How A1C Affects Life Insurance

When you’re shopping for life insurance coverage, the insurance company is going to look at dozens of different factors to determine how much they are going to charge you for coverage. One of the biggest factors is your overall health. If you have any pre-existing conditions, like diabetes, then you could encounter several problems when you’re trying to get affordable life insurance.

Diabetes is a rapidly growing health issue in the United States. According to the American Diabetes Association, nearly 26 million children and adults have diabetes and 79 million Americans have pre-diabetes. This disease is characterized by the body’s inability to produce insulin or not being able to use insulin effectively.

The result of having diabetes is high blood sugars, which has to be actively monitored and controlled by anyone who is a diabetic.

Diabetes does affect term life insurance rates, but how much it affects your premiums depends on your level of blood sugar control. Your A1C is probably the biggest factor in the life insurance premium of a diabetic – more than whether you are type 1 diabetic or type 2, whether you use oral medication or if you are insulin-dependent, or whether you were diagnosed with diabetes as a child or at age 50.

Life insurance is one of the most important investments that you’ll ever make for your loved ones. If something were to happen to you, your family could be left with a mountain of debt, which is going to make the whole situation a thousand times worse. We know that shopping for life insurance is never a fun experience, but we are here to help make it as quick and simple as possible for you. This agent is going to explore how your A1C levels will impact your life insurance rates, and we will also look at several ways that you can save money on your insurance plan.

What Is An A1C Test

The A1C test (also known as HbA1c or glycated hemoglobin) is what is used to test how well you are monitoring and controlling your blood sugar. It provides a picture of what your glucose levels have been over the previous three months. It specifically measures how much of your hemoglobin is coated with sugar.

If you are diabetic and shopping for life insurance, then be prepared to have your average blood sugar checked with an A1C test, so an insurance underwriter can evaluate your level of blood sugar control.

This test is helpful for a diabetic to see how well you are managing your glucose levels, but it’s also essential for insurance underwriters to get an idea of whether you have controlled or uncontrolled diabetes. The more controlled that your diabetes is, the less risk you are of having diabetes-related health complications, which means that you’re going to be less risk to the insurance company. The lower risk that you are, the less that they are going to charge you for insurance coverage. Each insurance company is going to have different A1C levels that they view as “healthy,” but all of them are going to view lower levels more favorably.

Controlled vs. Uncontrolled Diabetes

The higher your A1C, the higher your blood sugar levels have been, which puts you into the category of uncontrolled diabetes. This triggers an alarm to insurance underwriters whose job is to weed out risky applicants.

Statistics show that diabetics with uncontrolled blood sugar levels are 2 to 4 times more likely to have heart disease, stroke, as well as complications with various organs, vision issues, and neuropathy. Diabetes is also the leading cause of kidney failure,accounting for 44% of all new cases.

On the flip side, if your blood sugar levels are controlled, an insurance underwriter can determine that your long-term health outlook is better.

The Lower Your A1C, The Better

A low A1C indicates that your diabetes is controlled. This is a big factor for insurance underwriters to examine because of the long term effects of glucose levels on a person’s overall health. Your a1c is one of the biggest factors that determine which health class you fall under and what rate you will pay.

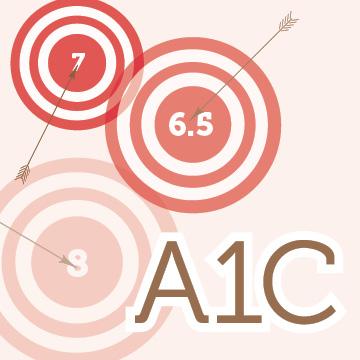

Overall, a life insurance company defines a “normal” A1C as 6.0 and less. This would be considered an A1C of a non-diabetic person. Anything over 6.0 and the higher likelihood that the premium for your policy will increase.

Generally speaking, an A1C of lower than 7.0 is considered good control by many insurance carriers. If everything else looks good, meaning there are no other health issues, then standard rates or better may be possible.

If your A1C is between 7.0 to 8.0 then your diabetes is considered to be under average control, and you can still get coverage at a reasonable rate.

Can I Improve My A1C To Prepare For A Life Insurance Application?

Because A1C levels have such a big effect on the life insurance premium of a diabetic, it is wise to have the lowest number possible. But since the A1C measures your blood sugar levels over an average of 3 months, there is no overnight fix.

The best you can do is begin to incorporate healthier eating habits as well as diet and exercise into your life. If you are planning on applying for life insurance and you can make positive changes to your diet, increase your level of activity, as well as manage your blood sugar levels through accurate insulin therapy or medication, then you should try that for 90 days. You will have a better A1C, and quite possibly a better rate.

