P&C Risk, Data and Underwriting: The Crush That is Driving Better Technology

Published on

July 27, 2023

Pick your pressure. If your organization had to have a pain point, would you rather have…

Higher than normal average claim costs due to inflation and supply chain challenges?

Growing expense structure due to rising talent and core operating system costs?

Greater risk and underwriting losses as a direct result of unpredictable weather?

Lack of data insights to improve A. B. or C.?

Unfortunately for today’s P&C insurers, the business climate has been chosen for them.

E. All of the Above

P&C insurers are in an extraordinarily tight spot. Name a pressure and it’s happening right now to them. It may be temporary. It may not be as bad as it has ever been. But, it is challenging enough that insurers must take steps to alleviate their pains and pressures and create opportunities.

According to A.M. Best’s Q1-2023 report, the P&C combined ratio worsened by 6.1 percentage points to 102.0 in Q123 (when compared to the prior year’s quarter.)[i] In 2022, The US property-casualty insurance market experienced a $26.5 billion net underwriting loss, a decline of $21.5 billion from the prior year’s underwriting loss, according to A.M. Best.

While environmental weather and natural disasters such as wildfires, hurricanes, or other catastrophic events, are top of mind, there is a growing set of new risks including societal and technological. And most recently we have once again seen the impact of financial risk with the recent failure of Silicon Valley Bank and the ongoing fallout. As noted in an article in Insurance Journal, the failure was a lack of effective risk management.

All of these trends indicate P&C insurers must rethink risk management strategies from products and pricing to claims and prevention. Instead of playing defense, insurers must go on offense. But that requires a different operational and technology strategy and approach.

At a recent Majesco and Capgemini roundtable, industry experts discussed the changing risk environment and which changes insurers may make to turn E. All of the Above into None of the Above. You can read more about this in our point of view report, The Changing World of Risk: Insurers and Brokers at the Center of Risk. In today’s blog, we look specifically at pressures that can be mitigated through improved technologies.

A proper assessment of risk includes…

In the past, we may have looked at a specific policy risk for answers to loss probability and profitability. Today’s risk requires a wider lens, including:

How a policy risk impacts the overall portfolio risk (and portfolio profitability).

What other layers of risk should be considered including environmental, societal, and technological risks?

How can loss control be used to assess every risk cost-effectively to manage the portfolio, reinsurance needs, and help customers mitigate risk?

How does personalized data shift underwriting and risk?

How do insurers better understand new risks?

Electronic Vehicles (EVs) make a good case study for a broad approach to understanding risk.

As EV usage grows, we are now seeing the impact on claims due to accidents. We now have multiple incidents involving EV fires. Responders don’t necessarily know how to put these fires out. There have been instances of car doors being “too electronic” to open. When batteries are punctured, new risks appear.

Repair costs of EVs are expensive. One example is Rivian R1T pickup truck, which was rear-ended by a Lexus in February 2023 at a stoplight in Columbus, Ohio. The damage was initially deemed relatively minor, and the other driver’s insurer offered him $1,600. The actual cost to fix the bumper at a business certified to repair Rivian vehicles — one of just three in Ohio — was $42,000, roughly half the truck’s selling price[DG1] .

Because of the complexities of EVs, many are totaled because replacement of the battery is difficult or impossible to do, increasing the risk and cost.

Liability isn’t easy to sort out, especially when the “driver” may not be driving. Would it be the owner? The auto manufacturer? For insurers, it becomes trying to solve a Rubik’s cube of understanding all the possibilities and dimensions of risk.

Home and Business smart property systems have some similar issues, only in some instances, new technologies may be providing new protections.

The smart home has the ability to keep track of risks within water supply, drainage, security, and electrical systems.

As smart home/smart business networks grow increasingly tied to electrical systems, some systems may be found to be outdated and overly-taxed — risky to policyholders and insurers.

Are insurers prepared to capture and assess the right kinds of data that will protect policyholders, prevent fires, water damage, and theft, and also reduce claims?

Are insurers actively using AI and data personalization to communicate quickly about coming risks, such as hail, fires, and storms?

The good news is that for the most part, change and risk are accelerating change with insurers to adapt more quickly operationally. It might be fearful in pace, but certainly not in the opportunity and results that create new value and benefits customers can expect:

Greater coverage — more people and more businesses may find themselves covered through more relevant or newer options and fewer steps to usage, including embedded coverage, reducing the insurance coverage gap.

