How much do insurance adjusters make?

How much do insurance adjusters make? | Insurance Business America

Guides

How much do insurance adjusters make?

These industry professionals play an important role in claims-processing, but how much do insurance adjusters make? Read on and find out

An insurance adjuster, also known as a claims adjuster, is considered among the highest-paying careers in the industry, which is one of the top reasons why many aspiring insurance professionals dream of becoming one. But how much do insurance adjusters make? Does entry to the profession follow a smooth-sailing path? What factors impact how much claims adjusters earn?

These are just some of the questions Insurance Business will answer in this guide. If you’re still working out whether being an insurance adjuster is a worthwhile career or you’re an industry veteran wanting to compare how much you make with others in the profession, you’ve come to the right place. Read on and find out everything you need to know about an insurance adjuster’s earning potential in this article.

Insurance adjusters earn a mean annual salary of $73,380 or an hourly rate of $35.28, according to the latest data from the Bureau of Labor Statistics (BLS). While entry-level salaries can be significantly lower than this figure, industry veterans with an established reputation and professional network can earn a six-figure salary.

In coming up with the national average, the BLS factored in all types of insurance adjusters, including specialists that handle property, casualty, life, health, and other forms of claims for an employment estimate of 285,270. The table below reveals the percentile wage estimates for “claims adjusters, examiners, and investigators” based on the bureau’s latest Occupational Employment and Wage Statistics (OEWS).

How much do insurance adjusters make – salary estimate from lowest to highest

PERCENTILE WAGE ESTIMATES (INSURANCE ADJUSTERS)

Percentile

Annual wage

Hourly wage

10%

$46,040

$22.14

25%

$57,050

$27.43

50% (Median)

$72,230

$34.73

75%

$85,250

$40.99

90%

$102,630

$49.34

As you may have noticed from the figures above, there’s a huge difference between the earnings of those in the bottom and top percentiles. This is because how much insurance adjusters make is influenced by a range of variables. These are the biggest factors that impact a claims adjuster’s earning potential.

1. Type of adjuster

There are three main types of insurance adjusters, all of whom follow slightly different payment structures, which impact how much they earn. We will discuss how these roles differ in more detail later, but generally this is how they get paid.

Staff insurance adjusters: These are salaried employees who work for a single insurance carrier. They earn between $40,000 and $70,000 and have access to employee benefits such as health insurance and paid leaves.

Independent insurance adjusters: These professionals work as independent contractors for adjusting firms and can handle claims from different insurers at the same time. They can earn significantly more than staff adjusters, with potential earnings that can reach six-figures, depending on how hard they work. However, they don’t have access to the same employee benefits.

Public insurance adjusters: These are self-employed professionals who policyholders hire if they believe that they have received an incorrect or unfair settlement from their insurers. Public adjusters are paid a portion of the settlement fee, usually ranging from 5% to 20%.

2. Type of policy

How much insurance adjusters make is also affected by the type of claims they are handling. Using the BLS’ OEWS Query System, Insurance Business has found that adjusters handling life, health, and other medical claims are paid an average of $59,500 or about 23% less than those dealing with other types of insurance claims – including auto, home, and commercial – estimated at around $76,980.

3. Location

Where an insurance adjuster practices also dictates how much they can earn. Some areas, for example, are more prone to natural disasters and adjusters can be in high demand in these locations, especially after a calamity. Cost of living, public safety, and accident rates can likewise impact a claims adjuster’s earning potential.

Insurance Business also used the OEWS tool to find out how much insurance adjusters make in the following:

10 highest-paying states for insurance adjusters

10 lowest-paying states for insurance adjusters

10 highest-paying metro areas for insurance adjusters

10 lowest-paying metro areas for insurance adjusters

10 highest-paying non-metro areas for insurance adjusters

10 lowest-paying non-metro areas for insurance adjusters

You can check out the rankings in the tables below.

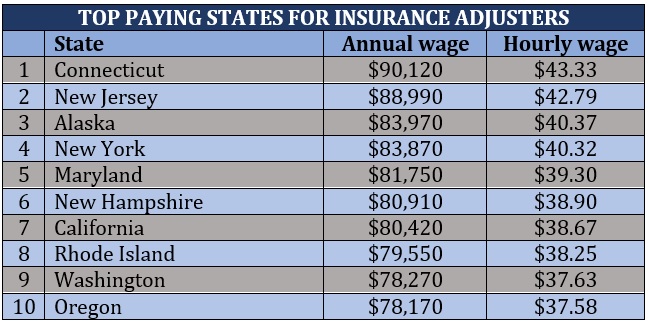

10 highest- and lowest-paying states for insurance adjusters

Insurance adjusters in the 10 states listed in the first table earn the highest salaries, while those working in the states in the next table have the lowest average annual pay.

