The Value of the Distribution Management Maturity Curve

This is the first in a series of blogs featuring a dialog on Distribution Management between Denise Garth, Chief Strategy Officer and Majesco, and Brad Denning, Principal at PwC.

Brad Denning: Welcome to our ‘Two-Minute Q&A Chat Series’ exploring distribution management,

where we ask the tough questions on how to get the most out of your transformation. Denise Garth from Majesco and I will spend the next 10 weeks deep diving into the importance of Distribution Management taking turns asking and responding to your questions. Let’s kick it off! Denise, what are some of the questions you’ve received?

Q1: Brad, Distribution Management is such an interesting topic, but why exactly should insurers care?

Brad Denning: Industry forces are reshaping distribution management, from shifting customer expectations to driving reach and scale in a multi-channel world. For decades, agents and brokers have been the channel of choice for P&C and L&A insurers. While they remain important, the channel landscape is rapidly expanding and changing, driven by several factors, but especially customers and partner ecosystems. These factors together are pressuring distribution management operations to change and leverage technology to achieve a new level of capability and maturity.

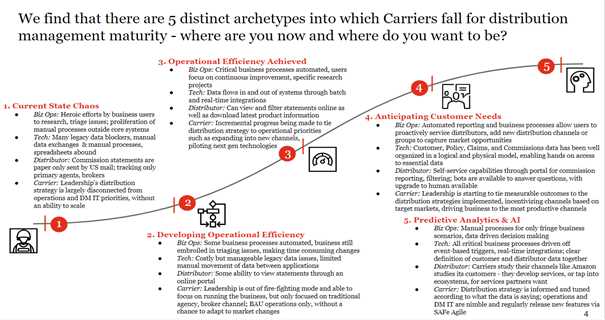

What we have found is that there are 5 distinct archetypes into which carriers fall for distribution management maturity:

Q2: Where did the DM maturity curve come from?

Brad Denning: The model came from 15 plus years of experiences in the industry and with our clients, driving several DM transformations. Distribution Management is no longer an organizational silo limited to hierarchies and commissions; it spans the distributor life cycle and focuses on empowering channel and sales teams.

Carriers deliver value for their customers and clients through a mix of herculean efforts by operations team members and hands-on relationship management with key distribution partners at the executive level. We believe that the real value of a Distribution Management transformation lies in a carrier’s ability to rise above the competition by enabling key capabilities to climb the maturity curve.

Q3: What’s the value to insurers in defining DM maturity and breaking it up into a framework like this?

Brad Denning: Defining the curve and breaking it up into this framework provides carriers with measurable outcomes to go after as a part of their transformation journey. A carrier should first define where they are on the curve. Then, the carrier should proceed by defining where they want to be, given your organization’s strategic drivers for growth.

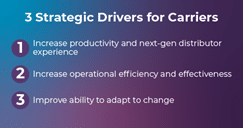

Moving along the maturity curve allows your organization to hit three core strategic drivers for growth. Using the framework will help guide your organization in achieving these three core capabilities in Distribution Management. These three strategic drivers include carriers increasing their productivity and next-gen distributor experience, carriers experiencing increased operational efficiency and effectiveness, and carriers improving their ability to adapt to change. We will touch on these in the next section.

Brad Denning: I hope we answered your questions on how to start thinking about Distribution Management and the benefits of defining your current location on the maturity curve. In our next session, we’ll talk through defining your current location on the maturity curve, as well as the benefits of doing so. Have a question on the current chat or want to include your question in the next session? Just drop it into the comments section.