Canadian female leaders and their rise in the insurance industry

Canadian female leaders and their rise in the insurance industry | Insurance Business Canada

Guides

Canadian female leaders and their rise in the insurance industry

Canadian female leaders discuss the challenges they overcame to get to the top. Find out what makes them inspiring role models for women empowerment

While Canada’s insurance sector has seen the emergence of more women in leadership positions over the past few years, their road to success wasn’t easy. Historically, insurance is a male-dominated industry. Canadian female leaders continue to battle deep-rooted biases that often hinder revolutionary changes when it comes to gender equality.

These challenges are what this year’s recipients of Insurance Business’ Elite Women awards have overcome to get to the top. In this article, we will share excerpts of our interviews with two outstanding women leaders as they talk about how they beat gender barriers to rise through the ranks in the country’s insurance space.

Read on and find out what led to the success stories of these inspirational Canadian female leaders.

Anita Swamy, senior vice-president of operations at Medavie Blue Cross, has a reputation for confronting systemic barriers to diversity, equity, and inclusion (DE&I). Her nominator specifically cited her “eagerness to challenge the status quo” as one of her exceptional attributes. This has enabled her to spark transformative changes not just in her career, but also her company and the insurance industry in general.

She recalled a debate around her firm’s approach to biological sex in the insurance sector. She raised the issue of intersex individuals and advocated for acknowledging all sexes, challenging the prevailing binary male and female system.

“We were having a lot of discussions around diversity, equality and inclusion,” she shared. “And part of that was figuring out where we want to place ourselves when it comes to DE&I. Do we want to be in front of the pack with some unique thinking or do we want to follow what everybody else was doing?”

Swamy said that despite her organization showing initial resistance to breaking from mainstream policies, she was able to influence a shift that led to its adoption of a more inclusive approach.

“That decision could have gone either way,” she added. “They could have said, ‘Great idea but we’re not going that route’ – and that’s fine. Part of being an effective leader is bringing something to the table for due consideration, and if it doesn’t proceed, that’s fine, too. The critical thing is questioning the concept of why not.”

Swamy’s drive has allowed her to flourish as among the top Canadian female leaders both professionally and outside work. Some of her most recent accolades and achievements include:

Receiving Insurance Business Canada’s 2022 Excellence Award for Claims Service

Serving as vice-chairperson of the Canadian Association of Blue Cross Plans’ national benefit and claims committee

Being named a Canadian delegate at the 2022 International Federation of Health Plans’ executive development program

Serving as an ally of the Connector program for newcomers and executives who relocate to Halifax and across Canada

Teaching the youth program at Vedanta Ashram Society

Being an active community booster of Feed Nova Scotia and United Way

Swamy also spearheaded the Medavie Benefits+, a unique walk-in health benefits and wellness resource center that serves clients in person when many companies are shifting to digital.

“We just recently launched our second location,” she shared. “So, at a time when most companies are turning to a full digital environment, we decided to create an industry-leading customer experience framework that serves customers’ needs in person. [Digital] isn’t the place where all our customers are at.”

Swamy explained that the center is designed to provide people who may not be that tech-savvy with a “safe place to come in and get the support that they need.”

“The next step is sharing that story so other insurers or even retail establishments can start to think about how things can be done differently,” she added.

Swamy on how Canadian female leaders can succeed in the insurance sector

Apart from challenging systemic barriers, Swamy shared some advice for those who are striving to become exceptional women leaders in the industry.

Find your voice.

Swamy started her career in another male-dominated sector – information technology. There, she quickly learned to stand up against deep-rooted biases and inequalities.

“It was early in my career working in a male-dominated environment,” she said. “I feel like having experienced that early in my career helped me to find my voice and establish my confidence in knowing the homework to do before you come to the table. The biggest challenge is not letting those barriers get in the way of standing up for the right path forward.”

Share your knowledge.

One of Swamy’s biggest passions is learning. But she also emphasized that part of being a great leader is sharing that knowledge to help others succeed.

“I’m a lifelong learner,” she bared. “It’s something I’m very passionate about. I’m always looking for opportunities and avenues to learn something new, but I also want to share the lessons on a broader scale. This includes talking at conferences and sharing our story and experiences.

“Achievement is when we share our successes, lessons learned and even our failures.”

Understand your strengths.

Canadian female leaders should understand where their strengths lie and focus on harnessing them, according to Swamy.

“As women, we tend to focus on areas that we need to improve on or those that we don’t have much exposure to. But to be successful in the insurance industry, a big part is knowing yourself well enough to know your value proposition.

“We should work on other areas for sure. But our confidence lies on our ability to feel that we have a solid footing going forward and that’s in our strengths.”

Christine Wilson serves as assistant vice-president of insurance inside sales at Canada Life, leading a team focused on DE&I initiatives and team engagement. But a breast cancer journey has helped her understand firsthand how crucial living benefits can be for others undergoing a similar experience.

Wilson emphasizes the important role critical illness and disability insurance plays in risk management planning by sharing her personal story on the conference circuit.

