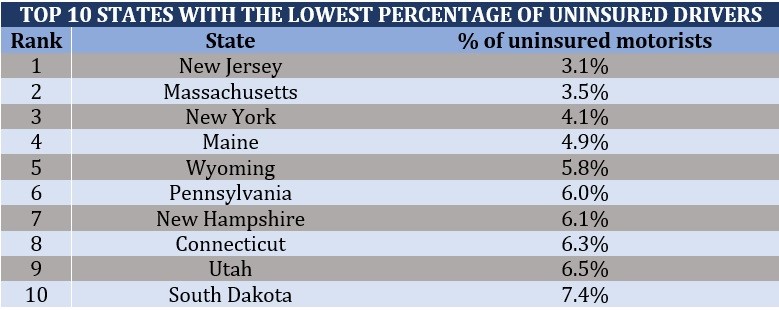

Maine, Idaho, and Vermont, meanwhile, benefit from sparse population and abundance of rural roads where traffic accidents are less common, allowing motorists to access cheaper rates. These states also have among the lowest number of uninsured drivers in the country.

Where you live plays a huge role in determining how much your car insurance premiums cost. Here are some of the biggest location-specific factors that can push up or drive down your auto insurance rates.

1. Car insurance laws

Each state imposes its own minimum requirements when it comes to auto coverage. Some require drivers to take the mere basics, usually liability car insurance. Others make medical payments and uninsured motorist coverage mandatory.

In the 12 no-fault states listed below, personal injury protection is required:

These state requirements also come with minimum coverage limits that can raise or lower your auto premiums. Industry experts, however, recommend that motorists take out coverage more than what their states require. These mandatory limits are not always enough to cover the entire cost of an accident.

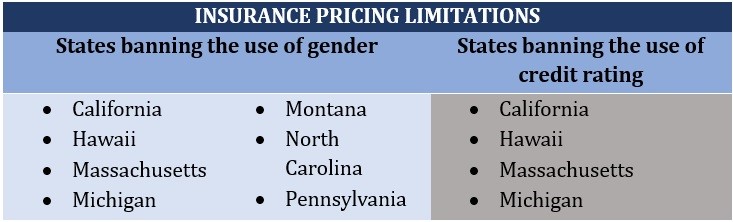

Apart from these, some states prohibit car insurance companies from using certain personal information in determining premiums. These include gender and credit rating, which cannot be used in insurance pricing in these states:

If you’re looking for a state-by-state breakdown of the different mandatory coverage limits, we have them compiled in one neat table in this guide to how car insurance works. You can also click on the links there to visit your state’s insurance commissioner or motor vehicle department’s website where you can find more details about these requirements.

2. Geographic location

The most expensive states for car insurance are often prone to extreme weather conditions and other natural calamities because of their geographic location. Florida, Louisiana, and Texas, for example, often experience violent hurricanes, hailstorms, and flooding due to their long coastlines. This pushes up premiums in these states.

Some insurers have even ceased providing coverage in locations that are susceptible to weather-related calamities. This situation is among the main reasons why Florida car insurance rates are going up.

3. Crime rates

Auto insurers typically use a person’s address to gather crime reports from local police to evaluate the risks in an area. Locations that experience a high incidence of theft and vandalism are likely to have higher claim rates as well. This makes car insurance in an area more costly.

And because insurers base their pricing on collective risk, rate increases apply even to residents who haven’t fallen victim to a crime. In layman’s terms, if you live in a bad neighborhood, your neighbors could file more claims, also affecting how much premiums you pay.

4. Number of uninsured drivers

Car insurance companies tend to pass the cost of uninsured motorists to those who have insurance to mitigate their risks. This means that states with a high volume of drivers without coverage will often have more expensive rates.

The tables below list the top 10 states with the highest and lowest percentage of uninsured drivers, according to the latest data from Triple-I.

5. Urban population

Motorists in urban areas are more likely to pay more for auto insurance. City roads are often packed with vehicles, increasing the risk of collisions. More accidents mean more claims, which results in soaring car insurance rates.

