Italy floods to cost billions, but insurance protection gap to be significant: Aon

The economic losses and cost associated with the ongoing severe flooding event in Europe that has particularly affected the Emilia-Romagna Region of Italy is expected to be significant, rising into the billions of Euros, but the insured losses will be lower as a “significant protection gap” for flood risk persists, broker Aon has said.

Reporting on this week’s severe weather and catastrophe events of note, insurance and reinsurance broker Aon’s Impact Forecasting division cautioned that damage assessments related to the floods are ongoing, as “multiple water courses still exceed flood stages.”

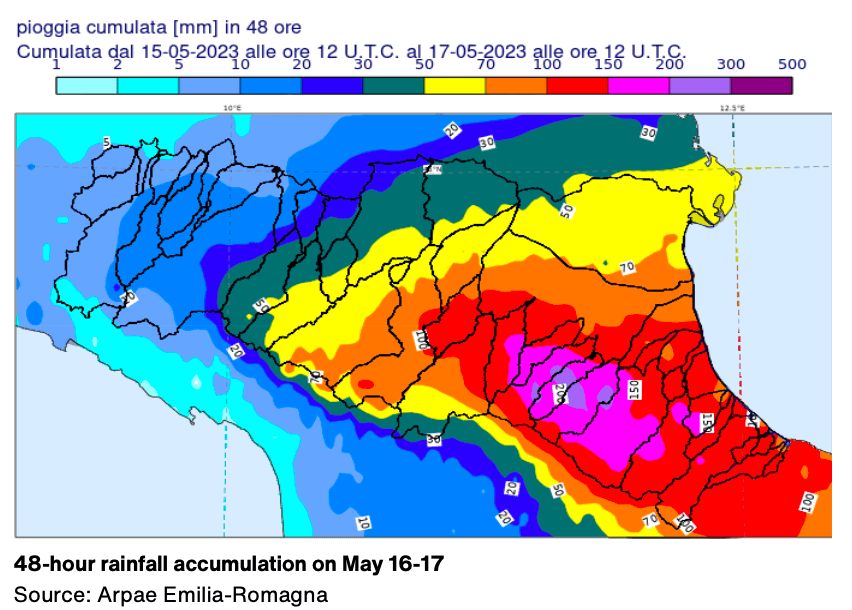

Aon’s Impact Forecasting explained the meteorological background to this flood event, writing, “Heavy rainfall and localized thunderstorms started to affect the region on May 13-14, as the first low- pressure system Benedikt (named by the FU Berlin) brought favourable conditions for storm development and intense precipitation. A new round of downpours associated with another low Chappu followed on May 15-17. This storm acquired an international name Minerva.

“The low persisted over the region for several days, bringing torrential rain, particularly in Emilia- Romagna region, central-northern Italy. 48-hour rainfall totals exceeded 200 mm (7.9 inches) at multiple locations (see Table below).

“This rainy episode followed intense rainfall that hit the same area in early May. These two notable events resulted in extreme rainfall totals. Several stations in the provinces of Forlì-Cesena, Ravenna and Bologna have already surpassed 500 mm (19.7 inches) of rain since the beginning of May, according to data provided by the local meteorological service (Arpae-SIMS).”

Impact Forecasting said that the severe flooding affected a number of other countries in Southern and Central Europe this week.

In Emilia-Romagna, Italy, at least 14 fatalities had been reported and considerable damage to property, vehicles, infrastructure, and agriculture.

This rainfall and flood event came just two two weeks after a first round of flooding hit the region, meaning river levels were already quite high.

Regional governments have reported that total economic losses are anticipated to reach into the billions of Euros.

In Italy, across Emilia-Romagna and Marche regions, over 10,000 were forced to evacuate from their homes by the floods, while around 400 roads were closed, and at least 50,000 power outages reported, Aon said.

In addition, notable agricultural losses were incurred on tens of thousands of hectares of crop land, Aon further explained, saying that local agricultural associations reported over 5,000 farms as having been inundated by the floodwaters.

Flooding was also seen in Croatia, Bosnia and Herzegovina, Austria and the Czech Republic, with some damage reports coming from each country.

Aon’s Impact Forecasting stated, “Additional rainfall is also expected in the coming days and the situation thus remains critical and more evacuations were announced on May 19. However, given the extensive scale of the disaster, local authorities are already anticipating economic losses in the billions of EUR. As a significant protection gap for flood coverage remains in place, impact on the insurance industry was expected to be a smaller percentage of the total cost.”

It’s worth highlighting that the catastrophe bond market has held exposure to flooding in Italy and the most recently issued and still in-force Lion III Re DAC cat bond sponsored by Generali does have some exposure to the peril, our analysis suggests.

Previous Lion catastrophe bonds sponsored by Generali had explicitly named flood risks as a covered peril, but the most recent Lion III Re dropped that explicit coverage.

However, flood is still included under the European windstorm peril, it appears, as flood can be an included perils related to a windstorm that has been named by the reporting agency, we understand. The reporting agency for windstorm for this cat bond is the Free University of Berlin, one of the agencies that named the storms that have caused this flooding event, as Aon reported above.

While at this stage it appears unlikely a cat bond cover would be threatened by this flood event, it is a reminder that such perils do exist in the ILS market, although perhaps likely to be more of an issue anywhere there might be collateralised participation in regional insurer reinsurance towers.