Morocco reels from devastating quake, but economy & population to bear brunt of losses

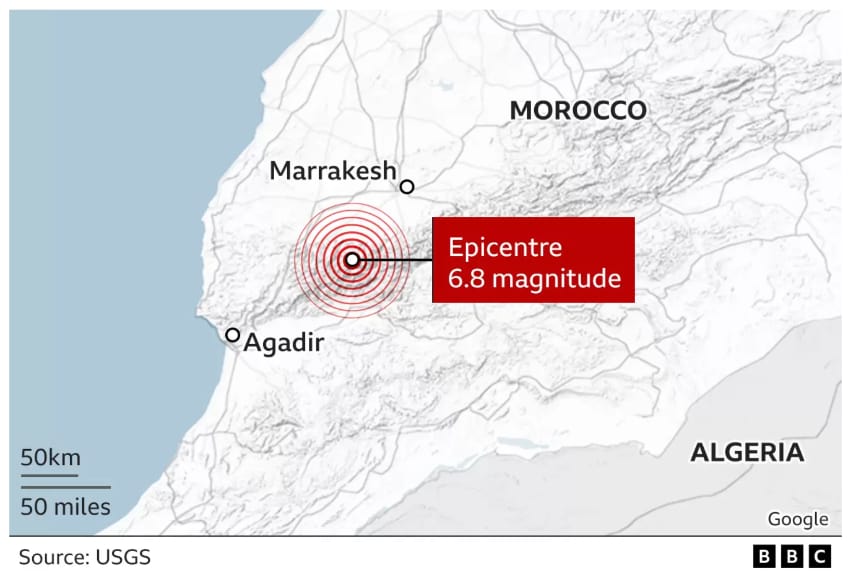

The North African country of Morocco is reeling after a magnitude 6.8 earthquake struck to the south of Marrakesh on Friday night, with more than 2,000 deaths now reported, the USGS forecasts that the economic impact could be as significant as 8% of GDP.

The earthquake struck in the High Atlas Mountains, roughly 7okm south-west of the World Heritage city of Marrakesh.

Upwards of 168,000 people are thought to have experienced severe shaking from the earthquake and significant structural damage was seen in rural areas and within cities and towns.

The sad result is now more than 2,000 people thought to have died from the earthquake, with at least the same number being injured.

Provinces just to the south of Marrakesh appear to have suffered the most significant damage and loss of life, with close to 1,500 injuries of a serious nature reported.

The quake is the deadliest to strike Morocco since 1960 and once again lays bare the insurance protection gap and the lack of catastrophe risk coverage in countries at this stage of development.

The USGS estimates that the economic cost of Friday nights earthquake will fall between US $1 billion and as much as US $10 billion, saying it could cost the country up to 8% of its GDP.

The insurance market losses are expected to be insignificant compared to the economic loss, as the much-discussed protection gap once again makes itself very evident when a tragic natural disaster occurs.

Morocco has a social safety net catastrophe insurance system in place, that provides households and business with a low-level of guaranteed coverage, through a World Bank supported scheme.

But this is basic insurance compensation, despite covering close to 9 million people against bodily injury in catastrophic events, and in the past its maximum capital available for payouts was just US $100 million per-year, it’s not clear if that has ever increased.

We understand that, back in 2020, it was estimated that a 1-in-100-year earthquake event could drive up to US $170 million in pay-outs from the private disaster insurance scheme.

The Moroccan government had also, again with World Bank support, established a social protection system to compensate uninsured people through a national solidarity fund.

The solidarity fund was estimated to expect to make payouts of around US $600 million in the event of a 1-in-100 year quake event.

The global reinsurance market was said to have covered roughly two-thirds of the liability associated with these government supported disaster insurance arrangements, but that is a drop in the ocean of the capabilities of reinsurers, and of course ILS funds, to support more disaster risk financing for countries like Morocco.

Reinsurance capital was expected to cover up to US $120 million of that 1-in-100 year earthquake scenario.

Outside of those schemes, private insurance market penetration in Morocco is relatively low, estimated at between 2% and 4% at most, with many households lacking any protection aside from the government supported schemes.

Morocco’s insurance market is highly concentrated, but on the reinsurance side it has its own companies, plus support from more than 30 foreign reinsurers that underpin its still relatively small, but growing, insurance market, a Fitch report from 2022 states.

Back in 2018, it was estimated by the World Bank that Morocco faced around US $800 million in average annual losses from natural catastrophes.

Even prior to that, work had been ongoing in the country to establish the private disaster insurance scheme and social safety net, while the World Bank had also set up a US $275 million catastrophe deferred drawdown option (CAT DDO) for Morocco back in 2019.

The CAT DDO was triggered by the coronavirus pandemic and disbursed in full at the time and, so far, we cannot find any evidence that it was renewed after the project expired earlier this year.

But the World Bank has also worked to educate the government of Morocco on alternative options, from parametric insurance, through disaster preparedness and even on catastrophe bonds as a possible source of capacity to back natural disaster insurance schemes both for the population and government infrastructure.

The government of Morocco had specifically reviewed the potential to use international reinsurance markets and also catastrophe bonds to underpin the solidarity fund that provides a disaster safety net for those without insurance in the country.

But sadly, to-date, there has not been any progress on establishing more robust disaster risk insurance and reinsurance capital support, to help the government expand the program and the support it provides when disasters strike.

Which all means that, once again, the insurance and reinsurance industry will be looking at relatively light financial impact from a disaster that has cost a country and its people so much.

The insurance protection gap is laid bare again and while the industry will no-doubt discuss it a lot, at events such as the ongoing Monte Carlo Rendez-Vous, there remains precious little evidence of tangible progress being made in narrowing it in countries such as Morocco.

Catastrophe bond investment specialist Plenum Investments commented on Friday’s deadly earthquake by highlighting that, “This Risk has not yet been covered by the CAT Bond Market,” and that, “CAT Bonds could fill the Insurance Gap.”

This is absolutely true, the insurance-linked securities (ILS) market is ready and able to absorb some of these disaster risks, with the only question holding back access likely to be a combination of cost and pricing, making the support of entities such as the World Bank and donor funding potentially critical in getting more protection to places that really need it.

Plenum Investments also said that, “It can be assumed that only a small part of the damage is insured and that the burden of reconstruction will remain largely with the population itself. At present, there is also no risk coverage via CAT bonds for earthquakes in Morocco, even though these would be an effective instrument for such natural disasters to quickly finance reconstruction and aid.”

Disaster risk financing is expected to rise up the agenda for many countries that have watched the tragic experience of countries such as Turkey, Syria and now Morocco this year. The industry needs to engage and find avenues to support these goals, to protect more lives and livelihoods against the devastating effects of natural disasters.