If you’re want to save money on your life insurance application, then improving your health through a diet and exercise is a great way to do that. Making a few simple lifestyle changes could save you hundreds of dollars on your insurance policy.

Aside from improving your A1C levels, a diet and exercise are also going to help improve your overall health by helping you lose weight, lower your cholesterol, lower your blood pressure, and reduce your risk of being diagnosed with other health complications. It’s easy to see why skipping the junk food and hitting the gym can save you hundreds of dollars on your insurance every year.

Other Way To Lower Your Insurance Premiums

Improving your A1C levels is not the only way that you can save money on your life insurance policy. There are several other ways that you can secure better premium rates, which means more money in your pockets. Making a few simple changes could save you thousands of dollars on your life insurance coverage.

The first thing that you should do is eliminate any tobacco that you currently use. If you’re listed as a smoker on your application, you can expect to pay much higher premiums for your insurance coverage. In fact, smokers are going to pay around twice as much versus what a non-smoker is going to pay for the same sized plan. If you want to save money on life insurance as a person with diabetes, you’ll need to kick those cigarettes to the curb once and for all.

The best way to ensure that you’re getting the most affordable insurance plan is to compare dozens of quotes before you decide which plan is the best for you. Every insurance company is different, which means that you’ll get drastically differing rates depending on which company that you get the quote from. As an applicant with diabetes, you could get drastically different rates, and finding the right company could be the difference in getting an affordable policy or getting a plan that breaks your bank every month.

Instead of wasting your time calling dozens of companies yourself, let an independent insurance agent do all of the hard work for you. One of these independent agents can save you both time and money on your life insurance search.

Declined for Coverage?

There is a chance your A1C levels will cause you to be declined for life insurance. If you have been rejected in the past, don’t assume you can’t get insurance protection. One option for life insurance is to buy a guaranteed issue policy.

These plans are a unique type of coverage which doesn’t require a medical exam or any health questions. Regardless of your health or any pre-existing conditions you have, it’s possible to get approved for these plans. All you have to do is answer a few basic health question, like your age, how much coverage you want, and your gender. After you’ve answer those questions, you have life insurance. It’s as simple as that.

Just like other kinds of plans, there are some pros and cons you should consider before buying one these policies. Getting life insurance without the medical exam or health questions might seem like a perfect option, but there are several pitfalls.

One of the most notable is these policies are going to cost much more. Without the health exam or the medical questions, the insurance company is taking a greater risk to give you coverage. They offset the risk by charging you higher premiums. If you want to save money on your life insurance as an applicant with diabetes, you need to apply for a traditional policy.

Another drawback of these policies is the limit on how much coverage you can purchase. With a guaranteed issue policy, you can only get approved for around $25,000 worth of protection. For most families, this is not nearly enough insurance. Not having enough life insurance is the worst mistake you could make for your loved ones.

One of the benefits of these policies is you can be approved for life insurance much faster compared to what it would take with a traditional policy. With a guaranteed issue policy, you can get life insurance in a matter of minutes. If you apply for a traditional policy, you can wait up to a month and a half to get life insurance.

We suggest you use a guaranteed issue plan as a last resort. As long as you can be approved for a traditional policy, you should avoid one of these plans. Traditional policies give you more insurance protection at a lower cost. If you’ve ever been declined for life insurance in the past, don’t assume your family has to go without coverage. Maybe you apply with the wrong company or you applied for the wrong type of coverage. Regardless, we can connect you with the best choice.

Compare Rates Today To Find The Best Policy For Your Needs

It’s very important to work with an experienced independent agent to help you find the best life insurance with diabetes. This is because an independent agent has access and relationships with dozens of companies and can present his or her client’s case to see which company will offer the best rate. In many cases, an experienced agent can help you save over 50% on your premiums.

If you have any questions about a1c and life insurance, call 877-801-4402 to speak with an experienced independent agent. You can also get started on comparing rates by using our quote engine to sift through the hundreds of life insurance programs so you can find the most competitive rates available.

Our agents have years and years of experience working with all types of clients across the country. We know which companies are going to give you the best insurance rates. We can walk you through the insurance process and help you get the coverage your family needs at the lowest possible rates.

You never know what’s going to happen tomorrow, which means that you shouldn’t wait any longer to get the insurance coverage that your family deserves. If something tragic were to happen to you, and you didn’t have life insurance, your family would be responsible for a massive amount of debt and other final expenses. Nobody wants to think about his or her own death, but not planning for your passing is one of the worst things that you can do for your family.