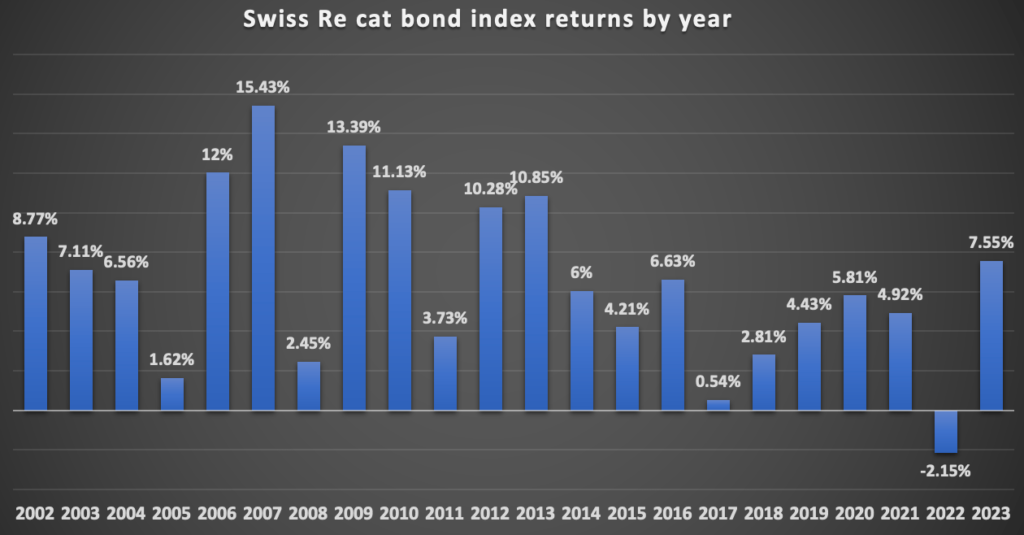

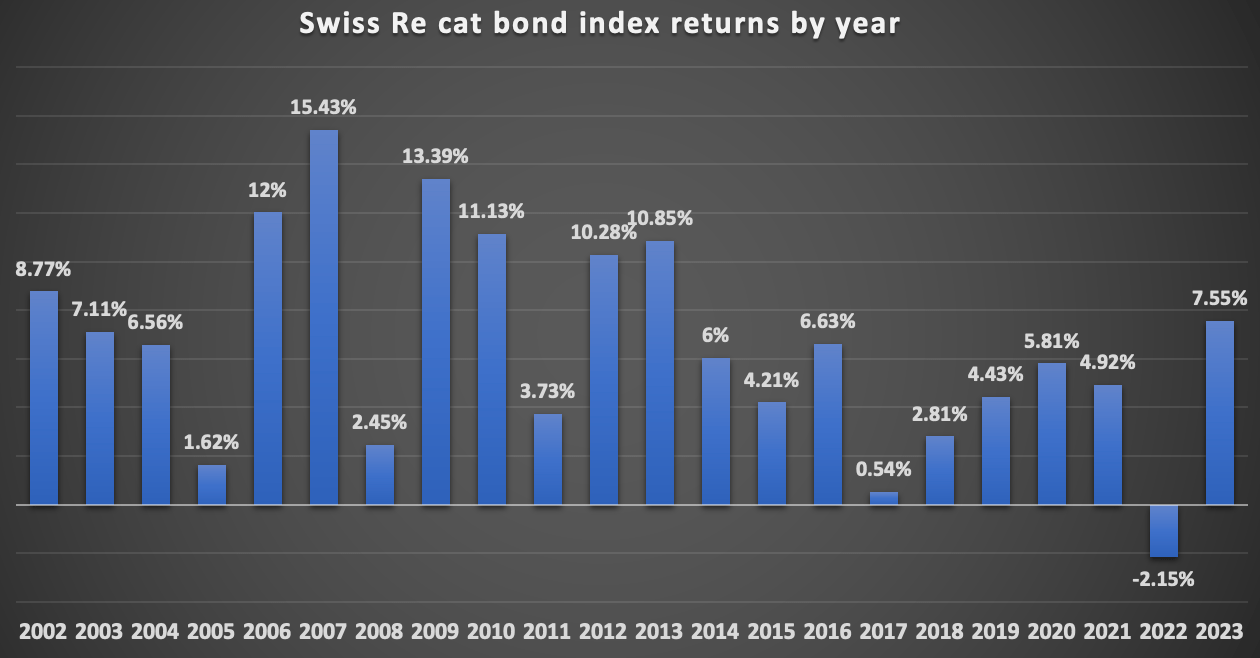

Swiss Re cat bond index already having best year since 2013

Reflecting the elevated spreads of catastrophe bonds, after just a few months of this year the return of the Swiss Re catastrophe bond index, perhaps the most widely used benchmark in the insurance-linked securities (ILS) space, is already at its highest level since 2013.

As we’ve reported before, catastrophe bond spreads had soared through the first-quarter of 2023, while Artemis’ data showed that cat bond spreads reached an all-time-high around the middle of March.

While the average spread above the expected loss of all cat bonds issued by that point of the year had reached a very impressive 10.47%, the moderation trend we’ve seen in cat bond pricing since, as new capital has flowed to cat bond funds, has now driven that figure down somewhat.

In fact, the average spread above expected loss for cat bonds is now running at 8.12% in 2023 year-to-date, according to Artemis’ data that includes all cat bonds that have been issued, priced and settled in 2023, right up to this morning.

The Q1 2023 spread eventually came out at 9.41% for the full quarter, while Q2 so far is running at a lower 6.77%, as you can see in our chart that tracks this cat bond pricing and spread data by quarter.

Which are still very healthy spread levels, especially if you look back at how cat bond pricing and spreads dwindled through most of the 2010’s.

As ever the question is, where will spreads settle and will the decline seen through recent weeks, which really began in the latter half of March, continue? Or will the market find a new equilibrium for risk and return?

Investors we speak with want to see an equilibrium found, for the decline in price multiples to slow and for spreads to eventually stabilise at a level well-above the softer points in the market’s history.

Multiples-at-market show a slightly different view on this, as it’s important to note that the average expected loss of cat bond issuance in 2023 is also down. So while spreads above it have tightened, the risk being assumed by cat bond investors has also reduced somewhat.

