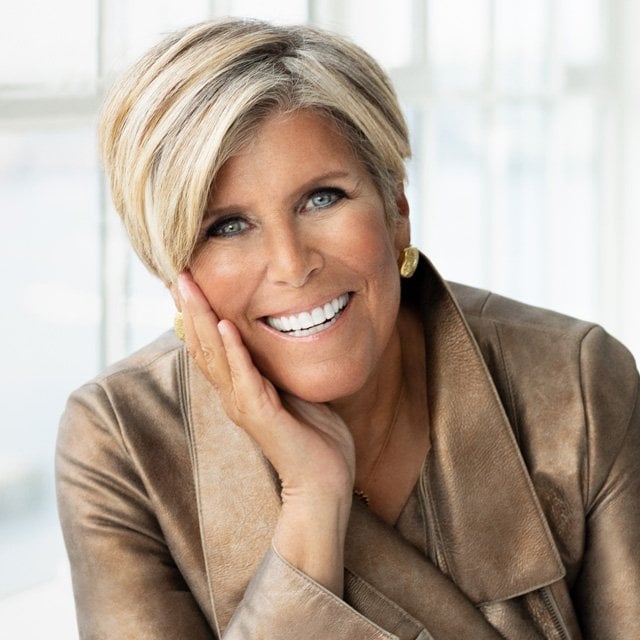

Suze Orman: 'People Are So Scared Right Now'

In an interview last August, you told me that you’re invested in at least 150 individual equities. Do you still have them?

I don’t have anywhere close to that now. In January of this year, I liquidated almost my entire portfolio of equities. I didn’t like what I was seeing.

We had some fabulous gains, and everybody was like, “If you sell these stocks, you’re going to owe a few million in taxes.” I said, “Okay, I get that. I’ll owe taxes.”

I’m very happy [I sold]. That money will now be geared more to our Treasurys. If interest rates start to come down somewhat, the money you can make on a 30-year Treasury bond will be absolutely incredible because as interest rates go down, the value of that bond will skyrocket.

You can make wonderful money in bonds if you’re on the right side of the direction of interest rates.

Do you still own preferred stocks?

Yes, I love them. When the banks went down, I had preferreds that went from $25 down to $20 because preferreds are issued at par at $25. But none of them defaulted on any of their dividends.

As interest rates start to go back down, which I think they probably will, [preferreds] will go up again, and they’ll be fine. So I’m not worried about them.

If I didn’t have as much money in preferred stocks, I would be buying them right now — I’ll tell you that much!

You told me you were shifting from growth to income investments, for the most part. So is that your strategy?

Yes, because I’m going to be 72 next month, and I’ve had an incredible scare with my [benign] tumor [surgery in 2020]. So I just wanted to know that I was safe.

My goal to make more money isn’t my goal anymore. My goal is: Can I just keep what I have safe and sound and generating income for me?

Presumably you know exactly how to meet that goal, right?

That’s what I’m doing. I have money in Treasurys, Treasury money market funds, preferred stocks. I have money in regular stocks that also pay a dividend.

Like, I think Pfizer is a fabulous company. It pays almost a 4-something-percent dividend and gives growth.

I still like the oil companies. Chevron is fabulous.

So there are companies that pay nice dividends, and I don’t care if they go up or down in value. [What I care about is] Is this dividend safe? Even if it’s an extremely high dividend, and they cut it, is it still a nice yield?

So I’m all right with everything I have.

Anywhere else that you’ve deployed assets?

I have money at Alliant Credit Union [sponsor of Orman’s “Women & Money” podcast] because, again, I do think that interest rates are going to go down.

You can get 5.15% for an 18-to-23-month certificate of deposit. That’s fabulous.

Do wealthy people need an emergency savings account?

Of course. Wealthy people have less disposable income than people who aren’t wealthy.

I learned this when I was seeing clients and doing retirement planning for Pacific Gas and Electric in Northern California [in the 1990s, as CEO of The Suze Orman Financial Group].

People would come to me with $1.3 million in their 401(k)s who were taking early retirement. These were executives, all of them in their mid-50s who were going to get a $13,000 pension, which led to $6,500 a month after taxes.

They might have had a few million in their 401(k) plans, but they couldn’t afford to retire because of their [lavish] lifestyle: They had two homes, two cars, a fifth wheel [camping trailer], a mortgage on their homes and high expenses.

You’d compare them to the gas workers — line workers — who got pensions of $2,200 a month: They had $200,000 in their 40l(k) plans, and all of them could afford to retire.

They would spend only $600 a year on clothes. The executives would spend $700 a month on a pair of shoes.

The workers had paid off their small homes. They were so happy, and they all took early retirement.

The executives were forced to take early retirement, but they all had to go find another job.

Let’s pick up on the benefits of an emergency savings account: Please talk about the difference between that and a savings account.

I would love to see people have eight to 12 months of savings in case they get sick, lose their job, we go into recession. That’s a backup plan.

But then there’s also an emergency savings account for, say, when your car or air conditioner breaks down or you have to pay a co-deductible on your medical, but you don’t have the money.

What do people usually do at that point?

You put it on your credit card, and so you now pay the minimum payment due because you don’t have the money to pay the whole thing.

Then something else happens, and this and that happens, and before you know it, you’ve maxed out your credit card.

So you go into your 401(k) or your IRA, and pay the penalty on it when you owe taxes, if you’re not of the age yet [to take distributions].

So now, just because one or two things broke down, you’ve started a cycle of poverty — believe it or not.

Compare that scenario with having an emergency savings account from which you can draw.

When you have $400 or $1,000 or so in an emergency savings account that you can get at any time, if you need a new tire, say, you have the money.

In this uncertain environment, it seems a good time to open an emergency savings account. Right?

There couldn’t be a better time than now because given what’s happened with inflation and the high interest-rate environment, banks are scared and don’t want to lend money.

Right now, [interest rates on] home equity lines of credit have gone from, like, 2% up to about 9% to 11%. Credit cards are in the 20%’s.

You’re going to have to start making student loan payments again. And when interest rates are up, the interest on them is going to be higher.

Last time we talked, you were still having a neurological issue with your arm after tumor surgery. Has that resolved?

It’s about 80% back. I’m starting to really feel more like myself now, after almost three years.

KT and I were out fishing today, and I pulled in a little one. We caught tuna, a huge snapper, mackerel, a barracuda.

We also catch wahoo, strawberry groupers, mahi-mahi, yelloweyes, yellowtail, muttons.

You name it, we catch it!

I’d say you really like to fish!

Fishing is one of the more complicated things I’ve ever done in my life.

The direction of the wind and of the current, moon phase, barometric pressure, tides — all of those will make a difference as to whether or not you catch a fish.

Do you take your boat out every day?

This is tuna season. We’re going out between 5 and 8 at night. They sleep on the bottom between 10 and 2. Today we caught three huge ones.

So we’re bottom fishing. We’re down anywhere from 500 to 1,200 feet with our hook.

We immediately know when they bite us.

(Pictured: Suze Orman)