CBO projections of US health insurance coverage: 2023-2033

A paper by Hanson et al. (2023) summarizes the Congressional Budget Office’s projections around US health insurance coverage between 2023-2033. They find that low rates of uninsurance due to provisions enacted to combat COVID-19 will not be sustained as these provisions expire:

Temporary policies enacted in response to the COVID-19 pandemic have increased Medicaid and nongroup coverage and decreased the number of uninsured people. The CBO estimates, as a result of those increases in overall enrollment, which continue into 2023, that the uninsurance rate will reach a record low of 8.3 percent this year. In 2033, after the temporary policies have expired, enrollment in the coverage categories most affected by the temporary policies will be lower, and the uninsurance rate will increase to 10.1 percent

Note that this 10.1% rate–while higher than the current level of uninsurance–is still below the 2019 uninsured level of 12%.

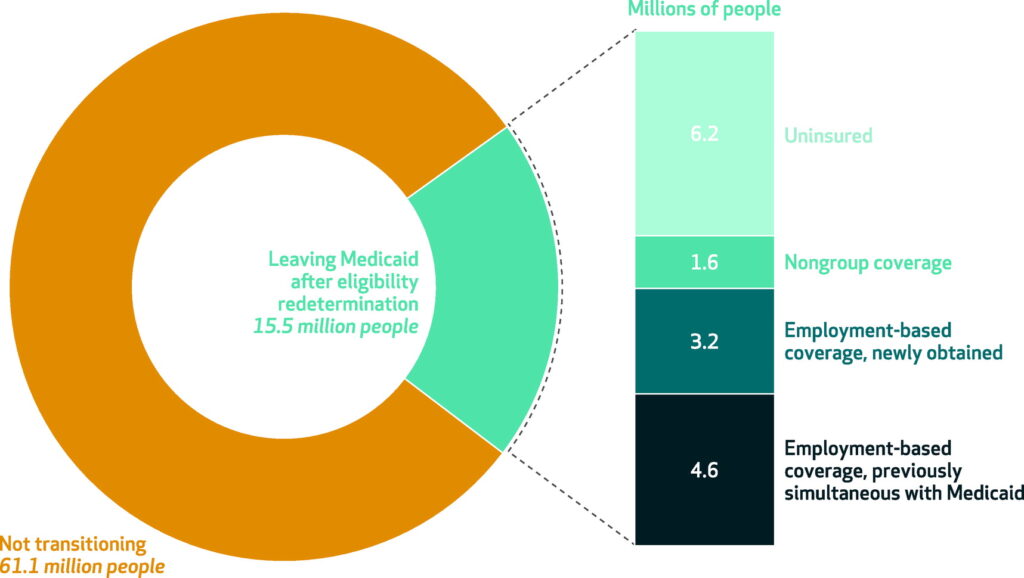

Of the 76.6 million people enrolled in Medicaid at the start of 2023, about 80% will remain on Medicaid, 12% will transition to private (employer or non-group coverage) and 8% will become uninsured.

Initial transitions in coverage in the 18 months beginning in April 2023, after the end of Medicaid continuous eligibility provisions

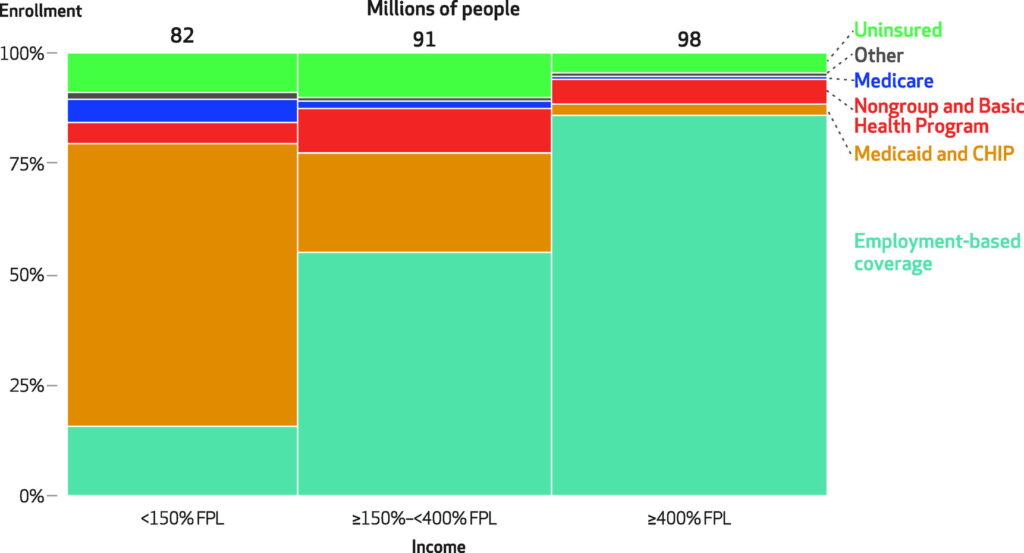

The article also provides a more detailed overview of health insurance coverage in the US. While most all individuals aged 65 and above are covered by Medicare, the type of insurance individuals below 65 receive varies dramatically depending on income. Lower-income individuals are more likely to be on Medicaid; higher-income individuals are more likely to be on employer-sponsored insurance plans.

Health insurance coverage for people <65 years, by type of coverage and income, 2023

CBO also expect private health insurance premiums to rise.

The CBO projects that private health insurers’ spending on per enrollee private health insurance premiums, which reflect paid claims and administration, will grow by 6.5 percent in 2023, an average of 5.9 percent during the 2024–25 period, an average of 5.7 percent during the 2026–27 period, and an average of 4.6 percent during the 2028–33 period…The higher short-term growth rates partly reflect a bouncing back of medical spending from the suppressed levels of utilization during the initial months of the COVID-19 pandemic in 2020.

For more details, you can read the full article here.