Workers compensation: What is it and how it works?

Workers compensation: What is it and how it works? | Insurance Business America

Guides

Workers compensation: What is it and how it works?

Workplace accidents can prove catastrophic to your business, that’s why workers compensation coverage is crucial. Find out how it protects your business

Almost all states in the US require businesses to take out workers’ compensation insurance and for good reason – accidents can happen at any workplace, even the ones with the necessary safety precautions in place. And while many of these incidents lead to minor injuries without a long-term impact on workers’ lives, some are catastrophic, which can prove costly to both the company and the injured employee.

These situations highlight the importance of having workers compensation coverage for any business that employs staff.

If you’re a business owner wanting to learn more about this form of coverage, then you’ve come to the right place. In this comprehensive workers’ compensation guide, Insurance Business will explain how this type of policy works, what it covers, who qualifies for coverage, how much premiums cost, and more. Insurance professionals can also share this piece with their clients to help them understand this crucial form of financial protection.

Workers’ compensation is a type of business insurance policy that pays out the cost of medical care and a portion of lost income of employees who become injured or ill while doing their jobs.

Employers are responsible for shouldering the entire cost of coverage and cannot require their staff to contribute to the premiums. In addition, workers’ compensation follows a no-fault system, meaning the amount of benefit an employee receives is not affected by their or the company’s negligence, although certain situations can void coverage.

Workers’ compensation insurance policies come with two main parts, according to the Insurance Information Institute (Triple-I). These are:

Part One: Workers’ Compensation

Unlike other types of insurance policies, workers’ compensation coverage does not have a capped amount, meaning the insurer is required to pay whatever amount is necessary to cover for injuries sustained in a workplace accident. In this part of a workers’ comp policy, the insurance company agrees to pay any state-required compensation amount.

Part Two: Employers’ Liability

This part of the policy protects a business financially against lawsuits filed by a worker for a job-related illness or injury that is not subject to state statutory benefits. Unlike in part one of the policy, employers’ liability has a monetary limit.

All states, except Texas, require businesses with a certain number of employees to purchase coverage. Each of these states has a Workers’ Compensation Board, which is tasked with processing claims. If necessary, the board also determines whether the benefits should be paid, as well as the amount payable. For every successful claim, employees can opt to receive structured weekly or bi-weekly cash benefits or a one-time payout from their employers’ insurers.

Workers’ compensation laws, however, vary by state. If you want to know how this form of coverage works in your state, you can click on the links in the table below. These will lead you to each state board’s workers’ comp page.

Workers’ compensation laws by state

The type and level of protection vary depending on the insurer, but generally workers’ compensation policies cover the following:

Hospital and medical expenses: Treatment costs for the sick or injured employee are mostly covered. These include hospital and doctor visits, surgeries, and prescription medication. Some policies also pay out for COVID-19-related medical bills, but coverage depends on the industry.

Lost income: If an employee needs to take time off work because of a job-related illness or injury, workers’ compensation will pay out a portion of their salaries to ensure that they have a means of income while recovering.

Ongoing care costs: Policies cover treatment expenses incurred if an employee requires extended medical care, including occupational, physical, and speech therapy, and other rehabilitation costs.

Legal expenses: In the event an employer gets sued, workers’ compensation protects them from the financial liability of paying for legal and settlement expenses out of pocket.

Disability benefit: If a job-related accident causes a worker to become disabled, they become eligible for full or partial disability benefits under the policy.

Death benefit: This covers funeral and burial expenses and provides financial support for the beneficiaries if an employee dies due to a workplace accident.

Not all injuries and illnesses that occur in the workplace, however, are covered by workers’ compensation insurance. Some of the incidents excluded from such policies include:

Injuries suffered while an employee is intoxicated or under the influence of prohibited substances

Intentional or self-inflicted injuries

Accidents that happen while an employee is on the way to or going home from work

Injuries sustained from recreational activities even if they occur in the job site

Food poisoning that happens while the employee is on lunch break as breaks are often not considered work-related

To qualify for workers’ compensation benefits, you must be an employee under a business and not an independent contractor. Being gainfully employed makes you eligible for medical treatment coverage and allows you to receive a portion of your salary after getting sick or injured while performing your job.

As mentioned, workers’ compensation operates a no-fault system, meaning that you don’t have to go the conventional tort route of proving negligence to access benefits. This system, however, also prevents you from filing charges against your employer for the injuries you suffer.

But there are also certain types of employees who do not qualify for workers’ compensation coverage. These include federal government employees as they are already covered under the Federal Employees’ Compensation Act (FECA). Here’s a list of the groups of workers covered by this legislation.

