Helping SMBs and Employees Thrive With Group and Voluntary Innovations

Published on

July 13, 2023

Sheila and Marcus own a public relations and marketing business with 54 employees. They want to foster a brand that seems “hip,” even if that means hiring some great people who may not stick around long. From the start of their business, they have created an environment where benefits play a crucial role. Periodically they ask themselves, “Does it pay to bring on new products and services or do these largely go unused? How can we know that our benefits are fairly priced? Do our employees get good service from our chosen providers?”

Justin is a senior executive in the company. He has a wide range of responsibilities for the business, including operations, payroll, HR, and benefits management. With his multiple roles, he is stretched thin, but he has noticed recently that new employees complain about student loans and struggle with life-work balance. He wonders if new types of benefits and services might help them and improve their work satisfaction. He also wonders if new benefit options could help them attract gig workers.

Megan is a recent graduate, just hired as an associate account representative. She is new to the working world, and she doesn’t understand benefits yet. What she does understand, she found using YouTube tutorials, not the company’s benefits guide. In her first week, as she’s trying to also learn her job, she is drowning in a sea of insurance terms and options. She makes some elections based on a friend’s recommendation and she determines that she’ll try to learn more next year. The most frustrating part of the process is that enrolling doesn’t just happen on one system. She must call some voluntary benefits providers, such as her pet insurance, and walk through their steps separately.

To understand today’s Group & Voluntary market opportunities, it’s helpful to look through the eyes of all three of these business types — owners, execs, and employees. In Majesco’s SMB thought leadership report, Resiliency in Times of Change: Rethinking Insurance to Help SMBs Thrive, we look at SMB priorities, changing demographics, and insurance challenges that are impacting the industry at large. By looking at SMB and employee pressures and priorities, we can also determine where technology investments are best applied in order to create resiliency and profitability.

Putting the digital foot forward.

As Millennials and Gen Z SMBs continue to grow in owning businesses, they will increasingly challenge insurers because they view and value things differently than the older generation. But more importantly, they are highly digital in how they do business. They expect and demand digital capabilities for their business management and employee benefits.

They want services, coverage, and interactions that are available to them whenever they want them, and however they wish to engage. Adding value to traditional products and creating new ones will be crucial to meet the unique needs of this generation of SMBs.

Any company interested in recruiting high-quality talent will also be faced with making their environment fit the lives and lifestyles of their employees. New employees especially will be envisioning how their work will support their life. Service must be simple and personalized. Products must be clear. The value must be obvious.

Which group & voluntary products do SMBs currently offer, if they offer anything at all?

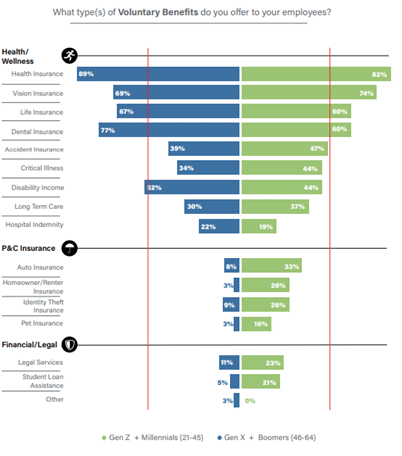

Majesco’s survey found that less than half of Gen Z and Millennial (38%) and Gen X and Boomer (43%) SMB owners offer voluntary benefits — a low number given the fight for talent. Among those who do, traditional benefits of health, vision, life, disability income, and dental are the top products offered, ranging from 52% to 89% seen in Figure 1. Accident insurance, critical illness, and long-term care create a second tier ranging between 30% and 38%.

After these two tiers, all other benefits drop off precipitously in the Gen X and Boomer segment but remain relatively strong in the Gen Z and Millennial segment. In particular, P&C insurance options, legal services, and student loan assistance all are relatively new voluntary benefit options. These results highlight that Gen Z and Millennial SMB owners appear to be more in tune with the changing needs and expectations of today’s employees – especially the younger generation – and the value of offering newer and innovative benefit options to attract and keep employees. This highlights growth opportunities for insurers who can offer benefits that meet a more diverse employee base with changing needs and expectations.

