The pros and cons of online car insurance

The pros and cons of online car insurance | Insurance Business America

Guides

The pros and cons of online car insurance

Buying online car insurance is an efficient way of getting coverage, but is it really as simple as it seems? We will walk you through the steps

Purchasing auto insurance online can be a quick and convenient way to access the coverage that you need. But the process isn’t always as straightforward as it seems.

In this guide, Insurance Business will explain how online car insurance shopping works. We will give you a walkthrough of the steps involved and the factors you should consider when choosing the right protection. We have also compiled the links to several insurer websites where you can buy coverage entirely online.

If you’re pressed for time and wondering if getting auto insurance online is the best route to take, then this guide can help. Read on and start your online car insurance journey now.

While many insurers offer free quotes for car insurance online, only some will let you complete the buying process digitally. Most carriers that don’t allow online sign-ups and purchases will require you to talk to a car insurance agent before finalizing your policy. However, you can still do most of the important steps on their websites.

The table below contains the names of some of the providers that allow you to shop and purchase online car insurance. You can click on the links to access their auto insurance page where you can get a free quote, choose the coverage that suits you, and sign up for a policy.

Purchase online car insurance from these providers!

Purchasing car insurance online is just one of the ways for you to access the protection that you need. You can also buy a policy from an experienced car insurance agent or broker. They can explain the different coverages in more detail and answer any questions you might have.

If you feel that you have sufficient understanding of how car insurance works and want to get coverage faster, then online car insurance shopping is for you. Here are the steps that you should follow if you choose to go this route.

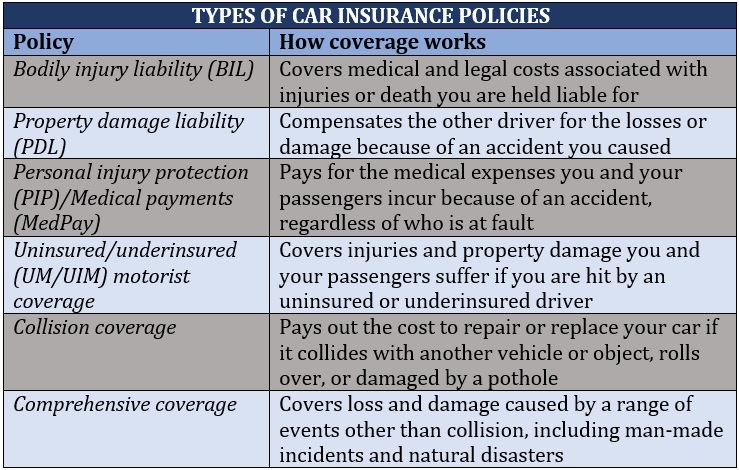

1. Understand the types of coverage you need.

Each state has its own minimum mandatory coverage when it comes to car insurance. You should be able to find the requirements on the websites of your state’s insurance commissioner’s office or motor department. But because these are minimum requirements, the level of protection they provide is not always adequate.

When shopping for online car insurance, it pays to understand how much coverage you really need. You can adjust the coverage limits to suit your personal preferences and circumstances. You can also add optional policies to get full protection.

The table below lists the different types of car insurance policies you can access.

2. Compare car insurance quotes.

Shopping around and comparing quotes are among the simplest and most effective ways to get the best value for your money. Because car insurance is a highly individualized product, an insurer that can offer you quality coverage may not be a good option for another driver.

One way of securing quotes is by going to each insurer’s request for quote (RFQ) page. There, you will be asked to provide certain personal information that will help insurance companies determine how much your coverage will cost.

The Insurance Information Institute (Triple-I) suggests comparing quotes from at least three carriers. This should give you an idea of how much online car insurance costs for your profile.

Do you prefer a faster way to compare quotes? Use online price comparison websites, where you can make a side-by-side assessment of each policy. These sites, however, may lack some of the policy details that you can find on insurer websites.

3. Choose your car insurance provider.

Once you have compared policies, the next step is picking a car insurance provider.

When choosing an insurer, look beyond just the rates. You must also consider if the policies these companies offer come with features and benefits that match your needs. You can likewise read client reviews to find out how they perform in terms of customer service and claims handling.

4. Sign up for an online car insurance policy.

Your chosen car insurer will send you the policy document to sign. This contains everything you need to know about your auto insurance policy. You will also be asked to choose a payment method.

Insurance companies typically offer discounts for policyholders who opt for annual payments and electronic transfers. Your coverage kicks in once payment is made. Unlike other types of insurance, auto policies don’t entail a waiting period.

