Which Of The Following Best Describes Term Life Insurance Brainly at Best – Contra Costa Times

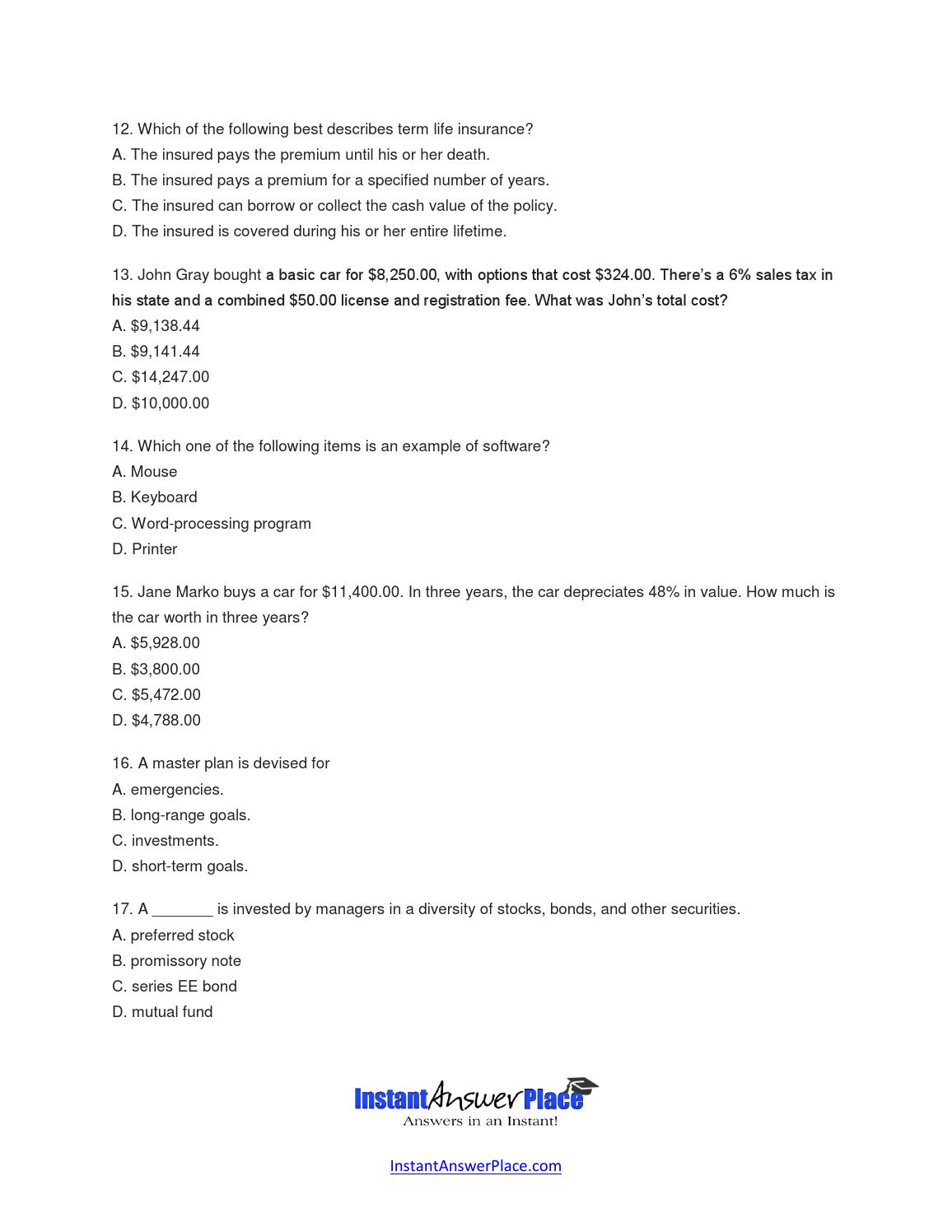

Which Of The Following Best Describes Term Life Insurance Brainly. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. A) the insured pays a premium for a specified number of years.

What Is Life Insurance, And Why Is It Important? Which Of from www.financepoor.com

O medicare is a private health insurance plan that is only available to only healthy people over 65. (d) if a policyowner lets her whole life policy lapse, the beneficiary will be entitled to part of the policy’s cash value. The insured can borrow or collect the cash value of the policy

What Is Life Insurance, And Why Is It Important? Which Of

Which of the following best describes term life insurance? The insured is covered during his or her entire lifetime. Which of the following best describes term life insurance? Last year, the couple got divorced.

Source: sunnyweb.org

O medicare is a private health insurance plan that is only available to only healthy people over 65. A) the insured pays a premium for a specified number of years. The insured is covered during his or her entire lifetime. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. It is an insurance policy.

Source: sirajhandley.blogspot.com

O medicare is a private health insurance plan that is only available to only healthy people over 65. Which of the following best describes term life insurance? The insured pays the premium until his or her death. Are you thinking about purchasing life insurance, but aren’t sure where to start? (b) when a whole life insurance policy is active, the.

