How much does small business insurance cost?

How much does small business insurance cost? | Insurance Business America

Guides

How much does small business insurance cost?

Does cheaper really mean better when it comes to small business insurance cost? What factors affect premiums? Read on and find out

Having the right type of coverage is crucial for any business, especially if you own a start-up or small enterprise that’s still weaving its way to profitability. But how much will small business insurance cost you? Will it provide the protection that you need? And does cheaper really mean better when it comes to this form of coverage?

If you’re a small business owner searching for answers to these questions, then you’ve come to the right place. In this guide, Insurance Business will give you a detailed breakdown of how much the different types of small business insurance cost. We will also explain how each policy works and what factors affect pricing. We encourage insurance professionals to share this article with their small business clients to help them work out how much they can spend on the different coverages that they need.

The cost of small business insurance starts at around $20 and can exceed $125 per month or $240 to $1,500 annually based on the various price comparison and insurer websites we checked out. The actual cost of coverage, however, depends on the kind of protection that your business needs.

The most common type of insurance that small businesses take out is called business owner’s policy or BOP. This can cost between $40 and $100 monthly on average.

BOP bundles together general liability and commercial property insurance. If purchased as a standalone cover, the monthly premiums for these policies range from about $40 to $55 and $60 to $70, respectively.

Some BOPs also include business interruption insurance, which can cost about $40 per month for low-risk enterprises and $130 for businesses that are exposed to more risks.

The table below provides a breakdown of the different types of policies small businesses typically purchase and how much they cost.

Small business insurance cost – breakdown by policy type

HOW MUCH DOES SMALL BUSINESS INSURANCE COST?

Type of policy

Average monthly premiums

Average annual premiums

Business owner’s policy

$40 to $100

$480 to $1,200

General liability insurance

$40 to $55

$480 to $660

Commercial property insurance

$60 to $70

$720 to $840

Business interruption insurance

$40 to $130

$480 to $1,560

Workers’ compensation insurance

$45 to $70

$540 to $840

Commercial auto insurance

About $150

About $1,800

Professional liability insurance

$50 to $60

$600 to $720

Product liability insurance

$30 to $60

$360 to $720

Cyber insurance

$140 to $150

$1,680 to $1,800

Please note that these figures are estimates. Your actual rates can be significantly higher or lower depending on your business’ unique set of needs and circumstances.

In the succeeding section, we will discuss how insurance companies determine the premiums for each type of coverage listed above.

The cost of small business insurance policies is impacted by a range of factors. Let’s go through each of them.

1. General liability insurance cost

Small businesses typically pay around $40 to $55 monthly or $480 to $660 annually for general liability insurance coverage. But since your business faces a different set of risks compared to other enterprises, your premiums may likewise vary. Here are the main factors that dictate the cost of general liability insurance.

Type of industry: Office-based businesses that don’t experience a lot of foot traffic such as financial consultancies pay lower rates than retailers, which customers frequent and face a greater likelihood of injuries.

Business size: The more employees a business has, the higher the cost of insurance as each staff member carries a certain level of risk.

Claims history: Each claim you make can push up your premiums come renewal time. Insurers view businesses with a history of lawsuits and past claims to cover losses as high-risk.

Location: Businesses based in areas with higher crime and accident rates are more likely to have higher premiums than those in safer locations.

You can check out our comprehensive guide to general liability insurance cost for more details on how insurance companies calculate premiums for this type of policy.

2. Commercial property insurance cost

Although not mandatory, commercial property insurance is often required in commercial leasing arrangements. The table below lists the different factors that influence small business insurance cost for this form of coverage.

3. Business interruption insurance cost

Business interruption insurance, also called BI coverage, provides financial protection for the losses your business sustains due to a disruption to your operations caused by an insured event. It covers your operating costs while your business temporarily shuts down.

Just like in other types of policies, the industry, business location, and past claims have a major impact on the cost of coverage. The other factors that affect BI premiums include:

Revenue: Because this type of coverage compensates a business for lost income during a temporary shutdown, those with higher revenue tend to pay higher rates.

Property value: Business interruption insurance covers the costs if you need to move to a temporary location. If you own or rent a high-value commercial property, your premiums will also be higher.

Coverage limits: As with other small business insurance policies, the higher the coverage limits, the higher the costs.

4. Workers’ compensation insurance cost

Workers’ compensation is a type of business insurance policy that covers the cost of medical care and a part of lost income of employees who become injured or ill while doing their jobs. Almost all states require businesses to take out workers’ compensation insurance.

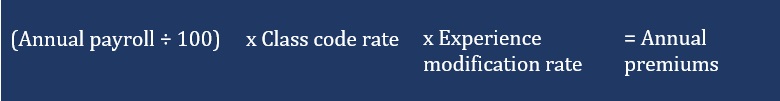

Workers’ compensation premiums are calculated using this formula:

As you may have noticed, there are three main factors that affect how rates are calculated. These are your business’:

Annual payroll: This consists of the salaries and benefits of all your employees, including those who work full-time, part-time, seasonal, and temporary. Generally, the larger your payroll, the higher the premiums you pay for coverage.