Artemis’ chart showing catastrophe bond multiples is a good way to visualise the difference, showing that while multiples-at-market have declined in the second-quarter, it remains far higher than the multiples of cat bond issuance even just two years ago.

Back to the Swiss Re catastrophe bond Index though, the widely used benchmark for the total returns delivered by the outstanding cat bond market.

By the last pricing of the Swiss Re Global Cat Bond Index in May 2023, the total return so far this year had reached a very impressive 7.55%.

That is the highest return for the Swiss Re Global Cat Bond Index since 2013, despite us only being in the fifth month of the year.

Obviously there is a long way to go in 2023 for the cat bond market, with an entire North Atlantic hurricane season to potentially contend with.

But the strong start to catastrophe bond returns this year means that investors have a much larger buffer available to absorb some losses, or volatility in cat bond pricing, something they did not have available to them in many other years of the last decade.

As we reported recently, UCITS catastrophe bond funds as a group had delivered an average return of 5.50% by the end of April, which was behind the 6.82% of the Swiss Re Index at that stage of the year.

The Swiss Re Index incorporates all outstanding cat bonds, so is not representative of a portfolio managed cat bond fund strategy. It also doesn’t contain any cash, so there’s no drag when maturities are high, as was seen earlier this year.

But, it does show what’s possible in cat bonds and right now what’s possible are some of the highest returns ever available in the cat bond market.

Finally, it’s also worth noting that ILS funds as a sector are delivering their best returns since 2007 to April so far, as measured by the Eurekahedge ILS Advisers Insurance Linked Securities Fund Index.

If this performance continues, the ILS Advisors Index could be reporting its highest returns on-record once May data is included and that’s before many of the collateralized reinsurance and retrocession strategies really start to benefit from seasonality boosting their returns through the wind season.

Find all of our charts and data here, or via the Artemis Dashboard.

All of our charts are updated as new catastrophe bond issues complete, and as older issuances mature.