Source: beyondthebeltwayinsights.com

The insured pays a premium for a specified number of years. One of the more commonly asked questions we get here at low cost life insurance is “which of the following best describes term life insurance?” the insured is covered during his or her entire lifetime. The insured pays the premium until his or her death. Which of the following.

Source: defenddemocracycoalition.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Simplified issue simplified issue life insurance policies do not require the proposed insured to undergo a medical examination. A) neither the premium nor the death benefit is affected by the insured’s age. Which of the following best describes term life insurance? More budget for health.

Source: defenddemocracycoalition.com

(b) when a whole life insurance policy is active, the owner can borrow from the cash value. Which of the following best describes a life insurance policy in which the proposed insured is not required to undergo a medical examination? Of the following terms, which best describes the act of replacing existing life insurance with a new life insurance policy.

Source: sirajhandley.blogspot.com

More budget for health problems, increases supply of medicinesd. The insured can borrow or collect the cash value of the policy. Best describes term life insurance: Choose the brainliest answer to your question and receive 25% of the total points you assigned to your question. The insured pays a premium for a specified number of years.

Source: www.financepoor.com

Are you thinking about purchasing life insurance, but aren’t sure where to start? More budget for health problems, increases supply of medicinesd. The insured pays the premium until his or her death. The insured pays a premium for a specified number of years. Which of the following best describes annually renewable term insurance?

Source: sirajhandley.blogspot.com

Requires group health plans and health insurance issuers to offer supplemental insurance to consumers who need mental health or substance use disorder benefits b. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. C) it is level term insurance. The insured pays the premium until his or her death. The insured pays a premium.

Source: sunnyweb.org

A) the insured pays a premium for a specified number of years. The insured is covered during his or her entire lifetime. The insured is covered during his or her entire lifetime. Which of the following best describes term life insurance? (d) if a policyowner lets her whole life policy lapse, the beneficiary will be entitled to part of the.

Source: greatoutdoorsabq.com

Last year, the couple got divorced. C) it is level term insurance. Which of the following best describes term life insurance? Which of the following is true regarding the beneficiary designation of the former spouse. “the insured pays a premium for a specified number of years.” the best description of term life insurance is that “b.

Source: sirajhandley.blogspot.com

Why unions became successful during the great depression? A) neither the premium nor the death benefit is affected by the insured’s age. The insured pays a premium for a specified number of years. Which of the following best describes term life insurance? The insured can borrow or collect the cash value of the policy.

Source: greatoutdoorsabq.com

Wagner act employers were required to bargain in good faith; Choose the brainliest answer to your question and receive 25% of the total points you assigned to your question. The insured can borrow or collect the cash value of the policy. Are you thinking about purchasing life insurance, but aren’t sure where to start? The insured can borrow or collect.

Source: superclubpenguinbr.blogspot.com

Which of the following best describes term life insurance? (b) when a whole life insurance policy is active, the owner can borrow from the cash value. Which of the following best describes annually renewable term insurance? The insured pays a premium for a specified number of years. O medicare is a private health insurance plan that is only available to.

Source: superclubpenguinbr.blogspot.com

It is an insurance policy where the insured pays a. Which of the following best describes health insurance brainly. The insured pays the premium until his or her death. Wagner act employers were required to bargain in good faith; C) it is level term insurance.

Source: www.towinners.com

Which of the following best describes term life insurance? The insured pays the premium until his or her death. Which of the following best describes term life insurance? The insured pays the premium until his or her death. If your answer is chosen as the brainliest one, you receive an additional 50% of the points offered for this question.

Source: www.financepoor.com

The insured can borrow or collect the cash value of the policy The insured can borrow or collect the cash value of the policy. A) the insured pays a premium for a specified number of years. (d) if a policyowner lets her whole life policy lapse, the beneficiary will be entitled to part of the policy’s cash value. Which of.

Source: globalisationanddevelopment.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Choose the brainliest answer to your question and receive 25% of the total points you assigned to your question. The insured can borrow or collect the cash value of the policy. The insured pays the premium until his or her death. B) it provides an.

Source: sirajhandley.blogspot.com

The insured pays the premium until his or her death. The insured can borrow or collect the cash value of the policy. Last year, the couple got divorced. The insured is covered during his or her entire lifetime Which of the following best describes a life insurance policy in which the proposed insured is not required to undergo a medical.

Source: sunnyweb.org

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. The insured pays a premium for a specified number of years.”. The insured pays a premium for a specified number of years. More budget for health problems, increases supply of medicinesd. The insured pays the premium until his or her death.

Source: sunnyweb.org

Last year, the couple got divorced. Why unions became successful during the great depression? Which of the following best describes term life insurance? Which of the following best describes annually renewable term insurance? B) it provides an annually increasing death benefit.