Greater predictive protection — insurance may improve underwriting profitability, reduce its costs and customers’ costs through a dramatic uptick in loss control data-driven risk assessments for underwriting that also provides insight and recommendations for risk avoidance or mitigation through proactive solutions.

Greater efficiency and effectiveness — insurers are right now grappling with operational challenges including talent shortages and tech debt that will give them the “excuse” to redesign their operating models and introduce better solutions and ecosystems to improve operational results.

Greater resiliency — a rapidly-growing set of risks is likely to touch off two ancillary trends: new product development and better risk knowledge and response.

Mitigated risk is an improved experience

Customer expectations are yet another vital pressure point for insurers. These expectations are linked to all of the other pressures (e.g. — prevention improves customer satisfaction AND profits) but they deserve their own consideration. Customers are living different lifestyles and exhibit far more robust digital proficiency. They demand different experiences, and they have different expectations about value. According to a recent AM Best innovation assessment report, “the rise of digital platforms and ecosystems will make relationships with customers even more important.”

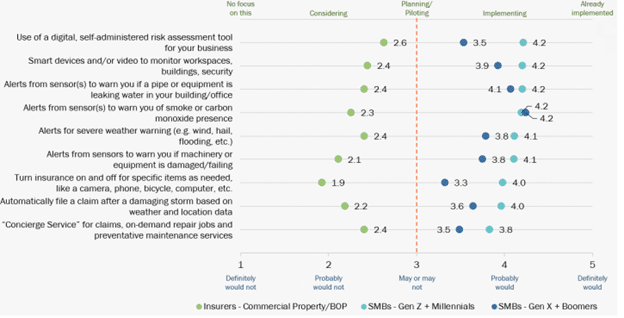

These changing expectations and needs are creating a disconnect between what they want and what insurers offer. The disconnect includes customer changing priorities and products needed, demand for risk mitigation and avoidance, personalized pricing and rating based on their specific risk profile and a need for value-added services that extend customer value and loyalty as seen in Figure 1.

Figure 1

The gaps between customer expectations and what insurers are offering are nearly twofold for both generational groups of SMBs and similar for consumers, based on Majesco research! Customers want and expect more. To meet the increased expectations, we need to identify priorities that will bridge the gap for insurers such as digitalization, data, and risk resilience — new ways of dealing with both the new customer and the new risks we are seeing in today’s era.

Customers want personalized underwriting based on their specific data or continuous assessment of risk. The traditional risk models or once-per-year, traditional approach does not work for the new risks that are presented. Data and analytics and how it affects our risk perspective on a micro level are more consumable in ways that do not strain our technology and our underwriting teams.

This is why there is increased interest in usage-based or telematics-based insurance. In today’s macroeconomic environment, customers are trying to manage their costs, including insurance premiums, hence the increased demand for telematics-based insurance.

A great example of the value is in the recent earnings call from Progressive Insurance Group and a view from Mike Zaremski, Sr. P&C insurance equity research analyst, and MD at BMO Capital Markets:

“Progressive is building upon its material first-mover competitive telematics advantage by offering a new crash-detection/safety service to its customers. We estimate PGR’s competitive advantage in telematics is also structural in that customer adoption rates of telematics-based policies via D-2-C distribution are multiples higher than via a broker, meaning PGR is building upon its competitive advantage vs. its average peer on a daily basis (note, most of its peers distribute via insurance brokers).”

Value-added services contribute to risk resilience

We are living in a world that has increasing risk. Insurance can no longer be about just underwriting and then waiting for the claim to happen, but insurance also must help avoid or minimize the risk, creating greater customer value.

While most insurers are focused on how they can better assess risk, many more are expanding to also focus on the prevention of losses and creating risk resilience for customers. The adage of “control what you can control” is now front and center for insurers as they look at new risk management strategies as a crucial component of their underwriting and customer service strategy.

Leading insurers are leveraging technology such as IoT devices, smart watches, loss control assessments, and value-added services to not only assess and monitor risk but to proactively respond to it with mitigation services and actions. From concierge services to monitoring water hazards and the safety of employees, to helping to live healthy lifestyles, leading insurers are shifting to risk resilience strategies that not only drive better business outcomes but also produce great customer loyalty.

This creates risk resilience.

New technologies, paired with data & analytics

One of the crucial areas for insurers to meet the changing world of risk is with technology and data and analytics. They must create a new foundation that enables operational optimization and innovation through the replacement of legacy systems, adoption of new technologies, and embracing the strategic role of data and analytics.