Apart from your address, insurers consider other variables in determining car insurance premiums. Here are some of the key factors that auto insurance companies base their pricing on:

Age:

Teenage drivers pay the highest premiums because they are seen as the riskiest age group to insure. Rates, however, tend to go down as motorists enter adulthood. By the age of 25, you can expect car insurance costs to drop significantly. You can check out ways on how younger drivers can access cheap car insurance in this guide.

Gender:

In most states, female drivers pay less than their male counterparts; studies show that men are more likely to get into car accidents. This gender disparity is more pronounced among younger motorists but closes as they approach 25 years old. From that point on, men and women are roughly on equal footing.

Driving record:

A clean driving history shows your insurer that you’re a responsible driver who doesn’t pose a risk to other motorists. Typically, insurance companies reward safe drivers with lower premiums. A poor driving record, on the other hand, indicates that you’re more likely to file a claim in the future, driving up your rates considerably.

Credit rating:

Most states allow insurers to use credit-based insurance scores in determining premiums. Car insurance companies view motorists with a good credit history as less likely to file claims than those with poor credit.

Vehicle type:

How much your car is worth, how costly it is to repair, how powerful its engine is, and what safety features are installed all have an impact on your car insurance rates. If your vehicle is especially prone to theft, this will likely raise your premiums as well.

Mileage:

The less you drive, the lower the likelihood of getting involved in a collision. By limiting your mileage, you can also reduce the premiums you pay.

Level of coverage:

Policies that meet your state’s minimum requirements come with cheaper premiums than those for full coverage plans. While you can save money on minimum coverage initially, you can end up losing more, especially if your policy’s limit is not enough to cover the cost of an accident.

Getting affordable coverage, however, doesn’t necessarily mean you will also be sacrificing quality. Find out how you can get inexpensive premiums from the industry’s biggest names on our list of the 10 cheapest car insurance companies across the US.

If you live in one of the most expensive states for car insurance, all is not lost. There are still several practical ways you can lower your premiums. Here are some of them:

Shop around and compare quotes: Shopping around and comparing rates from different insurers is still the most effective way to ensure that you’re getting the best deal possible. Triple-I suggests comparing policies from at least three insurers to get a picture of what benefits suit you and how much coverage costs.

Take advantage of discounts: Car insurance companies offer an assortment of discount options that you can take advantage of to reduce your annual premiums. These range from practicing safe driving to choosing an eco-friendly vehicle.

Skip the unnecessary coverage: Insurers offer a range of car insurance types that allows you to get the best possible protection. But these can add to the cost, and you don’t need all of them. When choosing coverage, it’s best to assess what type of protection you really need and purchase only what’s needed.

Maintain a clean driving record: Auto insurance companies reward motorists with a spotless driving record with discounts. These money-saving perks can increase each year you’re free of infractions and accidents up to a certain period.

Consider raising your deductible: A higher deductible means cheaper premiums, but it also increases the amount you need to pay before your coverage kicks in. Make sure that you have enough saved up in case an emergency repair is necessary if you intend to go this route.

Be mindful of the insurance cost when picking a ride: Some vehicles are more expensive to insure than others. If you’re looking to save on insurance costs, it would be best to check out sedans, vans, and other family-friendly vehicles. These often have the lowest premiums.

Switch to pay-per-mile insurance: If you log fewer than 10,000 miles every year, it may help to switch to pay-per-mile insurance. This way, you will only be paying for the distance that you traveled.

Pay your premiums yearly: Paying premiums as one lump sum rather than in monthly instalments can help slash your car insurance costs. This way, you can avoid being charged for interest or finance arrangement fees.

Be smart about what you claim: Each claim can have an impact on your rates at the time of renewal. That’s why it pays to be smart and strategic about when and what to claim to protect your risk rating and future premiums.

Avoid letting your car insurance auto-renew: Your upcoming renewal is the best time to assess if you’re still getting the best value from your car insurance. By shopping around, you can see if there’s a policy out there that offers the same coverage for a better rate.

If you’re searching for more practical strategies on how to save on premiums, our guide to finding cheap car insurance can help.

Do you agree with our list of the most expensive states for car insurance? Are there states that you feel have been left out? Share your thoughts in the comments section below.

Keep up with the latest news and events

Join our mailing list, it’s free!