Figure 1: Voluntary benefits offered

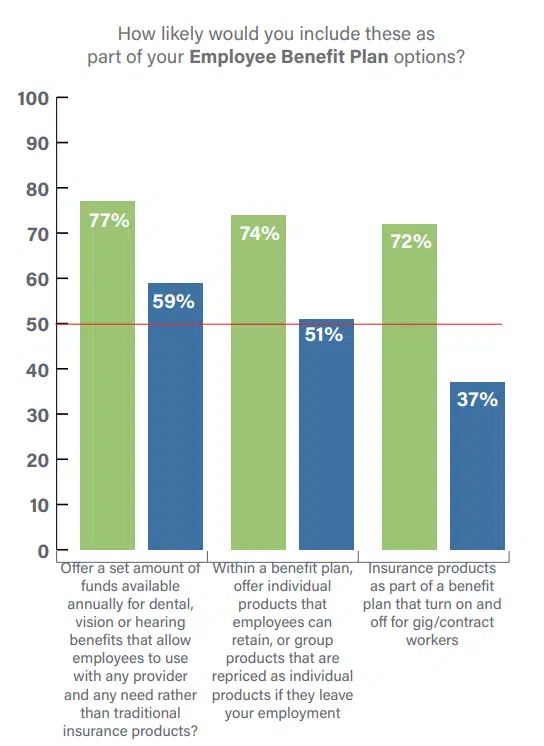

When we asked SMB owners about dental, vision, and hearing benefits and the desire for flexibility and simplicity, there was a strong interest with both generations at 77% and 59%, as seen in Figure 2. This concept would provide employees the greater latitude to spend a set pool of funds on whatever procedures and with whatever providers they choose, rather than being limited to a specific network or limited procedures covered.

Likewise, benefit products that are offered as individual/worksite products, or as group products that can be repriced and ported for employees to take with them if they leave employment are of high interest from Gen Z and Millennial SMBs (74%). They recognize their generation’s tendency to see employment as fluid. Their response is to seek benefits that will attract talent by fitting with a prospect’s vision of their future — instead of assuming that they will stay with the company long-term. And while interest is lower with Gen X and Boomer SMBs (51%), there is still strong market potential. Increasingly, employers and brokers are seeking benefit plans that offer a broader range of products that meet the changing needs of their diverse employee base – highlighting an opportunity for insurers to think beyond traditional benefit offerings.

Gen Z and Millennial SMBs are also interested in on-demand benefits that can be turned on and off with engagements as a Gig or contract worker. Given the strong use of this employee type, it is not surprising they would seek innovative benefit plans to attract this worker segment. While Gen X and Boomers are not as interested and use contract/gig workers less, their acceleration in the use of this employee segment over the last year could alter their views on offering on-demand benefits in the future.

Figure 2: Interest in offering new employee benefit plan options

Group and voluntary benefits are vital tools for attracting and retaining the talent that SMBs need, particularly given the low unemployment rates, fluidity of younger generations, and the growth in the Gig market. By helping to protect their financial security, employers are helping employees to remain more focused, motivated, and productive. It follows that any new or innovative offerings that enhance that protection would be growth opportunities for insurers to offer SMBs.

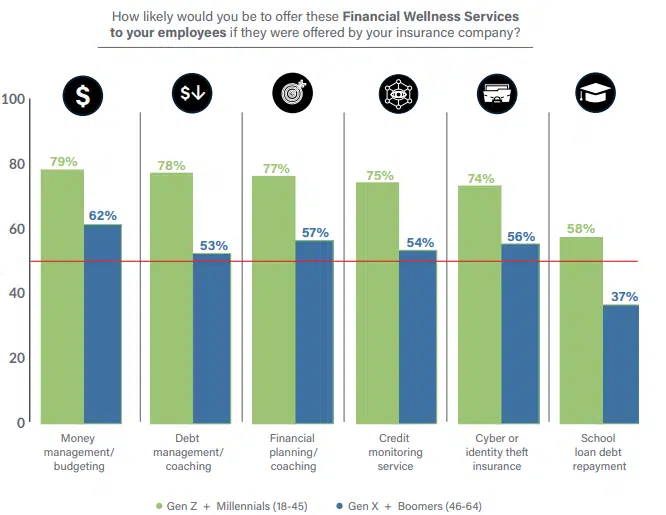

For SMB employees, financial wellness is a growing concern.Majescofound that while Gen X and Boomer SMBs exceed 50% interest in five of six potential financial wellness services offerings, Gen Z and Millennials show significantly higher interest, from 74% to 79%, as highlighted in Figure 3. In addition, Gen Z and Millennials show strong interest (58%) in offering student loan debt repayment assistance, an option that may be even more attractive after the June 30, 2023, Supreme Court decision regarding student loan forgiveness.