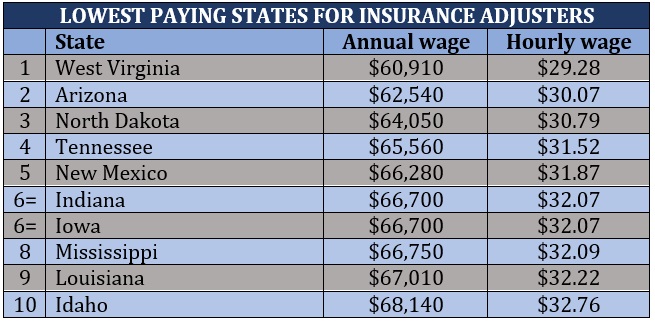

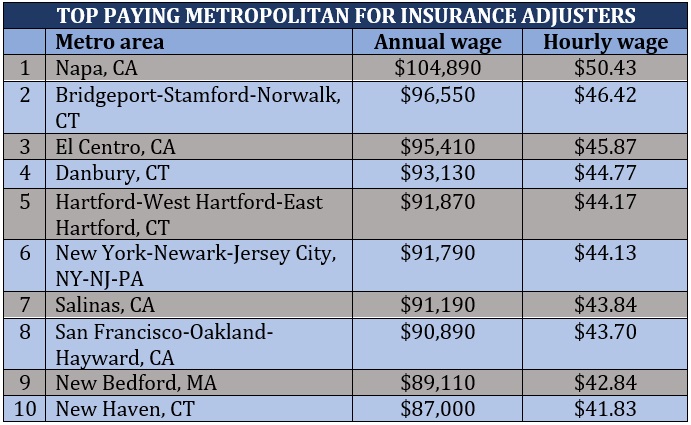

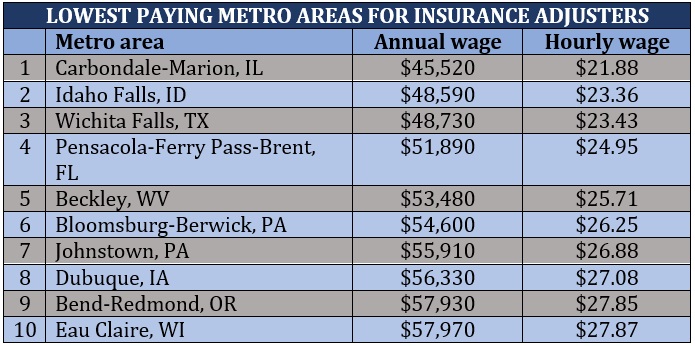

10 highest- and lowest-paying metro areas for insurance adjusters

These metropolitan areas pay claims adjusters the most and the least. Check out the figures below to find out how much insurance adjusters are paid in these areas.

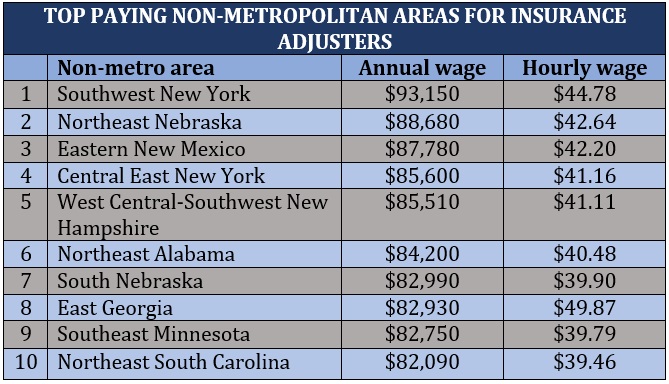

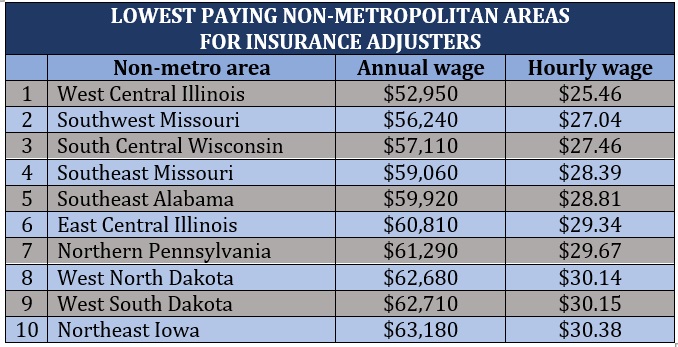

10 highest- and lowest-paying non-metro areas for insurance adjusters

If you’re wondering how much insurance adjusters make outside the big cities, the tables below reveal the estimated median salaries in the highest and lowest-paying non-metropolitan areas.

