What types of subcontractor insurance do you need?

What types of subcontractor insurance do you need? | Insurance Business America

Guides

What types of subcontractor insurance do you need?

Subcontractor insurance is commonly associated with construction projects, but coverage extends to other industries. Find out how it can protect you

As a subcontractor, you can’t always rely on your contractor’s insurance policies for coverage. If you want to ensure that you and your business are protected, it is best to take out coverage yourself. Subcontractor insurance comes in many forms, so it’s vital for you to sift through the choices to find the right policies that match your needs.

That is where this guide can help. In this article, Insurance Business will walk you through the different policies every subcontractor should consider and how these can protect your business. Read on and pad your understanding about the various types of subcontractor insurance policies your business needs.

Subcontractor insurance is the overall term given to a range of policies designed to protect subcontractors financially against claims of third-party injuries and property damage. Although subcontractors are commonly associated with construction projects, this type of coverage extends to those operating in other sectors, including advertising, media, and technology.

Some policies are legally required, depending on the industry. Others are often set as requirements on a business contract.

Subcontractors can access a range of policies, each offering different levels of protection. Here are some of the most common types of subcontractor insurance policies that are worth considering.

1. General liability insurance

General liability insurance is not mandatory for subcontractors to operate in the US. Many contractors, however, impose this type of policy as a requirement for doing business with you to protect their assets and investments. This, along with the kind of protection it offers, is why general liability policies are among the most commonly purchased forms of subcontractor insurance.

General liability insurance pays out the legal and settlement costs for the following claims if these are caused by your business activities:

Bodily injury

Property damage

Copyright infringement

Reputational harm, including incidents of libel, slander, and malicious prosecution

Product liability

Some policies may also cover medical expenses from injuries that occur within your business’ premises. This is regardless of who is at fault or whether a lawsuit has been filed.

2. Professional liability insurance

Professional liability coverage is another crucial form of subcontractor insurance. It protects you financially from claims resulting from service-related mistakes and oversights, including:

Breach of contract

Budget overruns

Negligence

Personal injury

Unfinished work

Also called errors and omissions (E&O) or malpractice insurance, this policy pays out the legal and settlement costs you incur from these types of claims.

If you intend to work on government projects, you’re required to take out professional liability insurance under the Federal Acquisition Regulation (FAR). The purpose of this rule is to prevent the transfer of risk from your business to the government.

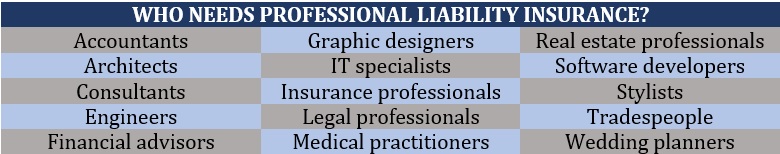

These businesses require this type of coverage:

Construction companies

IT specialists, including consultants and cybersecurity experts

Pharmaceutical and healthcare services providers

Professional services providers, including financial and public relations firms

Transportation and logistics services providers

Coverage is not compulsory for architects and engineers, but it can be beneficial as it covers legal and settlement costs resulting from:

Advice and design errors and oversights

Allegations of negligence

Breach of contract

For tradespeople, professional liability insurance pays for the costs incurred to repair or redo faulty work. It also covers any legal costs from lawsuits, settlements, and damages resulting from such errors. This group of professionals include:

Carpenters

Electricians

HVAC technicians

Painters

Plumbers

The table below lists down the occupations that need professional liability insurance, whether they are subcontracting their services or not.

3. Workers’ compensation insurance

Unlike most businesses, subcontractors are not legally required to purchase workers’ compensation insurance. Contractors, however, put it as a condition before doing business with you; without it, the financial liability of work-related accidents falls on them. Subcontractors, once they sign up with a contractor, are essentially considered the contractor’s employees.

Workers’ compensation covers the cost of medical care and a part of lost income if you become injured or sick while doing your job. It also pays out disability benefits if you become disabled due to an on-the-job accident and death benefits to your family if you die.

Workers’ compensation insurance follows a no-fault system. This means the benefits you are set to receive are not affected by your or your business’ negligence. If you’re curious about how much the highest workers comp settlement cases in the US cost, you can click on the link to access our exclusive rankings.

4. Tools and equipment insurance

If your business depends heavily on your tools and equipment to get the job done, then having the proper coverage for these items is important to keep your operations running smoothly. This is where tools and equipment insurance comes in handy.

This type of subcontractor insurance covers the cost to replace or repair your tools and equipment if these are lost or damaged. Most policies cover items worth up to $10,000 and less than five years old. Some plans, however, provide coverage for older items on an actual cash value basis.

Certain policies also come with provisions that pay out for lost income and the costs incurred for additional supplies or services needed to keep the project on schedule.

Tools and equipment insurance is not compulsory. But as with other kinds of subcontractor insurance policies, businesses may require you to have coverage in place before agreeing to work with you to protect their investments. You can take out tools and equipment insurance as a standalone policy or as a rider to your commercial property insurance or business owner’s policy.

Tools and equipment insurance doesn’t cover company cars or any vehicle you use exclusively to transport staff. For this, you need a different form of policy called commercial vehicle insurance, which we will discuss in more detail below.

5. Commercial vehicle insurance

If your business uses vehicles to transport staff or perform business-related duties, then you’re required to take out commercial vehicle insurance. It is mandated in almost all states just like private car insurance. Getting caught driving without one can result in hefty fines and affect your future eligibility for obtaining coverage.