5. Get your insurance ID.

After your payment has been processed, you will receive an email confirmation. This will include the policy document and your insurance ID card, which you can readily print. Most insurers also provide digital insurance ID that you can access through their mobile app. This enables you to easily show proof of insurance when necessary.

The entire online car insurance shopping process usually takes less than an hour. This is as long as you have decided on the types of coverage to purchase and have all the relevant information ready.

To make the purchasing process go smoothly, you should have all the relevant information ready. This includes those for every driver who will be listed in your policy.

Personal details such as name, address, and date of birth

Driver’s license number

Driving history, including any traffic violations, at-fault accidents, and safe driving courses taken

Vehicle information, including make, model, year, mileage, safety features, and vehicle information number (VIN)

Current insurer

You can usually download a copy of your driving history from your state’s motor department for a fee.

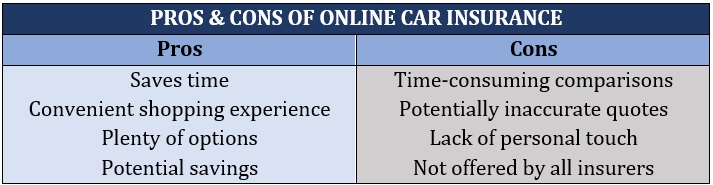

Online car insurance shopping is not for everyone. While it can be a fast and convenient process for insurance-savvy drivers, it can be confusing and time-consuming for others. Here’s a list of the benefits and drawbacks of purchasing auto insurance online.

Pros

Saves time: If you have a good understanding of how car insurance works and the types of coverage you need, buying car insurance online is a quick way to get coverage.

Convenience: Online car insurance shopping can easily fit your schedule. You can purchase coverage at any time of the day or whenever you’re free.

Plenty of options: You can easily compare quotes and policies online, especially if you’re accessing a price comparison website.

Potential savings: Some insurers offer discounts for those who buy auto policies online. Online car insurance may also be cheaper than those bought from insurance agents as commission rates are excluded. If you’re curious about how much car insurance agents make, you can click on the link to find out.

Cons

Comparisons can be time-consuming: Because of the large number of options you can access, comparing quotes and policies can be overwhelming. This is especially true if you don’t have a clear picture of the type of coverage you need.

Inaccurate quotes: To get an accurate estimate, you must provide truthful information. Otherwise, the quotes you will receive may vary significantly from your actual rates.

Lack of personal touch: If you prefer talking to another person, then online car insurance isn’t the way to go. You’ll be better off speaking with an insurance agent who may be able to explain coverage in more detail.

Not all insurers allow online sales: Although most insurers allow you to do most of the steps online, some require you to talk to an agent before finalizing your policy. This is being done to ensure that you’re getting the coverage that matches your needs.

The table below sums up the advantages and disadvantages of buying car insurance online.

Online car insurance policies are generally cheaper than those offered by insurance agents as these don’t include commissions and other fees. Most auto insurance companies also offer discounts if you purchase car insurance online.

However, using an agent has its share of benefits. An experienced insurance agent can guide you through the process and provide information that may not be readily available on insurers’ websites. They can also address any questions or concerns that you may have.

But as we have mentioned before, don’t base your insurance purchase solely on the price. Apart from affordable premiums, your car insurance policy should provide sufficient protection once unexpected accidents strike.

If you want practical tips and strategies on how to slash your premiums without sacrificing quality, you can check out our guide to cheap car insurance.

The answer lies in what your coverage needs are and your level of understanding of the car insurance process. Online car insurance is a good way to get coverage if:

You know your auto insurance well enough to make an accurate comparison of quotes

You’re not easily overwhelmed by the number of choices

You don’t have specialized coverage needs – insurance for classic cars, for example

You can access car insurance without complications, meaning no serious traffic violations

Enlisting the services of a car insurance agent, meanwhile, is a better option if:

You get easily confused by the jargon and number of coverage options

You need coverage for high-net-worth assets, including luxury vehicles and yachts

You want to bundle other coverages – home and life policies, for example – with your auto insurance

You may experience complications because of your profile and driving history

Many of the country’s top insurers allow you to take out online car insurance. You can check out what type of coverage they offer in our latest rankings of the 10 largest car insurance companies in the US.

Do you think purchasing online car insurance is better than buying from an agent? Share your thoughts in the comments section below.

Keep up with the latest news and events

Join our mailing list, it’s free!