If you’re planning to pursue a career as an insurance adjuster or you want to move to a different role within the profession, you have several options. This employment website ranks the highest-paying insurance adjuster roles. Here are the top 10.

Top 10 highest-paying insurance adjuster jobs

TOP-PAYING INSURANCE ADJUSTER JOBS

Rank

Job/Role

Annual salary range

What they do

1

Auto damage estimator

$50,000 to $114,000

Inspect vehicle damage after an accident to determine what repairs are needed

2

General adjuster

$96,500 to $100,000

Assesses incidents to determine an insurance company’s financial liability

3

Independent insurance adjuster

$74,000 to $92,000

Usually employed by independent adjusting firms, they are contracted to handle claims from several insurers

4

Casualty claims adjuster

$80,000 to $88,500

Evaluates and settles claims related to property damage, injuries, or other losses, excluding life/health insurance claims.

5

Field adjuster

$72,500 to $86,500

Travels to the place of a claim to assess the damage, as opposed to a desk adjuster

6

Property field adjuster

$65,500 to $85,000

A field adjuster that specializes in property claims

7

Bodily injury adjuster

$66,500 to $81,000

Handles claims that have resulted in physical injury

8

Property claims adjuster

$52,500 to $78,500

Inspect and assess damage to property, including those in residential and commercial buildings

9

Material damage appraiser

$43,000 to $61,000

Evaluates and settles insurance claims by assigning appropriate values to damaged items

10

Auto damage trainee

$48,000 to $54,000

Trained to specialize in auto body damage, determine a repair estimate, and process insurance claims

An insurance adjuster is just one of the several careers in the industry that has a high earning potential. You can check out our latest rankings of the highest-paying insurance careers by clicking the link.

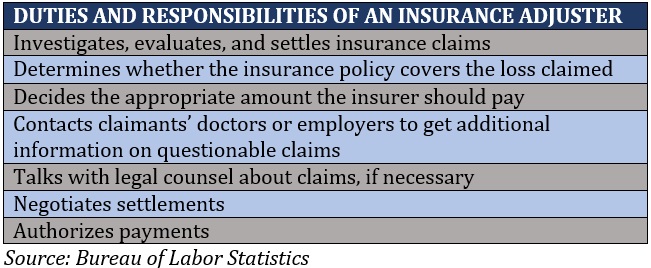

Insurance adjusters are industry professionals responsible for assessing and investigating claims to determine how much or if an insurance company should pay for the losses and damages. The table below lists down the main duties and responsibilities of a claims adjuster, according to the BLS’ website.

A claims adjuster should also ensure that the claims made are not fraudulent. If you want to know the lengths at which some people go to commit such crimes, you can check out our latest rankings of the worst insurance fraud cases of all-time.

As mentioned earlier, there are three main types of insurance adjusters. These are:

Staff adjusters: Handle claims for a single insurance company, similar to how captive insurance agents operate. If you’re curious to know how much insurance agents make, feel free to click the link.

Independent adjusters: Work for independent adjusting firms and are contracted to handle claims for different insurers often at the same time.

Public adjusters: Who policyholders turn to when they feel that their claims are unfairly and incorrectly assessed.

However, there are also several sub-categories under these classes, including:

Desk adjusters vs. field adjusters

Desk adjusters, also known as inside adjusters, work in offices. They handle claims using their computers by information, including images, send to them by policyholders. Field adjusters, meanwhile, go to the center of the action. They travel to where the damage occurred, interview people there, take pictures, and assess the damage firsthand.

Catastrophe adjusters vs. daily claims adjusters

Catastrophe adjusters, also called CAT adjusters, are tasked to handle large-scale calamities, and are often deployed to disaster zones to work on the claims. Given that these professionals work extremely long hours, with each assignment lasting weeks to even months, and face brutal conditions, they are also among the highest-paid adjusters.

Daily claims adjusters, on the other hand, handle claims resulting from losses that can happen in our everyday lives, including clogged toilets, grease fires, and burglary.

Where can you find the best insurance adjuster jobs?

Insurance jobs will always be in demand as long as people need financial protection – and insurance adjusters will be among the most sought-after professionals, especially with the important role they play in the settlement of claims.

A quick online search for insurance adjuster vacancies can yield hundreds, if not thousands, of job results. This can be overwhelming and tedious to sort through. To make the job-hunting process easier for you, we have listed down the best insurance websites to search for insurance jobs. Click on the link and jumpstart your insurance career today!

Do you think being an insurance adjuster is a career worth pursuing? Does how much insurance adjusters make play a role in that? Share your thoughts in the comments box below.

Keep up with the latest news and events

Join our mailing list, it’s free!