Personal experiences and views of retirement financial viability are likely influencing these gaps. Gen X and Boomers have accumulated more financial management abilities and confidence over time and have reached or are approaching Social Security eligibility. In contrast, the younger generation struggles to buy homes and has concerns about whether Social Security will be available when they retire. Insurers who can help employers address these issues have an opportunity to build trust and loyalty.

Figure 3: Interest in offering financial wellness services to employees

Data transformation pays off in improved pricing and increased sales

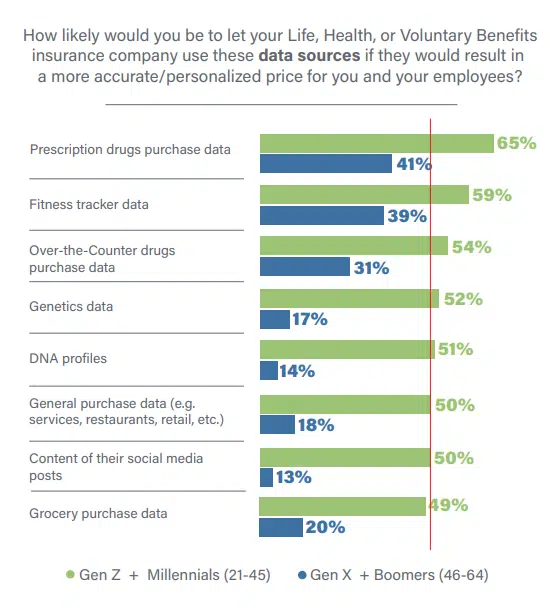

With inflation and finances/profitability the top two concerns facing all SMBs, it is vital for insurers to demonstrate transparency, fairness, and accuracy in their pricing. Using new, innovative data sources that can personalize the pricing can achieve this, provided SMBs are comfortable with data sharing. When marketed properly, insurers should see an increase in sales through clear and competitive pricing that provides its own justifications.

Gen X and Millennial SMBs are overwhelmingly interested in the use of new data sources for more accurate, personalized pricing as seen in Figure 4 — which given the interest in individual and portable products is key. Between 49% and 65% of Gen Z and Millennial SMBs are interested in their use for life, health, and voluntary benefits. In contrast, Gen X and Boomers are less comfortable overall, with prescription (41%) or over-the-counter (31%) drug purchase data and fitness tracker data (39%) representing the most interest. Interest in all other data sources drops dramatically, with a low of 13% for content from social media posts and 14% for DNA profiles.

Figure 4: Interest in new data sources for life/health insurance and voluntary benefits pricing

Once again, the large disparities in expectations between the generational segments require insurers to rethink their products, data sources, and pricing approaches to better meet the needs and demands of diverging expectations. Next-gen underwriting and policy systems will be required to effectively address these demands.

Value-added services show strong and growing appeal for SMB owners

A key strategy for insurers to address SMBs’ concerns about inflation, finances, and talent acquisition is to increase the value of the products they offer. To do so, insurers should bundle, or offer for a price, services that extend the value of the risk product/policy, such as earning points for wellness that can be used to buy things, annual financial planning assessments, roadside assistance, and more.

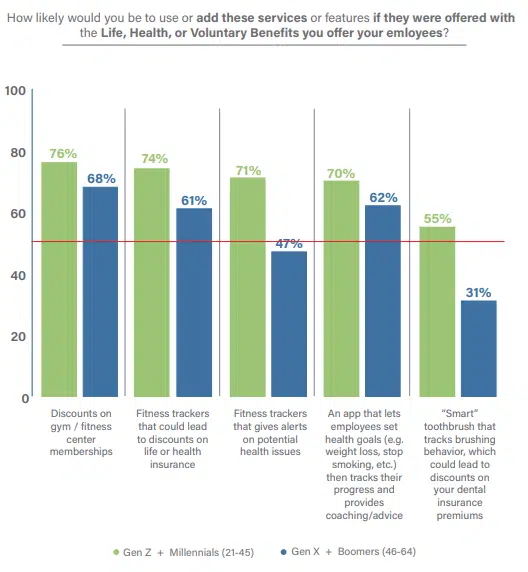

Both SMB generation segments are highly interested in value-added services as seen in Figure 5. Interestingly, 61% of Gen X and Boomers would be interested in offering employees fitness trackers that could lead to discounts on life or health insurance.

Figure 5: Interest in value-added services with life/health insurance and voluntary benefits

Preparing to expand into newer channels while giving great service through established channels.