Depending on where your business operates, you are required to purchase different types of policies. Here are the most common types of commercial vehicle insurance that you may need to get.

Bodily injury (BI) liability insurance: This covers hospital and legal expenses associated with injuries or death if the driver is at fault.

Property damage (PD) liability insurance: This pays out if your business’ vehicle damages another person’s property. It also covers legal and settlement costs incurred in a lawsuit.

Personal injury protection (PIP) insurance or medical payments (MedPay): This covers medical expenses for injuries the driver and their passengers suffer in a collision. Some policies also pay out for lost income if the driver needs to take time off work.

Uninsured/underinsured motorist coverage (UM/UIM): This pays for injuries the driver and their passengers sustain if they are hit by an uninsured or underinsured driver.

If you find your auto insurance premiums to be expensive and are looking for ways to slash costs, our guide to finding cheap car insurance can help.

6. Surety bond

A surety bond pays out the contractor or project owner if you’re financially unable to finish the project or your business goes bankrupt. It is also called subcontractor default insurance. This type of policy covers the cost of getting the services of another subcontractor, so the project can proceed as planned.

Unlike other types of subcontractor insurance, this policy doesn’t protect you. Instead, it gives your contractor the peace of mind in knowing that the project can go on schedule even without your services. Surety bonds are typically required for large construction or publicly funded projects.

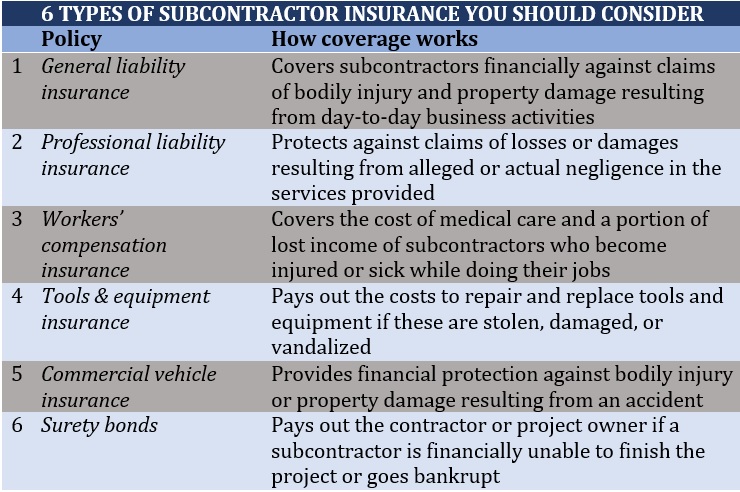

The table below sums up the different types of subcontractor insurance policies worth considering.

The different types of subcontractor insurance policies offer varying levels of protection. Because of this, it is also difficult to come up with a single accurate estimate of how much coverage costs.

The table below provides a breakdown of how much these policies cost. This is based on the premiums Insurance Business gathered from several price comparison and insurer websites.

Subcontractor insurance cost – breakdown by policy type

HOW MUCH DOES SUBCONTRACTOR INSURANCE COST?

Type of policy

Average monthly premiums

Average annual premiums

General liability insurance

$40 to $55

$480 to $660

Professional liability insurance

$50 to $60

$600 to $720

Workers’ compensation insurance

(Small business with 3 to 5 staff)

$30 to $60

$360 to $720

Tools & equipment insurance

($10,000 coverage limit)

$15 to $38

$175 to $450

Commercial auto insurance

(Comprehensive coverage)

About $150

About $1,800

Surety bond

$1,300 to $3,500

$15,600 to $42,000

These figures, however, are just estimates. Your actual premiums can be significantly lower or higher, depending on a range of factors, including:

The type of subcontractor work you do

How long you’ve been in business

Any past claims you’ve had

Your average income level

Your policy’s coverage limits

Liability insurance is one of the most popular types of policies among subcontractors because of the kind of coverage it provides. If you want to dig deeper into this form of protection, you can check out our guide to liability insurance coverage.

Subcontractors are not typically required by state laws to take out insurance. If you want to be covered for your potential risks, there are two ways you can go about it.

First, you can try asking your contractor to list you as an additional insured in their insurance policy. It is highly unlikely that they would do so as most contractors are not keen on working with an uninsured contractor. The reason is that doing so entails taking responsibility for all your risks and potential liabilities. And if for some reason they agree to this arrangement, you’re not even sure if their policy has sufficient coverage.

Still, the best way to go – and your other option – is to get the right subcontractor insurance policies, which yield the following benefits.

1. Subcontractor insurance gives you proper protection from the unique risks you face.

Every business or occupation comes with a different set of risks. That’s why taking out the right combination of subcontractor insurance policies is crucial. This ensures that your business is protected from the unique hazards it faces.

For instance, you can take out professional liability coverage and tools and equipment policy that match your specialization. If you use your car to travel to and from the job site, you can purchase commercial vehicle insurance.

2. Subcontract insurance enables you to comply with contractual requirements.

Although not legally required, most contractors impose general liability insurance and workers’ compensation coverage as conditions before working with a subcontractor. This prevents them from taking on more risks than they need to. Contractors will often require you to present proof of these types of policies and if you have sufficient coverage before signing on the dotted line.

3. Subcontractor insurance helps boost your credibility.

Having the right insurance policies shows that you’re taking responsibility for your risks. This also indicates that you take your job seriously. Overall, subcontractor insurance helps build your reputation within your industry.

Is subcontractor insurance worth investing in? Do you have a work-related experience where this type of coverage helped? Share your story in the comments section below.

Keep up with the latest news and events

Join our mailing list, it’s free!