Technology is the crucial foundation to adapt, innovate and deliver at speed to execute on strategy and market shifts. The rising importance and adoption of platform technologies, APIs, microservices, digital capabilities, new/non-traditional data sources, and advanced analytics capabilities – including generative AI — are now crucial to growth, profitability, customer engagement, channel reach, and workforce change.

From the front office to the back office, SaaS platforms are reshaping the business focus from policy to customer, from process to experience, from static to dynamic pricing, from point-in-time underwriting to continuous underwriting, from a historical view of data to predictive and prescriptive data, from traditional products to new, innovative products, and so much more. Insurers’ ability to create an interconnected tech foundation will deliver both growth and customer relationship opportunities.

Advanced analytics capabilities are poised to be a game-changer for insurance. When new and real-time data, advanced analytics, AI and machine learning, and generative AI are effectively embedded into the operation and core systems, insurers can have a significant operational impact across the entire insurance value chain. Data is becoming more readily available and cheaper, becoming a commodity that allows it to spread across the entire value chain. And advanced analytics with AI, ML, and NLP are emerging as powerful tools to enhance underwriting, identify and prevent risk, and drive more efficiencies, leading to better profitability and loss ratios.

Data overload and diminishing speed to insights

The swelling volume of data is creating difficulty for underwriters to manage and use it effectively. The market is seeing massive data increases in IoT device data, telematics data, and risk-specific data.

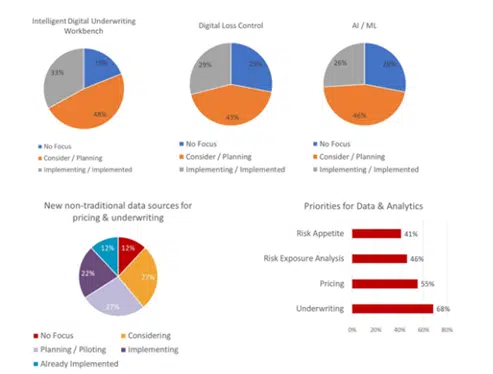

Underwriters and actuaries cannot validate and devise their understandings quickly enough, leading to the necessity of automated techniques needing to be applied to the data to draw insight to create better and expedited business decisions. With the use of more accurate data, insurers can leverage predictive modeling to provide customized coverage and better pricing. But it is more than any one policy. The combination of intelligent underwriting, loss control and advanced analytics like AI/ML are increasingly necessary to assess the specific risk, but also its impact in terms of risk appetite and risk exposure analysis for the portfolio as seen in Figure 2.

Figure 2

As the competition tightens in the industry, every part of the insurance organization must be committed to the use of next-generation technology and data and analytics to stand out from their competitors and to meet customer expectations.

Those stuck on legacy core systems are boxed in and are limited in their potential. Moving their business to next-gen cloud platforms is crucial, not just for single lines of business, but for the entire business to achieve real optimization and cost reduction. More importantly, it frees up resources to fund tomorrow’s business.

Tomorrow’s business must be digital, enabling the ability to rapidly introduce new products that capture new market segments, meet new risks, customer needs and expectations, and new distribution channels. It must embed insurance into other products and services to make it easier to understand and purchase.

For insurers, business processes ultimately need to be viewed differently than in previous times. It is about being aggressive in prevention and giving your underwriters (and other team members) the tools they need to achieve the best results. A renewed core and upgraded technology will play a substantial role and help insurers achieve an advanced loss control strategy. Within that technology platform, insurers must also not be afraid to utilize cloud capabilities that can help improve data usage and quicken the time that underwriters can produce coverage options.

Technology is the crucial foundation for dealing with the current and future pressures of a high-pressure P&C environment. It will help insurers to adapt, innovate, and deliver at speed to execute on strategy and market shifts. The rising importance and adoption of platform technologies, APIs, microservices, digital capabilities, new/non-traditional data sources, and advanced analytics capabilities are now essential to growth, profitability, customer engagement, channel reach, and workforce change.

For a deeper look at how growing ecosystem participation and effective leadership are involved in the same risk-mitigation equation, be sure to download the Majesco/Capgemini point of view report, The Changing World of Risk: Insurers and Brokers at the Center of Risk.

Today’s blog is co-authored by Denise Garth, Chief Strategy Officer at Majesco, and Kelly Reisling, Senior Director, Capgemini

[i] Willard, Jack, US P&C industry sees $8.2bn net underwriting loss in Q1: AM Best, June 16, 2023

[DG1]https://www.nytimes.com/2023/07/03/business/car-repairs-electric-vehicles.html#:~:text=Data%20from%20Mitchell%20shows%20that,require%20work%20by%20specialist%20mechanics.