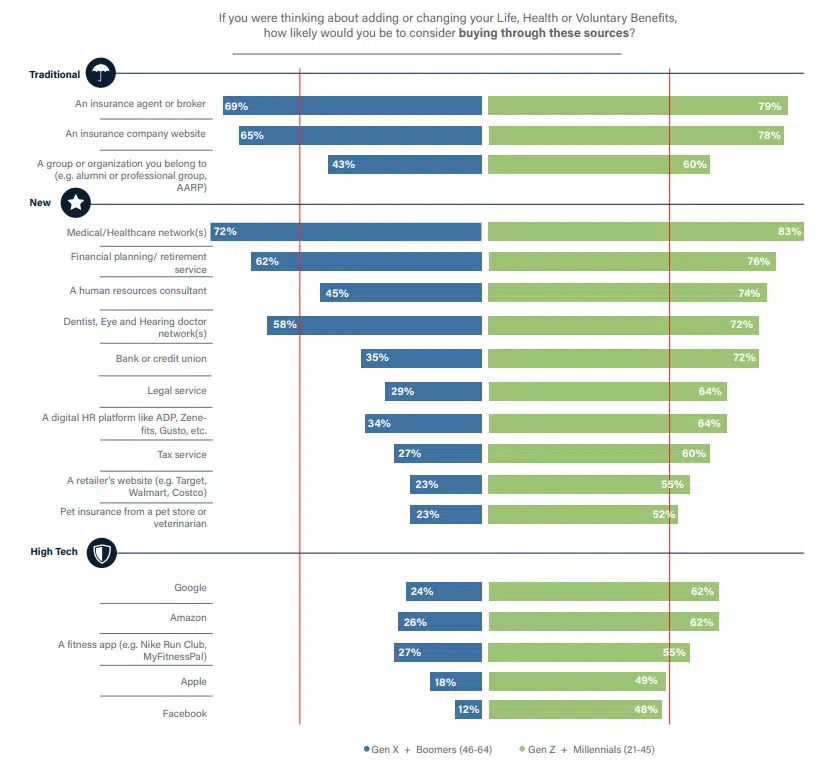

Traditional distribution channels for buying life, health, and voluntary benefits – insurance company websites and agents/brokers – continue to be among the most popular options in both generational segments, but they are eclipsed for the number one spot by medical/healthcare networks (83%, 72%) as seen in Figure 6. The next group with strong interest is financial planning/retirement service (76%, 62%) and dentist, eye, and hearing doctor networks (72%, 58%). Given the nature of SMBs being very localized, the interest in medical or healthcare networks within the community or state is not surprising and opens up new partnership options for insurers to consider.

After these five channels, Gen X and Boomer SMBs show significantly less interest in any of the other options. In contrast, Gen Z and Millennials are interested in all of the channel options, even two of the GAFA companies (Apple and Facebook) which are just under 50%. Some analysts are predicting Apple will enter the health insurance market in 2024, leveraging rich fitness and health data gathered from millions of Apple Watch users,[i] which will directly align with their desire for personalized insurance using data from fitness trackers.

Figure 6: Interest in channel options for life/health insurance and voluntary benefits

There is a hurdle, however, in nearly all of these cases. Soon, many products and services will be purchased and consumed through alternative, non-traditional channels. How are group & voluntary insurers going to prepare to sell and partner with organizations that can bring them additional business? How will they handle not only transaction data but the flow of personalized data back and forth from companies, beyond buying to serving and claims, through channels and into their current systems? How will they adapt their experience to those partners for a consistent one for buyers?

Can group & voluntary insurers prioritize updates to their data frameworks, as well as improve their digital service through cloud-based core systems? These are questions of immediate importance as SMBs quickly grow adept at locating and carrying innovative benefits and services.

The SMB market opportunity is growing larger each year. SMBs employ nearly 50% of all US employees. Is your organization ready for the new innovations in group & voluntary products and services? Let Majesco help you create an SMB-focused tech strategy that includes all of the features and capabilities your organization needs to innovate.

For more information about SMB group & voluntary trends or to find out more about SMB needs, be sure to read Resiliency in Times of Change: Rethinking Insurance to Help SMBs Thrive and then dig into detail specifically on current gaps in group & voluntary benefits with Bridging the Customer Expectation Gap: Group & Voluntary Benefits.

[i] Collins, Barry, “Apple Will Launch Health Insurance In 2024, Says Analyst,” Forbes, October 18, 2022, https://www.forbes.com/sites/barrycollins/2022/10/18/apple-will-launch-health-insurance–in-2o24-says-analyst/amp/