Rural hospitals rejecting Medicare Advantage?

That may be the case. Modern Healthcare reports:

Last month, St. Charles Health System threatened to cut ties with all Medicare Advantage plans next year, a move that would leave an estimated 26,000 local beneficiaries without access to a hospital less than 100 miles away.

“The reality of Medicare Advantage in central Oregon is that it just hasn’t lived up to the promise,” St. Charles Health System CEO Dr. Steve Gordon wrote in a news release at the time. “A program intended to promote seamless and higher quality care has instead become a fragmented patchwork of administrative delays, denials and frustrations,” he said. The Bend-based nonprofit company declined to make an executive available for an interview.

St. Charles Health System isn’t the only one. The article goes on to say that rural hospitals are “disproportionately affected by factors such as reimbursement cuts or denied and delayed payments from Medicare Advantage plans because Medicare enrollees make up most of their patient populations.”

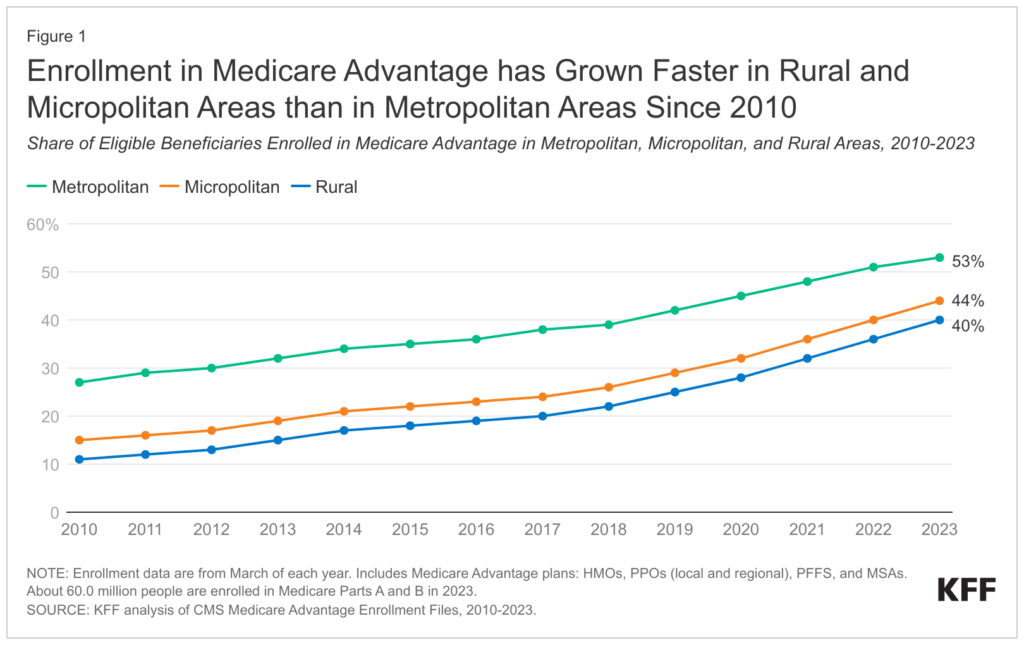

Rural hospitals are particularly sensitive because enrollment in Medicare Advantage among rural beneficiaries has grown from 11% to 40% of all rural Medicare beneficiaries between 2010 and 2023.

Medicare Advantage Enrollment, Plan Availability and Premiums in Rural Areas

On the positive side, plan choice for rural Medicare Advantage beneficiaries has increased, but this competition has lead MA plans to aim to lower premiums and pass through these lower costs to hospitals with lower reimbursement and reimbursement delays.

https://www.kff.org/medicare/issue-brief/medicare-advantage-enrollment-plan-availability-and-premiums-in-rural-areas/

https://www.kff.org/medicare/issue-brief/medicare-advantage-enrollment-plan-availability-and-premiums-in-rural-areas/

My FTI Consulting colleague Adam Broder was also cited in the article, stating:

“It’s like, ‘What’s the point of fighting about rates if we can’t even get paid?’” Broder said. “They make money on the commercial contracts. The margins are just so much smaller from Medicaid or Medicare, and if they can’t get paid on time or properly or in the full amount, then that’s going to lead to a dispute.”