Job classification code: This a is a four-digit number that indicates the type of work a job entails and the risks associated with it.

Experience modification rate (EMR): Insurers use EMRs to compare a business’ claims history against the industry average to predict its likelihood of filing claims in the future. An EMR above the industry average of 1.0 means your losses are greater than the average, which pushes your premiums up.

To understand the math, here’s a guide on how workers comp is calculated.

5. Commercial auto insurance cost

Commercial auto insurance is another mandatory coverage for small businesses operating a vehicle. It works just like standard private car insurance but covers commercial vehicles.

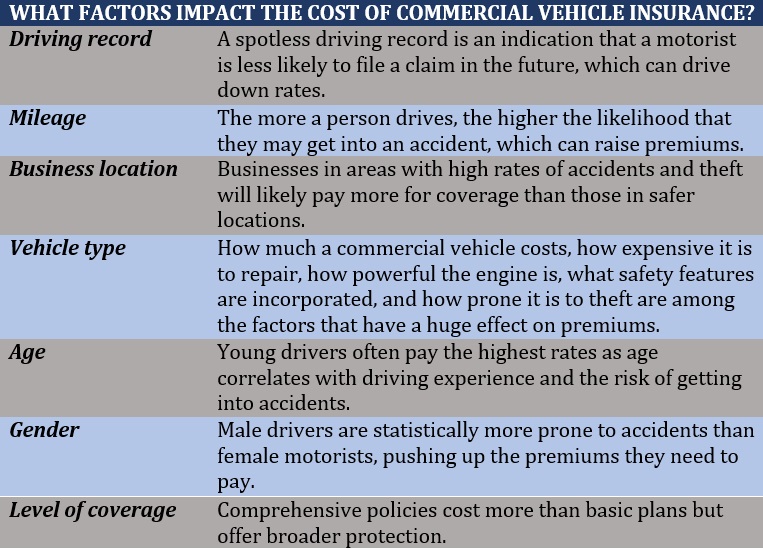

The table below lists some of the main factors that dictate small business insurance cost for commercial vehicles.

6. Professional liability insurance

Businesses in certain industries are required, either by law or industry standards, to purchase professional liability insurance. This type of policy protects them against claims of financial losses resulting from alleged or actual negligence. Some clients may also require your business to carry this type of coverage before agreeing to do business with you.

The main factors that impact the cost of professional liability insurance include:

The industry your business is in, and the risks associated with it

Where the business is located

Years of operation

Number of employees

Previous claims

Coverage limits and deductibles

If you want to learn more about how this type of coverage can protect your business, you can check out our comprehensive guide to professional liability insurance.

7. Product liability insurance

Product liability insurance protects your business against lawsuits from customers claiming losses or injury because of a product you manufacture, design, or sell. Some general liability insurance policies also provide this type of coverage.

Premiums for product liability policies are influenced by the same factors that dictate the cost of professional liability and general liability insurance.

8. Cyber insurance cost

Cyber insurance is a type of insurance policy designed to cover financial losses if your business falls victim to a cyberattack. Insurers often determine the cost of coverage using these factors:

Company size: The greater the number of users, devices, and systems your business has, the larger its threat surface. This means a higher likelihood of falling prey to cybercriminals, pushing up the premiums you need to pay.

The type of industry: Some industries are more prone to cyberattacks than others. Businesses that handle sensitive information such as those under financial services and healthcare are attractive targets for cybercriminals, raising the cost of coverage.

Revenue: If your business earns higher revenue, insurers tend to view it to be at a greater risk of being targeted by cybercriminals, increasing the price you need to pay.

Level of coverage: The higher your policy limits, the higher your premiums.

Cybersecurity measures in place: Insurers will often reward your business with cheaper rates if you allocate significant resources for preventing cyber incidents from happening.

Cyber insurance is increasingly becoming a crucial form of coverage, especially with digital transformation taking place at a rapid rate. You can check out what type of protection the top insurers in the country provide in our latest rankings of the top cyber insurance companies in the US.

Small business insurance cost – does cheaper really mean better?

Cost is an important consideration when it comes to choosing the right coverage, especially for many small businesses with limited financial resources. But as a small business owner, you should also pay attention to the quality of coverage less expensive plans provide. While a cheaper policy may fit your budget, it may not offer the level of coverage that your business requires.

If you’re searching for the right policies that suit your needs and financial situation, the best move is to strike a balance between small business insurance cost and the type of protection these policies provide. It is also advisable to consult an experienced insurance agent or broker who can help you make an informed decision as to what kinds of coverage to take out.

Business insurance plays a vital role in helping companies sustain operations when unexpected accidents and disasters occur. If you want to learn more about how this type of coverage can help you navigate challenging times, you can check out our comprehensive guide to business insurance.

Is small business insurance worth the cost? Do you think start-ups and small enterprises can survive without it? Feel free to share your thoughts below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!