Civilians working in the executive, legislative, and judicial branches of the government

Federal jurors

Members of the Coast Guard Auxiliary and Civil Air Patrol

Peace Corps volunteers

State and local law enforcement officers acting in a federal capacity

Students in Reserve Officer Training Corps programs

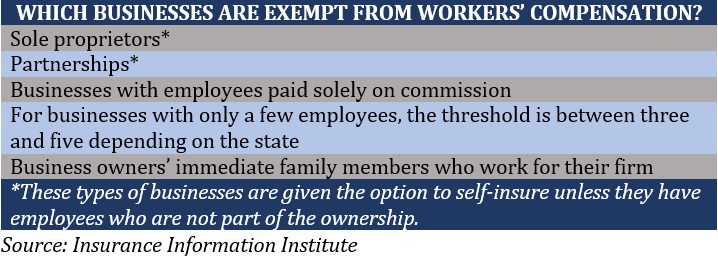

While most states require businesses to carry workers’ compensation coverage, there are certain exceptions. The table below lists down the types of businesses that are not required to take out coverage, according to Triple-I.

When it comes to independent contractors, the institute reminds businesses that while these workers are not legally considered as employees, workers’ compensation laws in many states treat contractors, subcontractors, and their employees as their own staff. This means that you can be held liable if they become injured or sick while working for you.

To avoid liability, Triple-I suggests that businesses require contractors to have workers’ compensation coverage before agreeing to work with them.

Just like in other types of insurance policies, premiums for workers’ compensation coverage are calculated using a range of risk factors, that’s why it is difficult to provide an accurate estimate. The cost of coverage for a small business, for example, can range from hundreds to a few thousand dollars, depending on different variables.

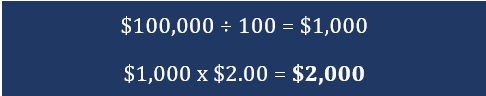

If you want to get an estimate of how much your business needs to pay in annual coverage, you can do so using this formula:

For workers’ compensation rates, these are set by your state’s rating agency using these four main variables:

Job classification codes, also known as class codes, which indicates the riskiness the work your business does

Location, which is where your workers perform their jobs and not necessarily where your business is based

Total payroll

Experience modifiers, which is a record of your previous workers’ compensation claims

Using the formula above, annual premiums for a business with yearly payroll of $100,000 and workers’ compensation rate of $2.00 will be calculated like this:

The company’s estimated annual premiums for workers’ compensation coverage cost $2,000. You can learn more about the math behind workers’ compensation premiums in this guide on how workers’ comp is calculated.

The amount of compensation employees will receive for a job-related illness or injury depends on a range of factors. These include:

The type of illness or injury

The severity of the illness or injury suffered

The type of treatment required

The employee’s salary

Workers can opt to get the payouts either as structured weekly or bi-weekly payments or as a lump sum. If an employee chooses a one-time payout, they are also essentially waiving their right to reopen the claim in the future. This means you are no longer responsible for shouldering the medical expenses if their illness or injury worsens. This is why many employees opt for structured payments, especially if they are not certain of the long-term effects of the injuries on their future lives.

Determining the exact cost of a workers’ compensation claim can be tricky, that’s why workers’ compensation settlement charts were created. If you want to understand how this tool can help you determine how much compensation an injured worker should receive, you can check out our workers comp settlement chart guide.

Every state has its own rules on the type of compensation sick and injured workers are entitled to. In general, businesses should ensure that the settlement amount is enough to cover the following:

Previous and future medical expenses incurred due to the work-related injury or illness

Past and future loss of income because of a job-related illness or injury

If you’re curious about how much the most expensive workers’ compensation settlement payouts in the country cost, you can check out our latest rankings of the highest workers comp settlements in the US.

Our Best in Insurance Special Reports page is the place to go if you’re looking for the top insurers in the US providing high-quality workers’ compensation coverage. The insurance companies featured in our special reports were chosen by their peers and vetted by our panel of experts as respected and reliable market leaders.

Recently, Insurance Business unveiled our five-star awardees for this year’s Top Workers’ Compensation Insurance Companies. To come up with the list, our research team conducted several one-on-one interviews and surveyed hundreds of workers’ compensation specialists to get their perspective on what makes a workers’ comp insurance policy the right fit for their clients. You can check out the full report, along with this year’s complete line-up of awardees by clicking the link above.

Do you think workers’ compensation is an essential form of coverage for all businesses? Do you have experience in dealing with an employees’ workers comp claim that you want to share? Feel free to share your story below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!