“It’s interesting how my career has gone from talking about my story as a client and making a claim, to being an adviser that sold those policies, and now working for a carrier that offers them,” she said. “I’m proud to be in the insurance industry, knowing that our products positively impact families, business owners, and charities.”

Wilson shared that her experience has also helped her team as they’re able to share a real-life story with their clients instead of just throwing out figures and statistics.

Wilson joined Canada Life in 2018 serving as an advanced planning strategist for living benefits, where she got to work with top advisors. Two years later, she took the opportunity to take on a leadership position and helped build the insurance inside sales team. The move has led to the senior leadership position she now holds.

Some of Wilson’s recent professional achievements include:

Establishing Canada Life Comrades, a program pairing Canada Life members nationwide to share best practices, build engagement, and drive workplace satisfaction

Leading Canada Life’s Asian market distribution strategy and advocating for Chinese-speaking advisers and clients

Being selected to speak at the 2021 Million Dollar Round Table (MDRT) global conference in Singapore to share her story on critical conversations

Being a cancer survivor has also reshaped the way Wilson approaches life. She now puts a premium on work-life balance. She also exercises regularly, eats a healthy diet, and works with a personal coach who provides her with life advice and insights.

Wilson is also passionate about driving engagement and collaboration in the workplace. She acknowledges that the encouragement and support she receives from others play a crucial role in her team’s success.

“I’m very fortunate that I love what I do and the people I work with,” she shared. “Each day brings new experiences, conversations, knowledge, and growth.”

Wilson also bared her commitment to helping other Canadian female leaders to succeed in the industry, as well as building on her leadership skills.

Canada’s insurance industry has seen more women leaders rise through the ranks as society continues to challenge traditional gender roles and increase representation in the professional environment.

Attitudes towards pay gaps, parity, and gender imbalance only prove that the sector has a long way to go before achieving gender equality. The figures and situations below reveal why:

Attitudes towards women

Women in the insurance sector tend to experience discrimination and microaggressions because of their gender, regardless of their position. For example, Aviva chief executive Amanda Blanc was a target of sexist remarks in a recent shareholder meeting that has left many insurance leaders, including Aviva board chair George Culmer, “flabbergasted.”

This 2022 opinion piece from one of our former colleagues, Bethan Moorcraft, explains why “there’s no excuse for sexism” in the insurance industry.

Unequal pay

A recent study on gender-based pay equality in Canadian insurance companies conducted by a Walden University doctoral student has revealed telling numbers:

Women with similar experience earn $4.13 less per hour than their male counterparts

The inequality is more pronounced for new immigrants, Indigenous women, and women of color

These groups earn less than 76.8 cents for every dollar a man makes

These figures show that transformative changes are needed to close the gender pay gap in the insurance sector.

Gender parity

Data from the Million Women Mentors Women in Insurance Initiative show that just slightly over a third, or 35%, of insurance professionals are women. Female broker representation is even lower at around 16%. For senior executive positions, only 29% are held by female leaders. These numbers indicate continuing gender imbalance in the industry.

What should the insurance industry do to be more inclusive of women?

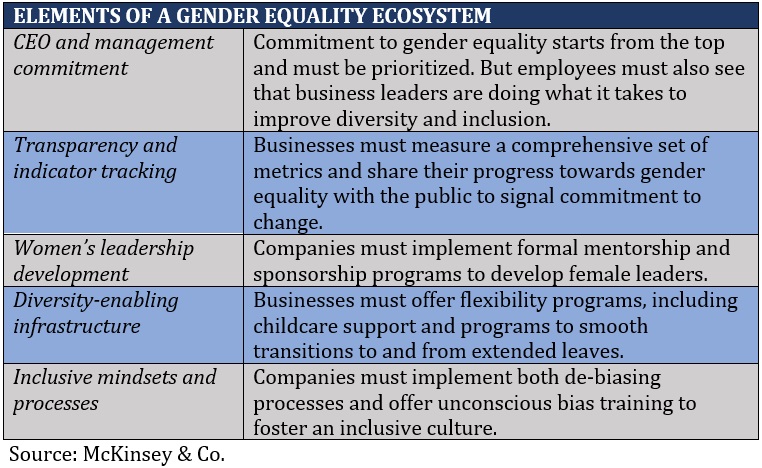

Global consulting giant McKinsey & Company published a 2019 study that delved deeper into gender inequality in Canadian workplaces. Based on its findings, the firm came up with a “roadmap” that businesses can use to create a work environment that fosters gender diversity and inclusion.

The table below highlights some of the most important elements, along with supporting figures, of what the company calls an “ecosystem approach” to gender inclusion and diversity.

This year’s edition of Canada’s Elite Women awards has a total of 55 recipients. Some of the other notable awardees are:

How can the insurance industry empower more Canadian female leaders? Do you think the industry is making strides towards gender equality? Share your thoughts below.

Keep up with the latest news and events

Join our mailing list, it’s free!